What 10 Reasons Will Keep A Lid On The Housing And Economic Recovery For California?

Click here for a link to complete article:

by DrHousingBubble | 12 December 2009

Every December I like to do a synopsis of the California economy and the impact on housing. 2009 has been a tough year for housing. If we had to sum up what occurred in California it is that housing sales jumped because of massive cuts in prices. Without the giant crutch of FHA insured loans and the Federal Reserve artificially keeping mortgage rates lower housing would be in a different position. And the other position isn't necessarily bad.

Lower prices would lower the housing burden on many. Keep in mind that the bailout of crony Wall Street with backstops of $14 trillion would have been enough to pay off every single prime, near prime, and subprime mortgage in the entire country. What the bailouts accomplished was to repair the failed bets placed by the crony bankers. The proof should be that 2009 saw the largest number of foreclosure filings and many Wall Street banks are dishing out record bonuses.

So here we are, nearing a close to the 2009 year and California is still in a difficult position economically. The unemployment rate is the highest on record and the government is bleeding money since revenues have evaporated. The access to easy loans is now gone but people can still get lenient terms with FHA insured loans.

My prognosis for California in 2010 is a continuation of a weak employment environment, continuing fiscal deficits, and a popular election that will focus on the economy. The housing market will continue to remain weak but we will see more price cuts appearing in mid to upper priced neighborhoods. Let us go through the 10 reasons why the California economy and housing market will face another challenging year in 2010.

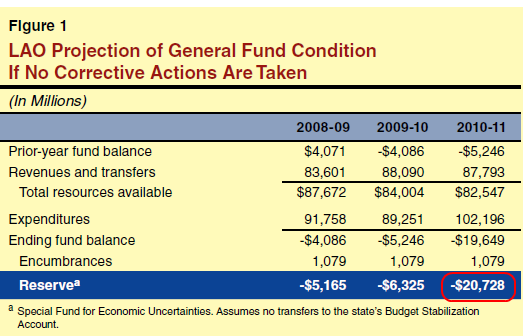

Reason #1— Budget Deficit

Click Here, or on the image, to see a larger, undistorted image.

There is probably no better indicator of the health of the current economy then current revenues into state coffers. The state of California has high income, sales, and capital gains taxes that go up in boom times and tank in recessions. This recession has caused shock and awe to those in Sacramento. In the last go around the state had to patch up some $60 billion in budget deficits. People took a deep sigh of relief but the reality is, we are facing another $21 billion budget deficit next year. The above data highlights this problem.

And it isn't next year alone. The Legislative Analysis Office projects $20 billion annual budget deficit up all the way through 2015. This is going to be a drag on the economy without a doubt. How did we patch up the last gap? Big cuts and taxes. That is the only way to balance a state budget. Hard choices will need to be made next year yet again. Whatever the choice happens to be Californians are going to have less money in their pockets.

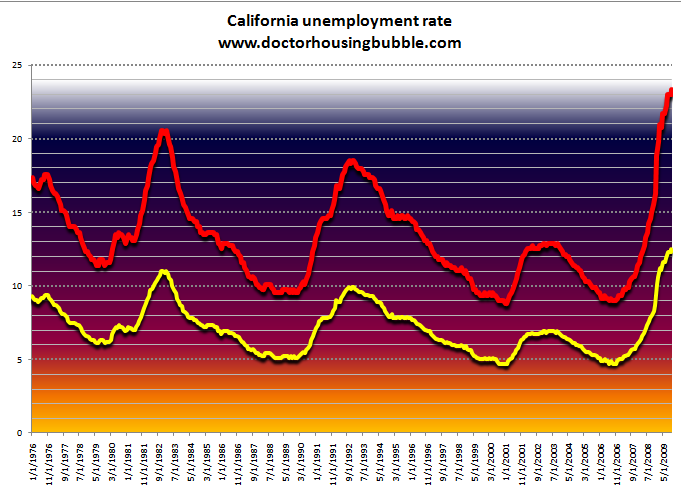

Reason #2— Unemployment

Click Here, or on the image, to see a larger, undistorted image.

I find it troubling that with all the talk of housing programs, tax incentives, cheap mortgage rates, and other subsidies that the most important driver of housing is missing. Jobs. The vast majority of Americans pay their mortgage with income they earn from a job. This is so obvious yet the lack of attention here shows how out of touch Wall Street and banks are from average Americans. Unemployed Californians are less likely to buy a home. They are also less likely to buy big ticket items.

One aspect of the California economy that is rarely examined is how closely housing was tied to many big revenue industries. Finance, construction, retail, and other aspects of real estate industries provided numerous high paying jobs. Those are gone and probably for good. The state benefitted from these jobs in higher revenues but now that is gone. It is a double whammy. We have yet to see a concentrated growth of good paying jobs in the state (to the contrary, we are still losing jobs).

Reason #3— Underemployment

In California the headline unemployment rate is at 12.5 percent, the highest since records started being kept. Yet if we include the underemployment rate we reach an astonishing rate of 23 percent. How in the world is this good for housing? Until we see a stabilization in this data point talking about booming housing is absurd. Housing at a certain point needs to connect with the real economy.

The underemployment problem is at the highest we have ever seen. Like Japan that has nearly one-third of its workforce on part-time employment, we are starting to see shifts in our economy that may become permanent. With the high cost of healthcare and other non-wage costs for employers, it may be easier for employers to simply hire consultants or temporary workers and circumvent the need to provide adequate compensation to employees. But that leaves many contending with high insurances costs and using more of their shrinking salary to pay for costs that are simply going up.

It is hard to see this trend changing. We have allowed our manufacturing base to simply disappear over the past three decades. The biggest input cost in manufacturing is labor and it is hard to see how the U.S. can compete with low cost producers overseas. People have a penchant now for cheap goods. It is a deal with the devil in many ways. If we want cheap goods as a country we have to be willing to accept that more and more jobs will be leaving this country. If this is unacceptable, then we must be prepared to pay more for goods as many Americans are tightening up their budgets. Both choices are painful.

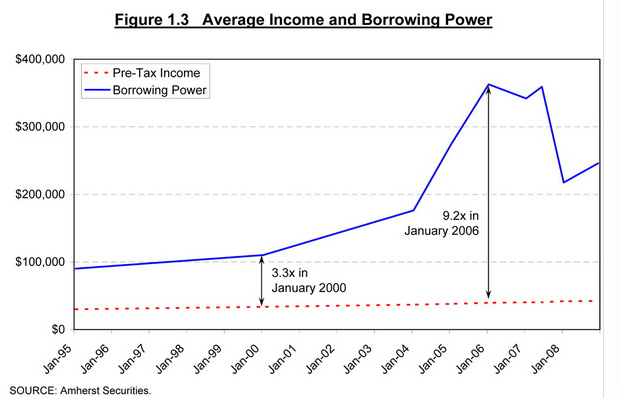

Reason #4— Lack Of Alt-A And Option Arms

Click Here, or on the image, to see a larger, undistorted image.

Source: T2 Partners

When I hear about arguments about the triumphant return of housing values I simply look at the above chart and realize that it is mathematically impossible. Since the government is now the lender of first, second, and last resort at least they are verifying income even with FHA insured loans. Yet the chart above showed how absurd lending standards got and were exploited especially here in California. This was the fuel that flamed the housing price bubble.

Yet the major source of housing appreciation in the state is now gone. The leverage to lift the world has been removed. With Alt-A and option ARM products buyers were able to get 10 and even 15 times leverage to purchase a home. Countless people making $50,000 a year went no doc and bought $500,000 homes. The $500,000 home in California was the median home back at the peak.

Without this leverage, prices can only go up so high when they do start going up. Real incomes are unable to support current prices in many places. The $250,000 median price only reflects the large volume of sales in the lower end. Next year we will see more price reductions at the mid tier as prices reflect the current economy and lack of maximum leverage products.

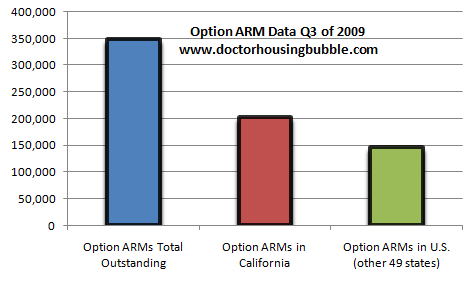

Reasons #5— Option Arm Recasts

The bulk of option ARMs have yet to hit recast dates. 60 percent of current outstanding option ARMs find their home in California. This is largely a one state problem. Florida, Nevada, and Arizona have the remaining large share of the loans but no state comes close to matching California. The problem with these loans are many are in the mid tier markets. The subprime debacle has already washed away much of the lower end of the market. Borrowers had less of a buffer in those areas.

Yet the option ARM does a good job hiding problems for a long time. The teaser payment can last for a few years and once that first recast hits, it is game over. Currently, 40 percent of all option ARMs are already 60 days late and we have yet to hit the major recast points. Once these homes start selling at lower prices comps will also take a hit.

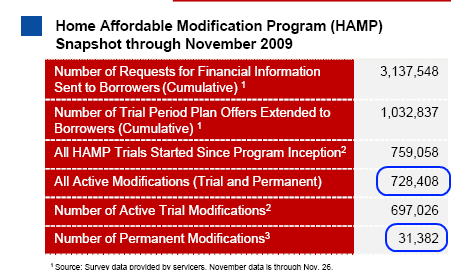

Reason #6— Hamp Failure And Growing Foreclosures

Another argument from the housing bulls was how banks were going to use programs like HAMP to stop the foreclosure mess. All it did was stall the inevitable. Last week data on HAMP came out and showed an utter disappointment. Only 4 percent of all current trial mods have entered into a permanent stage. California with 148,000 of the trial mods probably saw somewhere around 6,000 permanent modifications. 6,000 modifications at a time the state is seeing over 450,000 notice of defaults being filed in 2009.

Why is HAMP a failure? Because the offer to borrowers is basically converting them into long-term renters. Many in California bought as speculators although they won't say this. They used products like option ARMs because they were never planning on staying at any home longer than a few years. Now they are stuck with a product they don't want. Banks like Wells Fargo are trying to convert option ARMs into interest only loans for six to 10 years but how much good this will do is yet to be seen. One thing is clear however and that is HAMP is a failure.

With the failure, we can rest assured that many additional foreclosures are going to hit the market as banks are no longer able to keep homes off the books. People forget that a home with no payment or lack of payment is costing the bank money. And at a certain point, reality needs to be confronted. HAMP started with speed in May and here we are in December with no success.

Reason #7— Housing Still Overpriced

Click Here, or on the image, to see a larger, undistorted image.

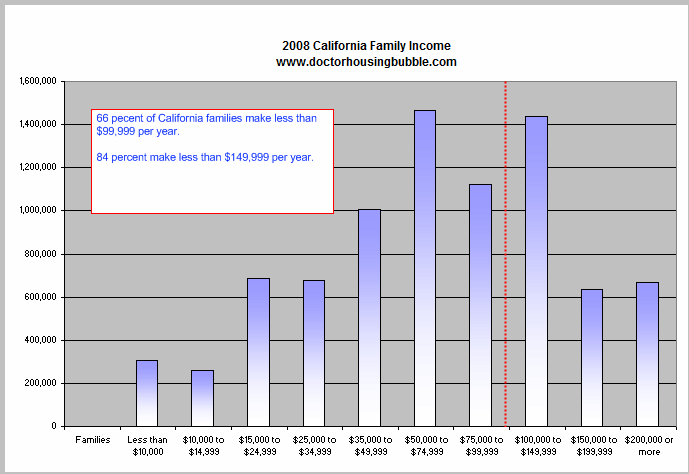

Home prices in many areas are largely overpriced. They simply do not justify local economies. But in areas like the Inland Empire where homes are selling for $100,000 to $150,000 local incomes can now justify current prices. These areas may have household incomes of $40,000 to $60,000 and this can support the current price even with a government backed loan.

But places like Pasadena and Culver City for example, still have the housing bubble delusion that kept prices inflated for the past few years. Take Culver City for example. The median home price is $620,000 yet the median household income is $82,000. There is simply no justification for the current price. Take even a household making $150,000 and the current price is still much too high. It is likely that we will see price corrections in these areas in 2010. We will probably see 10 to 15 percent price drops by the end of the year in the median price.

As a state, California income is not off the chart as you can see above. Even the current median price of $250,000 is too high given income data. If we simply erase the bubble decade, prices should be near $200,000 to $225,000.

Reason #8— Allure Of Real Estate Tarnished

There was a time, say before 2007, when saying that the best investment you can ever make was buying your home. Those days are long gone. Tired, repetitive, and catchy mantras regarding real estate have slowly disappeared. Buying a home is the biggest purchase for most Americans. This decision shouldn't be taken lightly. But it was.

It was taken for granted that home prices would never fall. The opposite actually occurred. Not only were home prices expected to rise they were expected to rise significantly. Many started depending on home equity lines and home equity loans as new sources of income to make up for stagnant wages.

Yet housing prices can go down and go down significantly. Caveat emptor. It is clear that many more people are now exercising more due diligence when they buy a home:

Click Here, or on the image, to see a larger, undistorted image.

The price drop nationwide has been painful but the price drop in California has been epic. And just because sales have increased does not mean home prices are going up. It seems like exhaustion is occurring with first time buyers and investors thinning out of the market. Even many successful real estate investors are now cautious about jumping into this highly unstable market.

The happy day psychology is now gone. This consumer behavior added to the mania and this is also largely gone. Take away the no doc maximum leverage loans and add in massive price drops and people start hesitating when they buy a home.

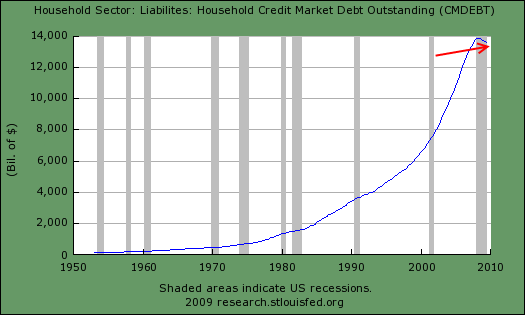

Reason #9— Too Much Debt

|

Homeowners are too leveraged. Here's the problem. Housing values have fallen by nearly $6 trillion yet the existing mortgage value doesn't adjust with the market. Say you bought at the peak for $600,000 and the home is now worth $300,000. You went in with a zero down loan.

Your home can only fetch $300,000 yet the banks still expect the full $600,000 and they expect you to pay in full. It isn't as if the mortgage adjusts to the new reality. That is why, if you pull up the mortgage debt picture, it has moved only very slightly during this correction:

Notice how little the above dipped? The way the system is fixing this discrepancy is by foreclosures, bankruptcies, and defaults. This is how the average American is forced to deal with this pain. The crony Wall Street bankers have even poorer balance sheets yet they have unlimited access to the best government money can buy so they operate under different rules.

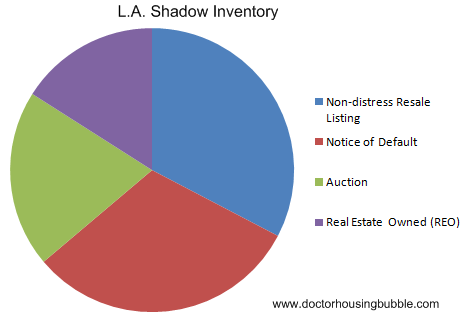

Reason #10— Shadow Inventory

Finally, shadow inventory is another big factor in the market. With HAMP being a failure and banks trying their own mods that will also fail, many of these homes will be hitting the market in 2010. Sure there was a buffer in 2009 but how long can this go on? If the economy doesn't improve, a bank can modify all it wants, but with no income and savings exhausted, the home is gone.

You need a healthy economy to have a healthy housing market. This should be no stunner but banks think they can hide inventory off the market by not moving on non-payers or playing games with HAMP and other temporary stalling tactics. But eventually things will need to change.

Many banks with California loans are praying for massive inflation. They are hoping that eventually wages will speed up and suddenly a $500,000 shack won't seem expensive. Yet what is happening is that the banks are hoarding money, so hardly enough new money is entering the real economy to cause any sort of inflation. On the contrary, with access to credit being stifled, we are seeing signs of dis-inflation [[even… deflation!?!: normxxx]]. Clearly prices collapsing in home values isn't a sign of price inflation.

Shadow inventory can be hidden for only so long. This is another variable that will be a factor in 2010.

Conclusion

It is hard to see how the housing market recovers in 2010 in California. My old prediction that home values may see a trough in 2011 seems like a reasonable estimate. Given the recast patterns and budget deficits, times will be tough in the state. Trying to keep home values inflated is merely delaying the inevitable reality.

There is even an interesting micro trend that foreclosure may provide a mini stimulus. For example, take someone struggling to make a big $4,000 mortgage. They suddenly decide to strategically default and rent a place for $2,000. They now have $2,000 more a month to spend in the economy. We have seen some weird things like this occur in this bubble.

Overall I would be cautious about buying a home in 2010. We still don't know how the state is going to patch up the $21 billion deficit and we have yet to see any employment trends show marked improvement. Until these things hit, the best course of action might be to sit tight.

No comments:

Post a Comment