Rebuttal To Those Calling For A Bottom For California Housing.

The $300 Billion Tsunami.

By Dr. Housing Bubble | 6 August 2008

Housing in California is years away from a bottom. Let me make that clear— and, if you have any doubts after reading this essay, you will at least have a better understanding as to how I arrived at that conclusion. This article is rather long since it will try to answer many of the arguments from those calling for a 'real estate bottom' much sooner in California. After looking at multiple sources of information like income, demographics, sales, psychology, and the economy there is no logical evidence for a housing bottom in California. It is well worth the read and certainly provides more information than a 1 minute sound bite. Recently I have noticed a resurgence of 'bottom talk' coming from professionals in the field but also through e-mail questions.

My assessment is this renewed energy has come from two primary culprits. The first is of course the Housing and Economic Recovery Act of 2008 that provides $300 billion in loan refinanceing and also bails out Fannie Mae and Freddie Mac. In addition, there are many other provisions in the bill to juice the market— but all of which will have very little impact on California.

Both Fannie Mae and Freddie Mac announce earnings this week and the news isn’t going to be good. [[It wasn't!: normxxx]] Freddie Mac lost $821 million in the second quarter and announced that they will be slashing their dividend from 25 cents to 5 cents to conserve capital. This wouldn’t be such a big deal except the U.S. taxpayer is now on the hook and a loss for Fannie Mae and Freddie Mac leads us one step closer to a total bailout [[which occured only a month later on 7 September 2008: normxxx]].

The second reason for the upsurge in bottom talk at least for California is the massive price drop we’ve seen this past year. A drop in the median sales price statewide by 38.38% is bound to get the attention of anyone. Yet simply because prices have fallen steeply in one year does not signal that now is a good time to buy. In fact, I will give you 10 solid reasons in this article why we are years away from any bottom in California.

We really are living in a once in a lifetime bubble. It is highly probable that none of us will see a real estate and credit bubble of this size ever again. There will be minor jumps and dips in the future but nothing on this level. I think the best way to conceptualize this extremely large fiasco is to think of someone who is massively in debt. Everyone knows of a friend or family member that spends way beyond his or her means and is usually in major debt. They have nine credit cards, a $700 car payment, a $4,000 mortgage, and yet seem to shuffle debt around like musical chairs. At a certain point, this game ends and some accept the reality and confront the issue head on and others live in denial.

Those that confront the reality sometimes meet with a financial professional or a debt counselor usually with advice to cut up the credit cards and develop a sustainable budget. A prudent plan. If you are serious about correcting negative cash flow situations, you really have to create a budget that takes into account how much money is coming in and going out. In the case of our country, it has gone into debt counseling, was told to cut up the credit cards but is refusing to do so and is actually applying for more credit cards!

What you will not hear from bottom talkers is any mention of incomes from the vast majority of people. Sure they will use random examples of those in Bel Air, Brentwood, Laguna Beach, or Newport Coast but that is a tiny fraction of the population. They cannot use income as a measure of support because it will demolish their bottom theory. Let us now move on to the 10 reasons why California is years away from a housing bottom.

Reason #1— REO And Foreclosure Phony Numbers

Here are some stunning figures:

Q2 of 2008 Notice of Defaults for California: 121,341

Q2 of 2008 Foreclosures in California: 53,943

Yet when we look at the overall inventory on the market and sales, it looks like overall inventory is decreasing. How can this be? First, there are shady things going on. Can we prove this? Not with a definite yes but using multiple sources of data we can see something is not matching up. It was hard to "prove" massive fraud in the subprime markets as it was going on but we knew it was there.

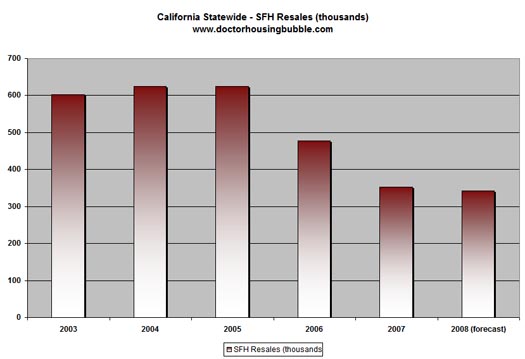

First let, us look at statewide sales for the past few years:

Click Here, or on the image, to see a larger, undistorted image.

*Source: C.A.R.

This chart is very important because it covers the entire yearly sales for California. Sales have been falling steadily since 2005, long before the mainstream media echoed any sentiment about a bubble in California. So this number is clear. We will use the sales figures for 2007 since those have already been recorded.

Now, let us take a look at the raw sales numbers for Los Angeles County for 2007:

Total Sales for Los Angeles County in 2007: 74,722

Total California Sales in 2007: 352,800

So Los Angeles County made up 21.1 percent of all sales for California in 2007. The point of this is that a county with 10,000,000 people and 88 cities may be looked at as a microcosm of the entire state with low, middle, and high income neighborhoods. Let us now look at the latest data for Los Angeles County:

Los Angeles County second quarter NODs: 21,632

Los Angeles County second quarter foreclosures: 9,609

Current Inventory August 2008: 51,315

LA Sales in June of 2008: 5,678

Months of Inventory: 9 months

These numbers alone point to the fact that we have not reached bottom. The June data for sales is normally the highest in California for many counties. So far for the first six months in Los Angeles County we have seen this many sales:

First 6 Months Los Angeles County Sales: 27,268

We are including the highest sales month in this data so we can easily see that we are already nowhere close to approaching the 74,722 homes sold in 2007. Keep in mind that the fall is a slow selling season and summer is almost over. We can safely assume that sales for Los Angeles County for 2008 will be approximately 50,000 to 56,000 by year's end. Take a look at the NOD and foreclosure numbers for the second quarter. The fact that nearly 8 out of 10 homes that receive a notice of default in California turn into foreclosures should tell you that we are on the verge of seeing an onslaught of inventory hitting the market in the next few months.

If sales are falling and foreclosures are growing, how can months of inventory be declining? First, those that do not need to sell are probably having second thoughts about selling their home, thus artificially lowering the overall inventory numbers. Second, we have lenders who are overwhelmed and simply choose on purpose or for whatever reason not to add the foreclosure as a REO and sometimes these homes do not appear in the MLS, thus keeping them off inventory lists.

You can do the math. This is no bottom. In June only 35,202 homes sold statewide. For the 'peak' month, this is a pathetic number.

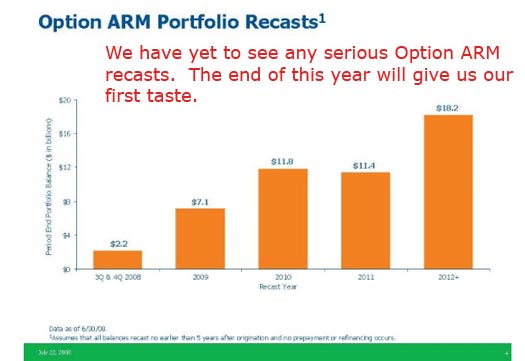

Reason #2— The Walkaway Pay Option Arm Test

It seems as if the mainstream media is finally catching on that Pay Option ARM mortgages are a disaster waiting to happen. The state of California is waiting to see who will blink first. I’ve been sounding the Pay Option ARM alarm for a very long time because I really do think that this is the next major crisis. To a certain extent, the $300 billion bailout given the current guidelines is something many can swallow bitterly because it would force lenders to writedown mortgages and also the borrower will have to share future appreciation with the government. Not exactly ideal but given our present government, probably the best that we can come up with.

There is literally no way to justify the Pay Option ARM mortgage debacle that we will head into. These loans turned thousands of Californians into futures traders by making their mortgage into an options contract. How so? First, these loans allowed borrowers with a few flavors of payments. You had your 30 year fixed vanilla payment. Your 15 year accelerated payment. Your interest only option. Or the most popular and most widely used, the negative amortization option. Many borrowers elected to make just the minimum payment— why make the full payment if you were going to the flip the place in a few years anyways?

These loans also offered longer recast dates masking the problems for years. 5 to 7 year "anniversaries" were common where a loan payment had the potential to double once the recast date hit. The only thing keeping this gig up was massive appreciation. The lenders got to book the deferred interest as income and the borrower kept making the lowest payment. This game was good until prices started to fall. Now, many of these lenders barely recovering from the subprime mess are anxiously waiting to see how borrowers are going to respond to their recast anniversaries. I can assure you that borrowers are going to let that option expire worthless.

This of course is easily explained. Why would a borrower keep making a payment on a $500,000 mortgage when the home is now worth $300,000? If they went zero down, the only incentive for them to keep making their payment is their credit history. In many cases as we are going to find out people flat out lied and never qualified for the loan in the first place. There will be no bailout for these people and this means:

(a) Lenders are going to take some massive losses and will do some serious balance sheet rebalancing.

(b) There is pent up demand alright. Pent up demand to get rid of these toxic mortgages. Many lenders are going to implode under the weight of their horrible mortgage underwriting.

We are going to find out how pervasive and extensive this fraud network is. To paraphrase Warren Buffet, the tide is going out and we are going to see who is swimming naked. Most of these loans fall under the Alt-A category and many lenders are deluded thinking these are much better than subprime loans. They are not. How many of these loans are out in California?

Total Alt-A loans as of June 2008: 688,975

Average Balance as of June 2008: $419,790

Number with a prepayment penalty: 302,909

Number with a second lien at origination: 206,216 (these are most likely worth zero)

Number with interest only payment: 252,329

Number with negative amortization: 198,385

Percent with at least one late payment in last 12 months: 27%

Percent ARM loans: 70%

*Source: New York Fed

Think about those numbers for a second. This one point is enough to quell any bottom talk. Take a look at WaMu’s Option ARM portfolio, half of which is in California and you’ll realize that we haven’t even seen the start of this mess:

Click Here, or on the image, to see a larger, undistorted image.

What is the actual notational value of the Alt-A junk floating out in the state? How about $289,224,815,250 as of June 2008. Those of you wondering where that $300 billion figure comes from, there you go.

Reason #3— Free Rent?

It is hard to believe that we are even in this situation but we are going to see unintended consequences galore. Lenders are going to realize that buyers are not going to stay current on their mortgages because of:

(a) The economy

(b) Recast/payment shock

(c) Psychology

And when we say 'walkaway' you need to realize that this is going to take on a whole new meaning here in California. The foreclosure process here in the state is incredibly slow. It can be anywhere from 250 to 300 days from the first sign of a problem until the sheriff comes to your door. The idea most have of walking away is that someone is going to send their keys to the lender and are going to vacate the home soon after. That is not the case.

Most people are going to walkaway psychologically first, then they’ll hold on to the keys until the very last moment. Many borrowers already know that the market in California is in the tank. It is not coming back. Many are now realizing that come the 'anniversary' date, they will simply be unable to cover the payment. With lenders being inundated with late and delinquent payments, the process is going to be delayed. If anything, borrowers have a few months to perhaps as much as a year of "free rent", as some articles are pointing out.

What will this do to the market? Well, lenders are going to get reamed because of this. Some of the bottom callers won’t see these numbers reflected as inventory, but those that look carefully at the data realize this is only pent up supply that eventually will be unleashed in the next 1 to 2 years. These people are on borrowed time and so are the lenders. Instead of speeding up the process, there is even talks about making it longer! In fact, Freddie Mac only a few days ago announced that in 21 states it would extend its foreclosure timeline to 300 days from the first missed payment and 150 days from the initiation of the foreclosure process. Is it any wonder the free rent meme is now spreading?

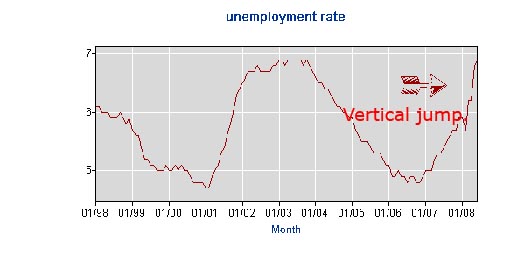

Reason #4— The State Of California Is In Recession

Many of those calling a bottom forget one other thing. The state of California (indeed, the whole world, including the US) is in a recession. We are seeing a unique combination economic collapse. In past housing busts in California, first the economy declined, then housing followed. In this bust, housing has declined first— taking down the whole financial system and economy with it and, as incomes and then credit failed, the housing situation was further aggravated. This vicious cycle sequel to the virtuous cycle that preceeded it is also likely to go on for some years. Currently, we are simply on a plateau (hopefully, at least the eye of the storm) until prices start falling again because of the economy and the continued unaffordability of homes. The bottom callers tend to feed off those economist and politicians that still deny we are already in a recession and think that one can still be avoided.

Governor Schwarzenegger has laid off 10,000+ part time state workers, called for hiring freezes and spending cuts, and is now in a battle trying to cut the wages of 200,000 state employees to the federal minimum wage because of the budget impasse. We already have a $15 billion budget deficit and one of the highest unemployment rates in the country. Does that sound like an economy good enough to support a housing recovery?

Click Here, or on the image, to see a larger, undistorted image.

You can rest assured that the next month of data is going to put us squarely over 7% for the unemployment rate. Somehow those calling a bottom forget that you also need a healthy, sustainable economy in order for people to jump back into the market for homes.

Reason #5— Federal Reserve And U.S. Treasury Smoke And Mirrors

The Federal Reserve, who was fundamentally at fault in providing the easy credit that fueled this entire mess in the first place, no longer seems to care about the value of the U.S. Dollar. In fact, the U.S. Treasury doesn’t seem to care about the dollar either. How so? Well, they insist that they support a strong dollar, yet continue to provide the low interest coolade in prodigious amounts. To combat inflation and a weak dollar, all they need to do is hike the Fed Funds rate. Yet they do nothing.

The U.S. Treasury, instead of trying to tamp down the egregious lending that has gone on for a decade, instead decided on the largest bailout in history (the Housing and Economic Recovery Act of 2008) on a weekend in which they extended credit to the two largest US mortgage entities so that they could continue to purchase crap mortgages. The U.S. taxpayer is going to take it in the shorts and in the end, it isn’t going to do a damn thing for the overall economy. Freddie Mac is already bleeding red and this program doesn’t go into full effect until October 1, 2008! It may help a few people purchase some nice golden parachutes, but the average citizen is soon enough going to realize that stimulus gimmicks and bailouts have high costs in the end.

How does this apply to California? This is going to be the ultimate shock. The Fannie and Freddie bailout package won’t do a thing to help that $300 billion Option ARM tsunami rolling along on the balance sheets of many lenders. Some borrowers are going to want to cement that minimum payment as their 30 year fixed payment. Bwahaha! That can’t happen. Try calling your credit card company and telling them, "yeah, I’m only going to give you $20 a month even though I owe $10,000 because that is all I can afford." Do you really think they are going to say, "okay, we’ll writedown your balance to $5,000 just cause we like you." Each writedown is a major loss that needs to be accounted for, and we have nearly 700,000 of these loans in this state alone.

Reason #6— It’s the Income Stupid!

Another major point that tells us we are years from a bottom is incomes still do not reflect the median price of homes in the state. In California the median household income is $53,770 if we look at the three-year average from the latest data at the Census Bureau. The median price for a home statewide is $368,250. That gives us a ratio of 6.8 which is still more than twice too high. It makes you shake your head when the peak price in April of 2007 was reached at $597,640 giving us a ratio of 11.11! Freaking unbelievable.

So from a relative perspective, yeah that 6.8 ratio doesn’t seem so bad but anything seems better then the ratio of 11.11. Let us use the hypothetical numbers of this median income family buying the median priced home with a conventional 30 year fixed mortgage:

Median Income: $53,770

Median Price for a California Home (June 2008): $368,250

30 Year Fixed Mortgage With 5% Down

Down payment: $18,412

PITI: $2,594

Net Take Home Pay: $3,607 (filing as a married person with 2 exemptions)

At this rate, 71.9% of the household net monthly income is being taken up by the house payment. Even if we use gross monthly income, this person would not qualify for the underwriting in government-backed loans. Now, those income figures matter once more, but are a direct reflection of the poor health of the economy, so we are about to enter the next phase of the housing market decline. (The first phase was the bursting of the bubble, creating the economic decline and falling prices. The second phase is going to be the revelations of the fraud and toxic loans which fueled the first phase, while recasts hit at the most inopportune time.)

Reason #7— Renting Is Hot

Renting or leasing a place is going to look a lot more attractive. In fact, in Los Angeles County the majority of people actually rent. Take a look at some of the rental rates for certain counties:

Households That Rent (Per County):

San Francisco: 65%

Los Angeles: 52.1%

San Diego: 44.6%

Fresno County: 43.5%

Orange County: 38.6%

Riverside County: 31.1%

As you can see, the amount of homeownership in a county is not indicative of a healthy market. One of the most battered counties, Riverside, has a high home ownership rate at 68.9%. San Francisco which has been one of the last areas to fall and has held up longer than most California counties only has a 35% homeownership rate.

What this should tell you is that renting in many places has long been a sound alternative. In places like San Francisco and Los Angeles the majority of households do rent. This is because, even before the boom, these were very high cost areas and after the boom they simply went into that wonderland territory which kept the renting numbers high and stable.

Many people who would have qualified under the "fog a mirror" guidelines during the past decade will now have a hard time landing a loan. Given the overall median income of the state the buyer pool just shrunk on a massive scale. Another argument I have been hearing looks simply at the supply side and assumes everything will once again play out simply because the inventory count is decreasing. So what. Look at the phantom shady REOs and the pent up supply that will hit the market shortly.

Take that, plus the fact that the lenders are demanding more stringent loan requirements, and you just erased a large portion of your market. The only way to get the housing market in California roaring again is to bring back the shady mortgage loan network and the complicit Wall Street backers hungry for loans to sell off to unsuspecting foreign buyers. Do all foreigners think all Californians live in Beverly Hills? Apparently, Wall Street wanted them to believe this, because the 'stuff' (MBS) rated as AAA made no logical sense.

Now renting no longer seems such a bad idea and many of those that will lose their homes will return to renting. Many others simply do not want to (or cannot) buy at current market prices.

Reason #8— Demographics

California has 36,457,000 people. That is approximately 12% of the U.S. population. So, the "positive demographic" argument is a simple one for many bottom callers because the total state population is constantly growing. Yet, given the overall economics, this will not help the housing market. Much of the population growth is not of people who earn high incomes. Most growth is in the lower to middle income households. Yes, these households do require housing but they aren’t going to be paying half a million for a shack. They are going to do either of two things:

(a) rent or lease a home (see Reason #7)

(b) purchase a lower priced home

There is demand for Affordable Housing in California and the unseen benefit is that this market correction is starting to do what politicians and builders couldn’t do. That is, create a surge of affordable housing through the real estate crash. You really have to love how the politicians scream and stomp their feet about affordable housing, yet when prices start coming down hard they do everything they can to legislate keeping prices unaffordable!

The idea that the sheer number of people coming into California is going to keep prices sky high is an absurd argument. If that were the case, China with 1.3 billion people would have million dollar homes on every corner. In addition, the fact that there is such a shortfall in our state budget means we are most likely going to see higher taxes— which will further impact the economy and housing prices. From most recent reports we have already seen a net migration of middle income earners from the state.

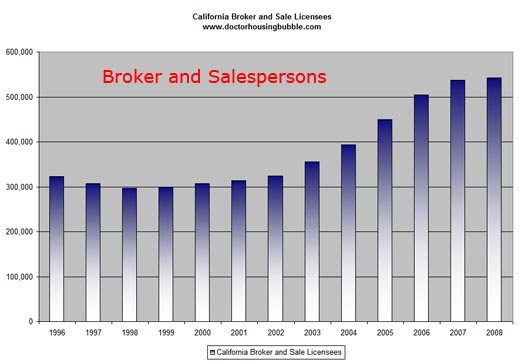

Reason #9— The Real Estate Feedback Loop

It wasn’t uncommon to hear during the bubble days of California loan officers making $20,000 to $30,000 a month with a high school diploma. That made the lender happy but also made the state happy when they collected their income and other taxes. The agents that were selling those median priced $597,640 homes were happy when they got their 6% cut. The appraiser, escrow officers, title companies, and sellers all had smiles on their faces in the mania which was the California housing market. Much of this income was a once in a lifetime opportunity. Wall Street through their sophisticated gambling racket of mortgage backed securities and all the synthetic derivatives based on those loans had figured out a way to fool the world into believing the rate of growth in real estate was somehow unlimited.

Just to give you an idea of how many people jumped onto this ship, take a look at the number of broker and salespersons licenses given out by the Department of Real Estate here in California:

Click Here, or on the image, to see a larger, undistorted image.

There are currently 542,267 broker and salespersons licensed in the state. This for a state that saw only 35,202 sales in June of 2008! In June of 1998 there were only 297,359 licenses in the state. So basically the number of people jumping into real estate doubled this decade while the population went up only slightly:

1998: 32,987,675

2008: 36,457,000 (an increase of 10.5%)

So our economy suddenly turned into one fueled by real estate. The government was happy because it was collecting beaucoup tax receipts from the decade long spending orgy. Incomes kept going up as the Ponzi housing scheme kept growing. That is the predicament we now find ourselves in. A state (and, indeed, a nation) utterly dependent on real estate for its prosperity is now facing a market that is collapsing. We didn’t diversify and we are now paying the price. Jobs connected to real estate that are now going away include:

- Construction

- Agents

- Brokers

- Banks

- Home Repair

- Insurance

- Finance

These were good high paying jobs. Not only do these people face the pain of seeing their income fall sharply but they also do not spend hurting our "consumer" economy. These were the people buying luxury cars, clothes, and eating at expensive restaurants. The ripple effects will be felt throughout the country. Those cars made in Detroit will no longer be purchased here in California at the same rate because people simply cannot spend money they do not have. [[The irony is, that that is exactly what they were doing up until now! : normxxx]] The fact that fuel costs have surged has only accelerated the decline. Energy costs are ticking lower slowly and this is good because it will bring attention back to the number one issue, which is the housing and credit crisis.

This is the negative feedback loop we are now in and will be in for many years. As you can see from the chart above, the real estate economy here in California took a decade to build and the consequences of its vanishing will take a long time to work out. Where do the bottom callers think these people will find jobs? The few sectors that do show growth, those of healthcare, leisure and government have their own problems:

(a) healthcare— usually requires some advanced training

(b) leisure— much lower paying jobs, typically in the service sector

(c) government— the governor has instituted a hiring freeze, so no luck there

I’m not sure we are looking at the same data. Many of those seeing a bottom also thought the subprime mortgage mess would be contained. There is nothing contained about this multi-front onslaught of credit and wealth destruction.

Reason #10— Consumer Psychology: Why Buy Today When Tomorrow Will Be Cheaper?

I talked about certain trends that are emerging. To blame only one group for the housing /credit fiasco is unfair because this was a collective spending orgy. There was the powerful line that agents used of "housing prices have never fallen nation-wide"— that is, until they did fall. This was the first time that we have seen a nation-wide median decline in price since the Great Depression. In fact, the rate and depth of decline is actually far greater then that during the Great Depression. So that mantra is no longer true.

In states like California, how do you explain a median price drop of 38% in one year? I love the new argument that goes like this, "well the few sales that are occurring are distressed properties and don’t accurately reflect the overall market." Newsflash: The entire state is distressed. Unless you are selling prime property in the Hollywood Hills, get accustomed to distressed sales (something like a third of all sales in the state). The number one issue on the minds of Americans is the economy. The vast majority don’t feel like buying homes while the economy is in the gutter.

Also, let us assume this is the bottom. What in the world will cause prices to jump up in the next year? If anything, you can rest assured that prices are going to stay low for a few years. I would argue that prices in California won’t bottom until May of 2011; and those that are betting their money in the housing futures market are of the same mind as I.

After looking at the above reasons, you can rest assured that many of those buyers sitting on the fence are well aware of some of the 10 reasons. And just one reason may be enough to keep them from buying. 10 reasons should be enough to keep anyone from jumping too quickly into a bubble that still has plenty of air to release.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment