Click here for a link to ORIGINAL article:

By John P. Hussman, Ph.D. | 15 November 2010

All rights reserved and actively enforced.

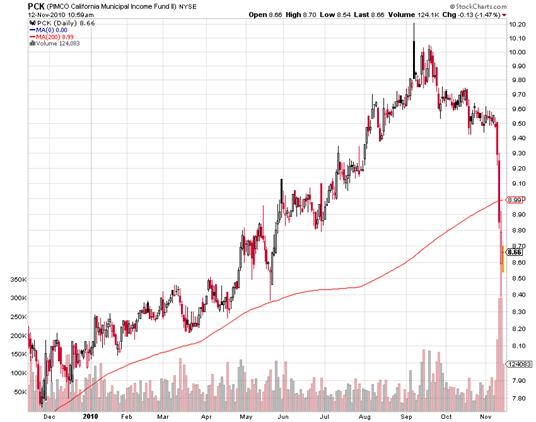

Last week, the return/risk profiles that we estimate for stocks, bonds and even gold declined abruptly, based on the metrics we track. We don't know how long this shift will persist, but at present, investment risk appears to have spiked considerably, and our estimates of prospective market returns have deteriorated. The abruptness of the shift in market conditions is exemplified by the weakness observed in Irish, Greek and Spanish debt, as well as the plunge in municipal bonds. Particularly, as Barry Ritholtz observes, in CA issues— see the chart below— which was steep enough to erase nearly a full year of progress in just three days.

Click Here, or on the image, to see a larger, undistorted image.

On the NYSE, hundreds of stocks achieved new 52-week highs, but ended down on the week, with technical evidence suggesting a uniform reversal from a "high pole" buying climax. The percentage of bullish investment advisors reached 48.4%— the highest since the April peak, while the AAII sentiment poll shot to 57.6% bulls— the highest since 2007. Our bond market measures shifted to an unfavorable status for yield pressures, putting the stock market in an overvalued, overbought, overbullish, rising-yields conformation despite QE2, which as anticipated, has been met with fairly eager offers from bondholders.

Whenever one evaluates market conditions, the entire context matters. Various economic and market indicators provide only partial views— much like the group of blind men who identified an elephant as a snake (trunk), a spear (tusk), a fan (ear), a tree (leg), a wall (side), and a rope (tail), depending which part they touched. While various positive indicators can be identified, what matters to us is the full context. In stocks, we have overvalued, overbought, overbullish, rising yield conditions. In bonds, we have unfavorable yield levels and now unfavorable yield pressures. In precious metals, conditions are mixed, so the negative overall conditions in that market at present are somewhat more subtle and may be short-lived.

I don't want to make a fanfare of these concerns. They are simply the average implications we observe based on historical market relationships— even in post-war data. Longer-term, based on our standard methodology, we estimate that the S&P 500 is priced to achieve sub-5% returns, albeit with significant risk, for every horizon out to a decade. Treasury securities are clearly priced to deliver similarly low returns. It's possible that internals will improve sufficiently to shift the expected return/risk profiles we observe in stocks, bonds and precious metals. For now, we are tightly defensive.

The Cliff

I've reviewed the valuation conditions of the stock market extensively in recent months, emphasizing that stocks are not a claim on a single year's earnings, but rather on a whole stream of future cash flows that will be delivered to investors over time. At present, investors and analysts who focus on simple price/earnings multiples (rather than modeling the entire stream of cash flows) are placing themselves at tremendous risk, because simple P/E multiples are being distorted by unusually wide profit margins. Part of this can be traced to weak employment conditions, which have held down wages and salaries. But there is more to the story— the rebound in profit margins also reflects a heavy contribution from financials (which may be more indicative of accounting factors than sustainable earnings), as well as the tail-end of stimulus spending.

The chart below underscores the relationship between high current profit margins and poor subsequent earnings growth. The blue line shows U.S. corporate profits as a percentage of GDP (left scale), which is currently just over 8% and at the highest level since 2007. The red line depicts subsequent 5-year growth in profits, but on an inverted right scale (higher values are more negative). In effect, it should not be a surprise if present levels of corporate profits are followed by negative profit growth over the coming 5 years. Indeed, the 2009 burst of stimulus spending is most probably the only factor that has prevented profit growth from being negative over the most recent 5-year period.

Click Here, or on the image, to see a larger, undistorted image.

Municipal bond investors are clearly re-evaluating the prospects for additional fiscal stimulus from the federal government. Indeed, many state and local governments (as well as health and disability service providers that benefited from stimulus dollars), are beginning to talk about "the cliff"— an abrupt reduction in revenues due to the loss of current stimulus funding which has been used to bridge existing budget shortfalls. My impression is that equity investors face a similar "cliff" which they may not have adequately recognized yet.

The essential point is that stocks are much more richly valued than simplistic P/E multiples would suggest. Investors may pay a heavy price if they fail to adjust valuations for the level of profit margins. The only proper way to value stocks is in relation to measures of sustainable, long-run, full-cycle financial performance.

