Examining 5 Areas Showing California Will Have A Tougher Economic Year Than 2008.

Click here for a link to complete article:

By Dr. Housing Bubble | 2 January 2009

I won’t sugarcoat it for you. 2009 will be a much more difficult year for California than 2008. I am astonished that many pundits are now claiming how 2009 will be an up year for the markets even though the Dow Jones Industrial Average just faced a pounding unseen since 1931, during the Great Depression. They’ll point to examples like 1907 when the market fell 37 percent only to rebound by 46 percent in 1908. This is absurd since 1907 was much more isolated in terms of global reach.

And, in 1907, J.P. Morgan stepped in, putting up some of his own money to instill confidence. You tell me who is putting up their own money today? What we have is a bunch of beggars— mostly Wall Street and financial firms going to Washington for a piece of the bailout money parade— but no one seems eager to be left behind while Uncle Sap is dishing it out.

This time is significantly different. I have already given you 10 reasons why nationally this recession will be the worst since World War II. Those 10 reasons still stand as we enter the new year. Yet California will face pain on a more pronounced level because it has cast its lot with real estate and finance. The heart of the housing bubble darkness started here in sunny California.

Remember epic toxic mortgage dealers like New Century Financial out in Irvine California? Or who could forget the ultimate toxic mortgage factory Countrywide Financial which has miraculously disappeared into the belly of the Bank of America beast? Or what about the fact that the median home price in California flirted with $600,000 for a month in 2007? These examples have all vanished. New Century Financial is gone and so is Countrywide. That $600,000 median price is now $285,680 IAW the California Association of Realtors data.

Many people, including those once skeptical, now think that we have reached bottom because things became so sour in 2008. They will be shocked this year. Why? Just because things have fallen so quickly is not a good reason that things will now go right back up. This seems to be the argument of most mainstream pundits who believe 2009 will be a better year.

They use an iteration of the argument that goes something like, "2008 was such a brutal year, and things are now so cheap, that it is time to go 'bottom fishing'." Total non-sense. If you look at the data what you see is continued weakness in the markets— possibly for some time yet. And California still has many other issues to confront.

What I will discuss today is the 2009 forecast for California in terms of the economy and housing. You can dig through the hundreds of articles here if you want to see how accurate some of my past analyses have been. [[I'll save you the trouble. He has been way ahead of the curve.: normxxx]] The first problem we still have is much of our employment is still closely tied to real estate. That has not much changed.

Consumer psychology is much more fragile now. That is, many people now, finally, believe that no, real estate does not go up forever. This is probably irretrievable damage to the outlook for a generation, which should keep another real estate bubble from forming anytime soon. Housing prices are still tanking and believe it or not, many metro areas in California are still wildly overpriced. Another reason is that the state budget (and that of any number of cities and local communities) is in shambles. Do you think it is good that we are staring at bankruptcy in 2 months? Plus, the toxic Pay Option ARM reset tsunami will be hitting with full force this year.

Reason #1— Employment

As you can imagine, I look at tons of data. The only way you can determine future movements in this market is to glance at and absorb many, many data points, reference similar historical economic events, and try to forecast where things will move— but not by the 'straight line projection' method favored by the stupid and lazy. You need to be cognizant of history, understand economics, and know how mass psychology affects consumer behavior. With that, let us first look at the California employment situation:

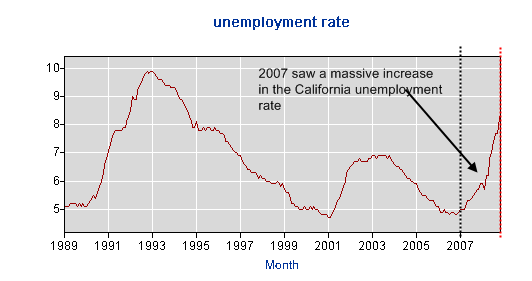

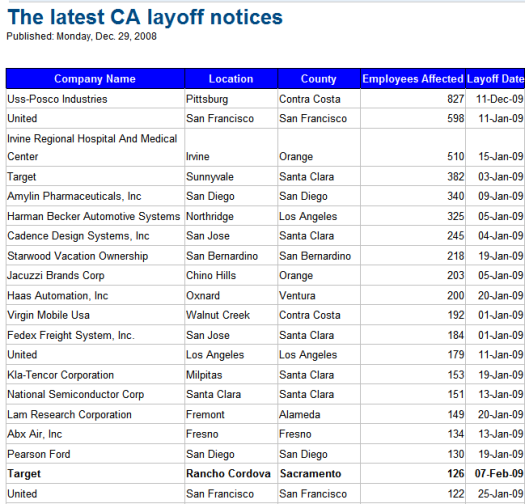

The unemployment rate in January of 2008 for California was 5.9 percent. The latest data we have is for November of 2008 and the current unemployment rate is at 8.4 percent. A 2.5 percent total increase in less than a year is amazing— that's more than a 40% increase in the number of unemployed! Without a doubt, the California unemployment rate will be well above 10 percent by the end of the year. Why? Well take a look at some of the latest layoff announcements being made:

What you should immediately notice is this is well beyond a real estate and finance problem. Sure, the bulk of layoffs came from industries closely tied to these fields but the above list now tells you this is spreading to pretty much every industry you can imagine. Looking at the raw numbers of unemployed persons according to the BLS, it looks like California added 478,000 people in 2008 alone. Nationwide 1.911 million people were added to the unemployment statistics. What this means is California was 25 percent of all unemployment net-additions.

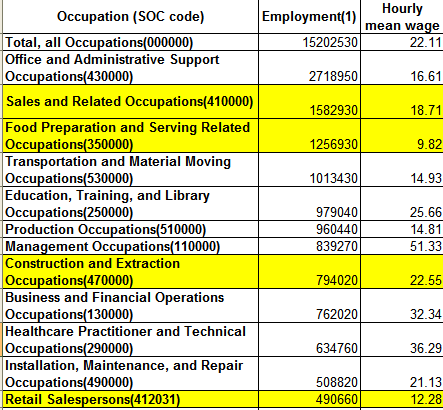

What you then need to do is look at which industries employ the most Californians:

The layoff announcements should tell you that practically every area is feeling the crisis. The above chart should give you a snapshot of how the employment picture pans out. I’ve highlighted areas that will be most directly impacted by this crisis. This does not mean other areas will not also suffer, but only that these areas will feel the pain most immediately and most significantly.

Together with the sales and food related fields, these are the lower paying industries. Many of these workers will have a tough time finding other work, should they be laid off. California’s unemployment insurance is reaching the breaking point. Construction will face pain as well. Who is building any large projects right now?

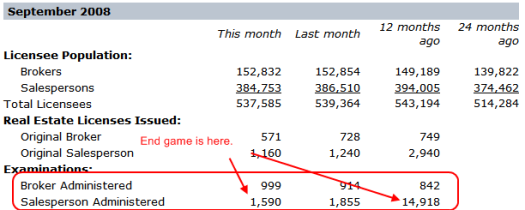

Reasons #2— DRE Licensees And Consumer Psychology

Click Here, or on the image, to see a larger, undistorted image.

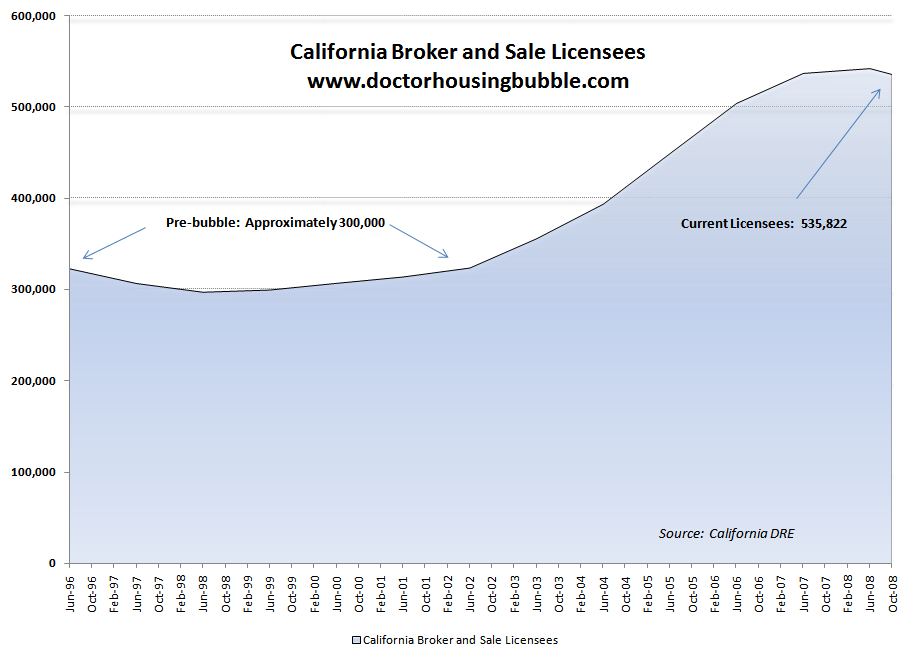

For most of the 1990s, there were approximately 300,000 real estate licensees in the state active at any one time. We are currently at 535,000+ active licensees. What does this mean? People are still delusional regarding real estate. (I should point out that many DRE licenses last a few years so you may be seeing people still active on the rolls yet not likely to be renewing anytime soon.) Forecasting means looking at the future and we can already see that the real estate psychology is broken:

The above is stunning. In September of 2007 14,918 salesperson exams were administered. In September of 2008 only 1,590 exams were given! In October of 2008 only 1,480 were administered. Game over.

What this tells us is the allure of real estate has been broken. The once glamorous lifestyle portrayed on housing porn shows is now rapidly evaporating. Keep in mind this was another revenue (although tiny) stream of income into the state which will now be gone. How many people will stop renewing their licenses?

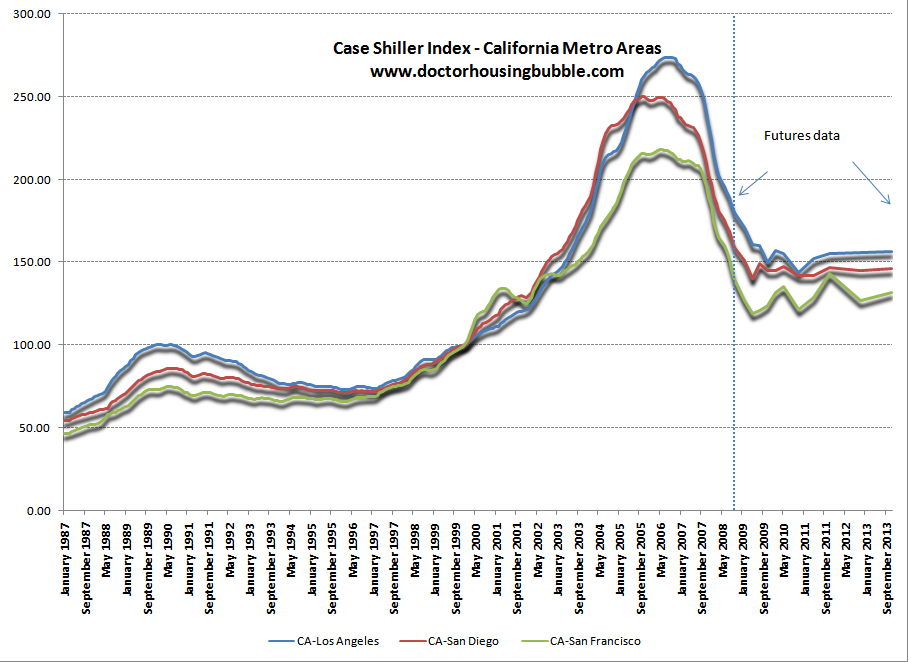

Reason #3— Case-Shiller Housing Prices

Click Here, or on the image, to see a larger, undistorted image.

I want to spend sometime on this chart. I have constructed the above chart using the Case Shiller Index data for 3 largely followed metro areas in California. The data up until October 2008 is from the actual data set. I’ve also included the 'futures' data which is traded on the CME.

When I tell you that California will not hit a housing bottom until 2011, I am not the only one who believes this. These contracts are backed by fairly sharp money people not accustomed to losing. If you believe otherwise, go ahead and bet against them with your own money. Let us see how many pundits put up some serious cash here to back up their rosy predictions.

The principal thing that should come to your attention is all 3 major areas have further to fall. Los Angeles and San Diego have the biggest drops ahead, according to the futures data. Yet what should jump out at you as well is how the market will essentially stagnate well into 2013. The contracts for 2012 and 2013 are little traded but you already have people betting for a stagnant market for another 4 years. I tend to agree with them.

There is very little evidence to show us that somehow prices will be rebounding anytime soon. Short of skyrocketing wages and solid employment, why are we to believe the market will do well in 2009?

Reason #4— California Budget

How can anyone listen to politicians tell us we are weeks away from a statewide bankruptcy and, then, in almost the same sentence, say things will be better in the state for 2009? Look at the chart on the left. I have used this chart numerous times because it highlights the magnitude of the problem.

The two largest sources of revenue for the state are personal income tax and sales tax. With unemployment rising (see above) and personal spending falling, that means less personal income tax and sales tax. With property prices tanking, this is another revenue source which will be shattered.

Also, California is home to many millionaires and billionaires, the most of any state in the country. Many of these people have money in the stock market. When they go to do their taxes, guess what is going to happen. We just had the worst stock market since the Great Depression. You can rest assured that many of these people are going to claim large losses, meaning they will pay substantially less in state income taxes than in 2008.

There is only two ways to fix this problem. Raise taxes or cut the state payrioll. Both are bad yet that is what is left. Cutting jobs only adds to the unemployment lines and raising taxes in a bad economy is a further drag on business. Our current group of politicians has no backbone. Do some of both and get on with it. Yet be a bit more strategic about it. Don’t be idiotic like our federal government that is bailing out crony capitalism and is throwing trillions of dollars into an abyss.

Unfortunately, we are broke both as a state and at a federal level. Where will the money come from? The California budget is well over $100 billion so this isn’t going to be solved by telling people to stop using staplers.

Reason #5— Pay Option Arms

The final nail in the coffin is the number of pay option ARMs that will reset in the state in 2009. These incredibly toxic loans are going to reset at the worst possible time. I’ve seen a few argue that lower rates will help yet this is another misconception: lower market rates will do nothing for the pay option ARMs of California. And for the purposes of pay option ARMs, over 50 percent of the nominal value of these mortgages outstanding rest here in California.

Why is this problematic? As we pointed out above, the median home price in California has fallen roughly 50 percent from its peak. Many of the option ARMs have little equity from home buyers. That is, little of the homeowner's 'skin' was put into the game. Now that prices have tanked, many borrowers are running the numbers and are gearing up for a 'moonwalk' away from their mortgage in 2009.

You can ignore the drop in foreclosures towards the end of the year. This was because of SB 1137 and the Fannie Mae and Freddie Mac moratorium. Guess what? Holidays are now over and now back to reality. These pathetic measures were the equivalent of an ostrich sticking its head into the sand.

In addition, you cannot refinance an underwater mortgage! And, the vast majority of these California loans are so underwater, they are swimming in Jacque Cousteau territory. These loans never served any purpose except to delude prospective homeowners and garner all of those lenders' middlemen outrageous fees. We can only hope that with new federal regulations, we will have an outright ban on them.

Those are 5 reasons why California will have a challenging 2009. There are many other reasons as well, but these should suffice for now, since the year is young. Buckle up because it is going to be bumpy ride folks.

M O R E. . .

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment