By Contraryinvestor.Com | 1 August 2010

The tale of two economies… It simply continues, and as we see it is THE key tension in investment decision making of the moment. It's the tension of the 'macro' versus the 'micro'. After all, isn't this very tension exactly what has been playing out as 2Q earnings season has unfolded? Again, the key question being, what will be more important to investor decision making ahead, the domestic and global economic and credit cycle backdrop or company specific earnings and forward guidance?

We'll move through this little look at life as we know it at the moment relatively quickly as basically it only continues to validate the "tale of two economies" theme we have been discussing for well more than a year now. But we do believe there are some very valid conclusions that can be drawn from one of the most noticeable economic divergences we have seen in many a cycle. To the point, in recent weeks we have been treated to the quarterly Conference Board CEO business confidence survey as well as the NFIB (small business) survey for July (data through June).

As with so many business conditions surveys, the CEO confidence survey is a diffusion index. Any reading above 50 tells us the preponderance of responses were positive, and vice versa. Quarter over quarter the CEO survey was unchanged in the recent report and remains consistent with headline economic expansion based on historical precedent.

At least over the recent past, survey levels at 50 or above have been consistent with at least 3% year over year real growth in GDP. Over 70% of the CEO's surveyed expect profit growth over the next twelve months and half of the respondents expect an increase in demand to drive profitability. Alternatively, for the small business crowd, demand and poor sales is their number one concern. In terms of the US corporate sector, large and small business conditions have been and continue to remain worlds apart.

The chart below is a look at the history of the CEO survey and the bottom clip aligns the historical CEO responses with the rhythm of year over year change in nominal GDP. In terms of the confidence survey versus GDP relationship, the CEO survey has been a very important historical leading indicator valid at both cycle peaks and troughs. It's why we always check in.

The Conference Board CEO survey now joins both the recent Duke CFO and Business CEO Roundtable surveys in one unanimous and very much unambiguous message— no double dip recession ahead. In fact as per the harmonious singular message of all three, we're not even close. But, after a good bit of improvement in April and May, small business optimism again retreated in June. We've been over this before and the divergent relationship between large and small business outlooks remains completely intact in the current cycle.

Therein lies the key tension for the US economy of the moment as we see it. And the key tension for investors. Why? First, as is exemplified in the chart below, there has been a very strong historical directional relationship between small business optimism and the year over year rate of change in headline US employment.

Levels above 95 on the small business survey have been consistent with payroll expansion in the past. Yes, there has been recovery in the year over year rate of change in payroll employment, but the census worker hiring has skewed this near term and we continue to compare to meaningful prior year weakness. Stripped of census worker hiring YTD, improvement in headline US payrolls relative to the job loss numbers since 2007 is nothing short of a rounding error.

When NFIB optimism dropped below 95 in November of 2007, not only was it heralding the onset of a nasty official US recession, it also (in the clarity of hindsight) marked the end of the prior cycle month over month expansion in US payrolls. That expansion did indeed end one month later in December of 2007 as the final month for positive payroll additions. Over the subsequent 24 months ended December of 2009 the US lost 8.4 million jobs and experienced only one month of job expansion (minor) over that 24 month period.

The bottom line here is that small businesses are the largest US job creators. As long as small business conditions remain depressed, it's going to be very tough to achieve any type of sustainable domestic labor market recovery. That should be more than clear by now. CFO and CEO optimism and outlook surveys recovered meaningfully close to one year ago now, and we have little to nothing to show for it in terms of non-census related labor market expansion.

Importantly, when we look at macro economic data such as the ECRI weekly leading index, necessarily small business outcomes are being reflected in those numbers. Based solely on historical numbers precedent, the ECRI data is telling us another recession either has arrived or soon will based on the historical track record of this data series. The NFIB business optimism numbers themselves are also consistent with a recession outcome.

In fact, the NFIB numbers really tell us small businesses never exited the recession in the first place. It's clear to us that large company CFO and CEO surveys are being influenced by the ability of large companies to participate in global stimulus (lowered costs of borrowing, strength in exports as per foreign stimulus related global demand maintaining strength, etc.). But what about small businesses? What stimulus have they received?

In the past we have questioned the lack of hiring tax credits or investment tax credits conspicuously absent in Administration policy. The Fed printing up money and buying back mortgage and CRE backed paper, as well as US Treasuries has only benefited Wall Street and the banks. It has done nothing for small businesses.

The only stimulus, if you will, that might have benefited small business was the reduction in macro interest rates vis-a-vis the Fed Funds rate. But something, at least for now, has changed in the current cycle pretty dramatically relative to historical experience. As we see it, small business conditions are not responding to interest rate stimulus [[probably because 'trickle down' isn't working— what good are 'abnormally low' interest rates, if small businesses and consumers never get to see them?: normxxx]]. This is different. The chart below chronicles the relationship between the NFIB numbers and the Fed Funds rate over time.

It is clearly seen that in prior cycles, dramatic drops in the Fed Funds rate ultimately sparked a move in the NFIB optimism reading back above 95 that would indicate expansion. In fact these death defying plunges in the Funds rate meant trips below 95 on the small business survey were very short lived, as is clearly seen in the early 1990's and early 2000's recession periods. Lastly, it took ever deeper Funds rate declines to work the reflation/expansion magic in each successive recessionary cycle of sparking renewed optimism stretching over the last quarter century.

In the current cycle, despite the Fed Funds rate being somewhere near academic zero, as it has been now since December of 2008, small business optimism remains in historical recession territory. But has the historical linkage between interest rates (monetary expansion) and small business economic conditions been broken in the current cycle, as the chart suggests? We suggest that for now the answer is yes. And this is a key difference between prior cycles and the present.

As a quick aside, it is becoming very clear to us that fiscal policy may be a 'non-starter' ahead. Although there is more 2009 stimulus spending in the pipeline as we move into 2011, the political backlash against further deficit spending/stimulus continues to grow. It's not just the Tea Party. This backlash is evident in recent State primary elections and we can only imagine how it will manifest in November.

So, stepping back for a minute as we look forward, this puts increasing pressure on the Fed as potentially the sole source of further stimulus. But with interest rates already at zero, just what can the Fed now do to positively influence small business outcomes? Print more money and buy back more financial paper? Hardly, that won't do a thing to help small business.

And that says something about the whole 'pushing on a string' thesis. The cost of credit may have gotten a whole lot more attractive for large corporations, but how about for households that are the largest small business customer base? Thanks to the government for allowing the financial industry to front run changes to credit card/consumer credit regulation, cost of credit to the average household has only gone up over the recent past. Is this why the linkage above appears broken? We think it goes a long way toward explaining the current period divergence up to this point.

What has changed in the current cycle that we believe directly affects small business conditions is the lack of job growth mentioned above plus the lack of personal income growth stripped of transfer payments, as we have also discussed in depth as of late. Again, over time, the NFIB optimism survey and the rhythm of year over year change in personal income devoid of transfer payments has been very highly correlated. If the June numbers are telling us small businesses are becoming more somber as they look into the second half of the year, then should we expect the rate of change in personal income to also contract (again, stripped of transfer payments)?

History tells us the answer is yes, as the NFIB series has historically led the year over year change in non-transfer payment related personal income growth. This is exactly why we suggested recently, despite our deep negativity regarding deficit spending, that in the absence of extended unemployment benefits retail sales and consumption in aggregate will slow over the remainder of the year. Is this what small businesses are "seeing" as they look ahead?

Three last charts and we'll call it a day in terms of the "tale of two economies" update. First, the tale of two economies theme plays out in highlight fashion in the top clip of the chart below. It's the ISM (large company) new orders subcomponent of the ISM series set against the NFIB business optimism numbers.

This is very highly directionally correlated until the clear departure seen in the current cycle. One issue to note is that in recent months these two data points have begun to move in much better directional harmony, as you can see. And why might that be? We personally believe it is because the bulk of the macro inventory rebuild cycle is over.

Inventory restocking will now be much more closely linked to demand/sales. And if inventory activity is any indication of business optimism, which we believe it is, we need to note that in the June NFIB report, inventory plans fell back into negative territory after a one month hiatus in the land of the positive. Although we'll spare you the chart, small business plans to add to inventory have been in negative territory now every single month since December of 2007 with the exception of May of this year.

That absolutely speaks to business confidence, or more correctly lack thereof and reinforces the tale of two economies theme playing out as we have seen inventory rebuilding in aggregate. Clearly it's the large companies that have driven the macro inventory rebuild. And we suggest this has been done with an eye to international sales.

The two bottom clips of the chart show us the divergence between hiring in the manufacturing sector relative to small business community hiring in aggregate. Please realize that the NFIB survey is dominated by service sector businesses. Manufacturers account for less than 15% of total respondents.

In the spirit of honesty and integrity, 20% of the NFIB respondents are involved in some form of construction. But the last time we checked, even these folks need jobs and personal income growth that is essentially the basis for macro economic expansion. And, we see the same dichotomy when look at the manufacturing ISM and non-manufacturing (service sector) ISM numbers and trends.

One last issue to keep in mind when looking at the ISM numbers is what is termed 'survivorship' bias. Companies formerly responding to the ISM surveys that are no longer around are not being "counted", so to speak. It's those that have survived and in all probability taken market share from the weak that dominate current period responses.

This is true in each cycle, but probably a good bit more pronounced in the current. So one question we must ask when looking at a series such as this is are current levels of response overstating strength? Again, just a bit of perspective.

Particularly disheartening for the small business community is the depth of lack of pricing power during the current cycle. The top clip of the next chart is clear on this observation. We've never seen anything like it. And certainly the only reason this is the case is that demand is the missing key ingredient for small businesses.

The top singular concern of NFIB respondents in June was "poor sales", as has been the case for many months now. Also after having emerged into the light of positive territory in recent months, June showed us a return trip to the dark side for forward small biz sales expectations. In the 2001 recession, small businesses blinked for one month concerning sales outlook. Night and day compared to the current cycle.

Without hesitation, we suggest that the above trends appear as they do because they are directly related to lack of job and income growth for households. If you ask us, this is a ground zero issue for investors ahead. Small businesses are clearly contributing to the deterioration in the macro, as exemplified by the ECRI numbers. Yet the micro of large company reported earnings is holding up for now.

Of course, large companies have the luxury of reporting "operating" (stripped of non-recurring costs which continue to grow) as opposed to actual earnings in the public venue. Is this why many a CEO and CFO are optimistic— because they can help 'shape' reported earnings outcomes? This is THE tension for investment decision making. And we're sorry to say it, but we do not believe this is going away anytime soon.

It will probably only be exacerbated as we venture into 2H 2010 and will surely be exacerbated in 2011 as tax rates go up. Moreover, recent legislation calling for producing 1099's for all corporate transactions over $600 is one of the largest negatives we can think of for small business. Not only does it add a layer of unreimbursed cost to small businesses, but will probably cause even large businesses to consolidate their supply relationships with smaller companies to avoid expensive bureaucratic and duplicative paperwork— a double negative for the small business community. Just what are politicians and the Administration thinking? Answer: They are not.

Finally, as we have heard it said a million times now in the mainstream media, lack of credit availability is hurting small business. A key source of business credit historically has been small community and to an extent regional banks. But these sources, licking their CRE wounds, are currently in no mood to lend. This is the key linkage between CRE outcomes and the small business community.

But, only 10% of small businesses said they were dissatisfied with credit availability in June. In fact, as per the top concerns of the small biz community, financing came in sixth. We strongly suggest lack of credit availability is not a key issue for small businesses, despite mainstream commentary to the contrary.

Maybe lack of credit availability to their customers (households), but not to themselves. So as we look at small business plans for capital spending, we do not believe this is being held back by credit availability, but is rather a statement of actual forward business outlook. Inventories and capital spending plans are the telltale real world and real time business confidence indicators. Both are down for the count relative to historical cycles.

Bottom line summary. The tale of two economies theme remains valid and intact for now. We are seeing a huge divergence between large and small business condition outlooks at present. A degree of divergence we have never seen in modern historical experience.

Large businesses represent the micro in terms of the positive of company specific earnings. They are the large S&P 500 companies whose earnings are more dependent on the rhythm of the global economy as opposed to the domestic US economy specifically. They are the large companies whose reported "operating" earnings are not falling apart, despite a few bumps in the road here and there.

Alternatively, we see the small business community as representing the domestic US macro. They are the job— and ultimately personal income— creators. They are largely the service sector, the largest driver of domestic US economic outcomes. The NFIB numbers are simply telling us of a deceleration in macro economic activity directly ahead. And herein lies the tension for investors.

What will be more important in decision making immediately ahead— the tone and rhythm of the US macro economy inclusive of jobs and personal income, or the micro of reported quarterly "operating" earnings of truly large and global-centric companies whose job and personal income creation activities largely lie abroad? It's why we need to remain focused on this "tales of two economies" theme. Is it really going to be the case that the S&P 500 companies alone (as a proxy for large corporations) experience a headline economic recovery in the current cycle, while small businesses never even leave the 'post recessionary' starting gate?

It's sure looking that way for now. In terms of "counting cards" as per a potential US 'double dip' recession outcome, the NFIB puts a checkmark in the plus column for the 'double dip' scenario. Just keepin' a list.

The danger today, as opposed to prior deleveraging cycles, is that the deleveraging is being attempted into the headwinds of a structural demographic downwave as opposed to a decade of substantial population growth. Japan is the modern-day example of what deleveraging in the face of a slowing and now negatively growing population can do. Prior deleveraging periods such as that which the U.S. and European economies experienced in the 1930s exhibited a similar demographic with the lowest levels of fertility in the 20th century and extremely low population growth.

The danger today, as opposed to prior deleveraging cycles, is that the deleveraging is being attempted into the headwinds of a structural demographic downwave as opposed to a decade of substantial population growth. Japan is the modern-day example of what deleveraging in the face of a slowing and now negatively growing population can do. Prior deleveraging periods such as that which the U.S. and European economies experienced in the 1930s exhibited a similar demographic with the lowest levels of fertility in the 20th century and extremely low population growth. They do so, he intelligently argues, to boost their standard of living, to bring consumption forward instead of languishing in the present. How could almost any of us have afforded a home without a mortgage? By the time we would have saved enough money we'd have been close to retirement with the kids grown and facing a similar predicament. And so we turned to the wizardry of borrowing on time to be able to purchase and then repay in full. Crucially, since debt is a handshake between at least two parties, the lender had to believe that it would be repaid, and that belief or "credere," was based on several rather 'rational' expectations when observed on a macro level from 30,000 feet.

They do so, he intelligently argues, to boost their standard of living, to bring consumption forward instead of languishing in the present. How could almost any of us have afforded a home without a mortgage? By the time we would have saved enough money we'd have been close to retirement with the kids grown and facing a similar predicament. And so we turned to the wizardry of borrowing on time to be able to purchase and then repay in full. Crucially, since debt is a handshake between at least two parties, the lender had to believe that it would be repaid, and that belief or "credere," was based on several rather 'rational' expectations when observed on a macro level from 30,000 feet.

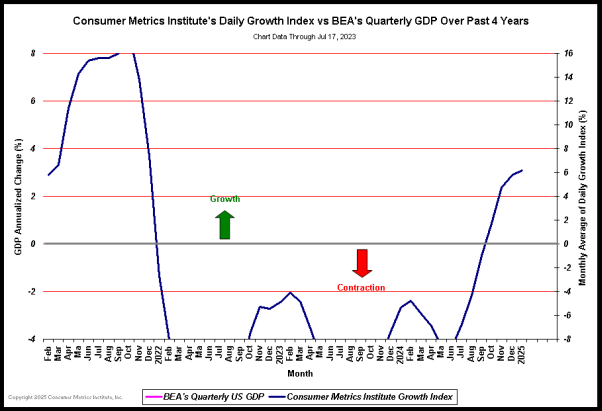

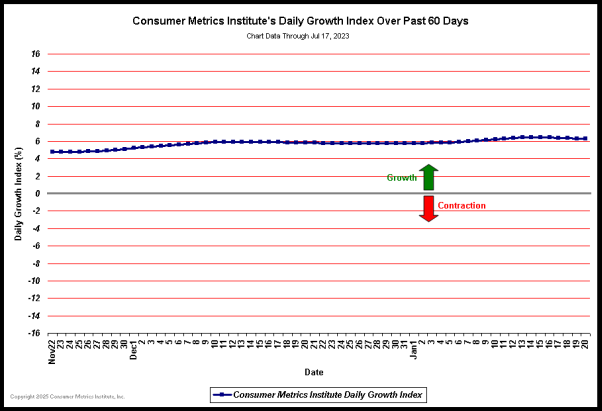

The current contraction in consumer demand for discretionary durable goods has now extended for more than 6 months.

The current contraction in consumer demand for discretionary durable goods has now extended for more than 6 months.