Singularity

From my perspective, an "economic recovery" that requires a tripling in the Fed's balance sheet, continues to average 450,000 new unemployment claims weekly, and relies on fiscal 'stimulus' to counter utterly stagnant personal income, is ipso facto (by the fact itself) not a "standard" economic recovery. We have swept an enormous volume of bad debt under rugs, behind dams, and in back of curtains (not to mention in off-balance sheet vehicles such as 'Maiden Lane' that were created by the Federal Reserve). But it is all effectively still there, festering. Meanwhile, our policy makers are trying to reignite financial bubbles in order to create an illusory "wealth effect" to propagate spending patterns that were inappropriate in the first place.

It is a bizarre notion that a credit crisis can be solved by bailing out lenders while doing nothing about the obligations on the borrower side. Think about it— what we have said to lenders is, 'here you have these homeowners who can't pay for their houses. Foreclose on them, sell the homes at half the price, and the public will make you whole' (largely through Treasury bailouts to Fannie and Freddie, made necessary by Federal Reserve purchases of these securities).

Heck, if the public is going to be on the hook anyway, at least notice that at equivalent cost to the public, the mortgage could simply be written down to half its value, with the homeowner now able to pay the balance off and the lender getting the public handout to make up the difference. But of course, that would reward the homeowner. So instead, we simply make the lenders 'whole' while people lose their homes and foreclosure investors flip the homes at a profit in return for providing liquidity at the auction. That way, the same amount of public funds can be spent through the back door without Congress even getting involved.

Memo to Ben Bernanke— throwing money out of helicopters isn't monetary policy. It's fiscal policy. How is this not clear?

The proper way to deal with a major debt crisis— indeed, the only way nations have ever successfully dealt with major debt crises— is through debt-equity swaps, restructuring and writedowns. There are numerous ways to achieve this with mortgages. My preference would be swaps of principal for pooled property appreciation rights (administered, but not subsidized by the Treasury). In any event, until our policy makers wake up to the need to restructure debt, so that the obligation is modified for both the debtor and the creditor, our financial system will increasingly tend toward a giant Ponzi scheme. We are racing toward the financial equivalent of a mathematical singularity, where the quantities become so large and outcomes become so sensitive to small changes that the whole system becomes unstable.

Market Climate

As noted above, the Market Climate for stocks last week was characterized by an overvalued, overbought, overbullish, rising-yields conformation that has historically been unusually hostile to stocks. The Market Climate in bonds likewise shifted last week, to a condition of unfavorable yield levels and upward yield pressures. The Strategic Growth Fund and Strategic International Equity Fund are tightly hedged. Strategic Growth holds a staggered strike position where our put strikes are generally quite close to the existing level of the market, and Strategic International Equity has less than 10% of unhedged market exposure, though only a portion of the Fund's currency risk is hedged (currency fluctuations typically represent only a fraction of the total variance of international equity investments). Strategic Total Return presently carries a duration of less than 1 year, with about 1% of assets in precious metals shares, 2% in utility shares, and 1% in foreign currencies.

These investment positions will change as market conditions evolve over time. As I noted last week, post-1940 data now includes a wide enough range of conditions— major recessions, inflation, deflation, expansion, bubbles, crashes, credit crisis, terrorism, war, and peace— that it should provide a representative basis on which to set investment expectations without appealing to Depression-era data. For more than a decade, investment conditions have been largely "out of sample," first on a valuation basis, and then on the basis of major credit strains that had never been observed in the postwar period. Whether it proves effective or not in hindsight, the appropriate response to events that have no context in one set of data is to find an alternative sample of data that is more representative. Though it's likely that we'll continue to see outcomes that have no counterpart in post-1940 data, I do expect that the postwar dataset is sufficiently encompassing that we can put last year's "two data sets" problem behind us.

It bears repeating that $850 billion of QE2 ($600 billion, plus $250 billion funded by bailed-out Fannie Mae and Freddie Mac securities) will not even absorb the new issuance of U.S. Treasury securities over the coming year. That means, in turn, that holders of existing Treasury securities will, in equilibrium, have to continue holding Treasury securities. The only effect of QE2 will be to change the maturity profile— not the overall quantity— of Treasury debt held by the public. At the same time, it will create an enormous overhang of what will effectively be "new issuance" of Treasuries at some future point if/when the Fed reverses its position. Long-term Treasury investors tend to be more forward looking than long-term stock market investors because the stream of payments is known perfectly. It's doubtful, aside from brief rounds of hot potato and musical chairs, that these investors will be moved in any persistent way by the Fed's manipulation.

— -

Prospectuses for the Hussman Strategic Growth Fund, the Hussman Strategic International Equity Fund, and the Hussman Strategic Total Return Fund, as well as Fund reports and other information, are available by clicking here.

M O R E. . .

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment