By David Merkel | August 17, 2009

On to tonight's topic, real estate and its effect on the real and financial economies.

1) Principal forgiveness— it is what underwater homeowners want, and what they are least likely to get. Principal forgiveness means that a loss has to be taken by someone now. Adjust the rate, adjust the term, adjust the amortization— it is all tinkering, even if it lowers the payment slightly, because the owner is still inverted on his mortgage. [[Reminds me of "East Side Al", who lost a $1 on each shirt he sold… but made it up in volume!: normxxx]]

Ideas like lowering the principal, but giving the bank a large chunk of the price appreciation at sale, or say 30 years out, would be cute, but still, the bank (or juniormost MBS certificate holder, who usually directs the servicer) would take a loss now. [[So, fugedaboudid— banks are not about to do any business that means taking a present loss— even for huge profits down the road.: normxxx]]

So, I'm not surprised when I read articles like these:

- Mortgage Servicers Are Under Pressure to Modify More Loans

- Lucrative Fees May Deter Efforts to Alter Loans

- U.S. Effort to Modify Mortgages Falters

- Foreclosure Plan Is Off to a Bumpy Start

- Foreclosures Are Often In Lenders' Best Interest

Governments have power, but it is very difficult to fight the economics of the situation [[People tend to be rather irrational about their economic survival— often second only to their biological survival, if that: normxxx]]. One further note, as is mentioned by a few of the above articles, is that the most profitable situation for the lenders/servicers, is [when] the present property owner teeters on the edge of solvency, not only paying the mortgage slowly, but paying additional [eg, late] fees in the process.

2) Will there be a second foreclosure wave? Maybe. First American CoreLogic argues that it will be the existing wave continuing. I tend to agree with CoreLogic for the following reason: when you have enough of the mortgaged homes of the country underwater, it is difficult to slow the rate of foreclosure, because foreclosures happen to properties that are underwater where one of the following occurs:

- Death

- Divorce

- Unemployment

- Disability

- Disaster

- Strategic default (buy a nicer home cheaper, then stop paying off on this overpriced piece of garbage)

- Debt reset/recast

3) The GSEs, despite the rally, are still in lousy shape. Fannie lost $14.8 Billion, and tapped the Treasury for liquidity. Freddie earned less than $1 billion, but only because they revalued assets $5 billion higher. Their regulator believes that they won't be able to repay all of the aid that the US has granted them. My verdict: the common of each company is an eventual zero. Stay away. Thrillseekers that like zero shorts, don't do it; the odds are good for a zero, but the payoff is asymmetric.

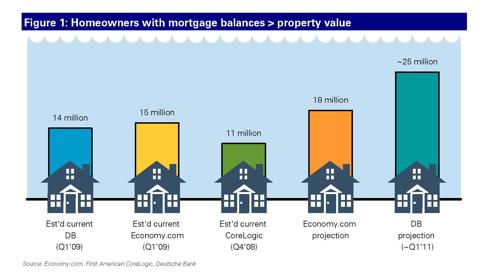

4) What percentage of homeowners are or will be upside-down or underwater?

- 24 or 32% (now and soon)

- 30% (Zillow— soon)

- 32% (First American CoreLogic— now)

- 48% (Deutsche Bank— in two years, challenged by Lawler)

I favor the estimates of First American CoreLogic. First, they have great data. Second, my view is that properties with greater than 90% LTVs are likely upside-down in a sale due to closing costs. The inflection point in mortgagee behavior occurs between 90-100% LTVs, not at 100%+.

That's why we are in such deep trouble. With 32% of all mortgages inverted, there will be many more foreclosures, and prices should still head downward, even on the low end.

5) But maybe things aren't so bad, at least on the low end.

- Home inventories fell in July.

- In some markets, on the low end, foreclosures are selling fast.

- New home sales increased in June.

- Bottoms are longer than we would like to expect.

6) All that said, the high end isn't seeing much action, and prices continue to sag. There aren't many move-up buyers.

7) What characterizes the underwater borrower? Cash-out refinancing, and home equity loans. The home as an ATM always relied on the "greater fool" theory implicitly— that there would always be a greater fool willing to buy out the home at a greater price than the new amount of leverage. On the home equity loans— banks are doing all that they can to avoid recognizing losses. With home equity loans, losses are usually total. The only thing that surprises me here is that it has taken this long to get to realizing the losses. [[Not if you delay the foreclosing process long enough!: normxxx]]

8) So you want appraisers to be honest, but not just yet? Appraisers, auditors, etc.— third party evaluators are conflicted— he who pays the piper calls the tune, and no one is willing to have the buyer pay for the appraisal. So now the appraisers try to be honest and business can't get done?! Those who hire appraisers, make up your minds; do you want a few short term deals, or do you want reliable long term business?

9) On the dark side, many option ARMs will default even before the payments recast. [[Yes, even Prime ARMs.: normxxx]] That means the next recast 'wave' will be more gradual, but it won't be any less troublesome in aggregate.

.

Property Values— Eight Key Charts

Click here for a link to supplementary article with bigger/better visuals:

By Michael David White | 19 August 2009

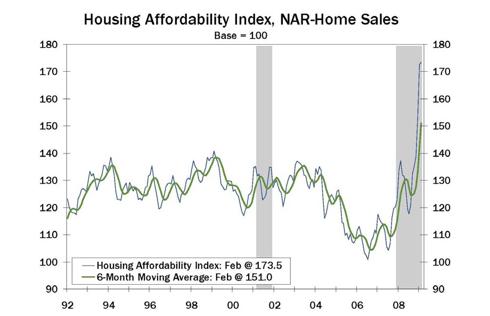

AFFORDABILITY (8/5/09): The affordabilty of real estate is shooting through the roof— ie, in the right direction— in a great way. The important questions are: Do buyers have the down payment? Does affordability justify taking on the other risk factors listed below?

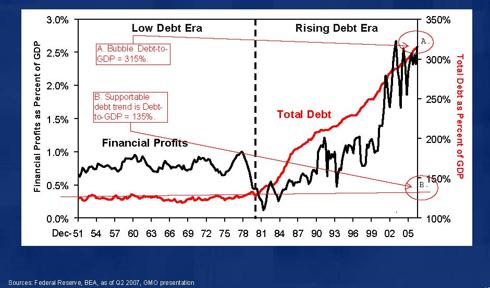

DEBT BE NOT PROUD (8/11/09): One school of thought says excess debt must be paid off or written off before we will achieve dynamic growth. This "Low Debt" and "High Debt" chart shows that the magnitude of the excess debt could be far beyond reasonable. If this school is correct, then we may have years or decades of slow growth unless we take radical steps to massively reduce debt issued during the credit bubble. The outlook for real estate investment is negative based upon this school of thought.

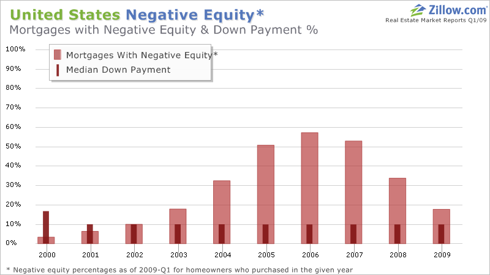

NEGATIVE EQUITY— TEN-TON GORILLA (8/13/09): How many homeowners would make money by walking away from their mortgage? Whether the number is 11 million or 25 million, the low and the high estimates in this graph, the risk factor is wildly high. It's exactly like Cheech & Chong on Spring Break in Cancun and they are going in to rehab after this last hurrah.

Click Here, or on the image, to see a larger, undistorted image.

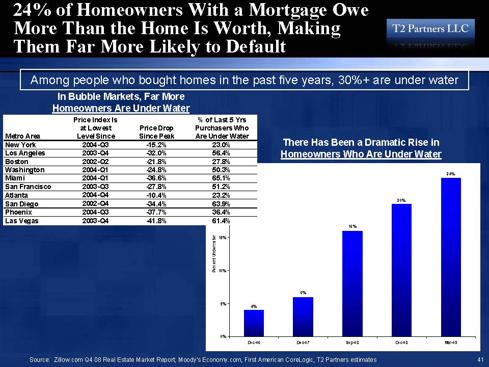

NEGATIVE EQUITY (8/5/09): Negative equity is a major risk factor for which no good research has been done. It's reasonable to suspect that we may experience a foreclosure wave as this variable worsens. Some owners will not pay on their mortgage if it will take five or ten years [[or maybe never? : normxxx]] to get to break even. Social factors are believed to play a major role. And we could hit a tipping point— after which all hell breaks loose. Bet your bottom dollar that the Fed and the Treasury have this at the top of their "freak patrol" chart.

NEGATIVE EQUITY (8/6/09): The graph shows half of all mortgages issued in 2006 have a balance greater than the value of the house securing the loan. What will happen to loan performance if 50% of all mortgages are worth more than their collateral? Nobody knows, and if nobody knows, then a wildly massive risk factor cannot be forecast. If you think that that is impossible, please note that Deutsche Bank issued a report in early August saying that 48% of all mortgages would be worth more than their collateral by 2011. This is unchartered territory adjacent to the galaxy beyond the next universe.

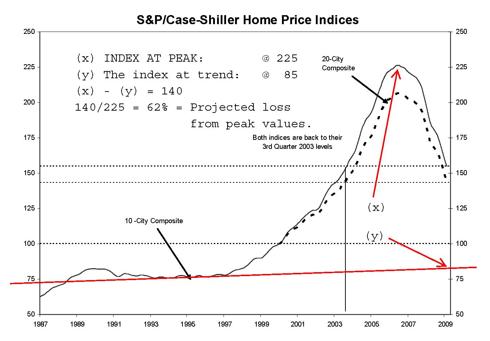

SALES— PRICE (8/5/09): THE FALL IN PRICES: There is a lot of good news in the stock market today, but sentiment would turn 180 degrees if it was known that property values would eventually fall 60% from their peak. They have already fallen 30%. If values fall according to the estimates in this graph, it is a certainty that banks and financial companies will fail en masse. There has been some good news about real estate prices lately, but the vast majority of indicators are still negative.

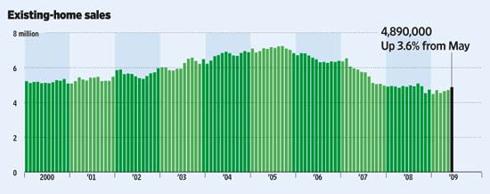

SALES— UNITS (8/5/09): Looking at the long trend, there has never been a serious problem in terms of the number of units sold. The quality of the sales is another question.

SALES— UNITS (8/5/09): NEW vs. USED: A wide gap between sales of new homes and existing homes suggests the stress level in the property market remains elevated. [[And continues to bode ill for the homebuilders.: normxxx]]

No comments:

Post a Comment