By Dr. Housing Bubble | 22 February 2008

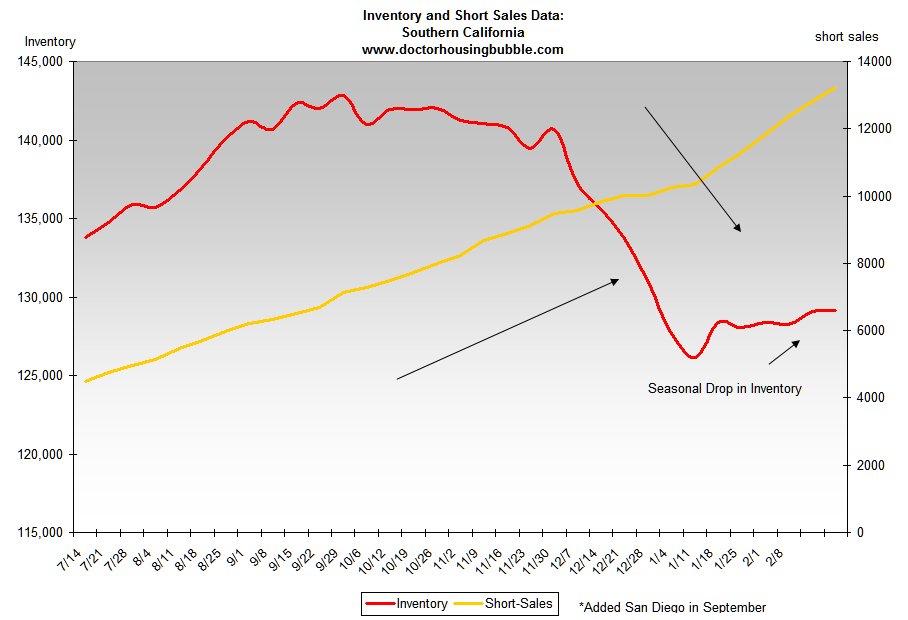

I prefer to take economic data and information like I take my sushi, raw with wasabi. In October, we reported the monumental tipping point of going over 10,000 short sales in Southern California. Those days now seem like a distant reality since as of today, there are 16,646 short sales in the Southern California housing market. There are a few graphs that we will be looking at in greater detail since these show the battle occurring in the housing trenches. Short sales are an important bellwether of the health in housing and until there is a slow-down in this area, we can put to rest any notion that we are even approaching bottom.

Also, there is this sudden notion that somehow we have been in the housing "slump" for ages and suddenly need to do every sort of bailout to keep housing prices sky high. Forget that housing has been on a tear for 10 years. It is as if there was no massive bubble and that even talking too much about 'the problem' is somehow going to make it worse. It may shift the market psychology a bit, but the reality is that you can’t make income appear out of thin air like David Copperfield. There lies the caveat. All this talk from politicians fails to address the fact that our current economy is based on large levels of conspicuous consumption and some major sector being in a bubble (housing having been merely the latest). Not something that bodes well for the future when the last bubble pops.

Click Here, or on the image, to see a larger, undistorted image.

The first graph shows inventory and short sales. As you can see, we are now out of the seasonal winter drop and inventory has been steadily increasing. Typically the peak in inventory numbers hits in spring and summer. Currently in Southern California we have 149,946 homes on the market. The chart above excludes San Diego inventory numbers since I do not have data beyond September but the short sale number does include San Diego numbers. According to DataQuick 9,983 homes sold in January. So let us do a bit of back of the napkin math:

Total SoCal Inventory (149,946) / Total Current SoCal Monthly Sales (9,983) = 15 Months

That’s right folks, we have over a year of inventory at the current sales rate, and take a look at the short sale inventory. This thing is increasing at exponential speed. There have been many studies discussing balanced sales figures but suffice it to say that 6 months of inventory is typically a balanced market for housing. We are nowhere close to that. Now let us take a look at another chart:

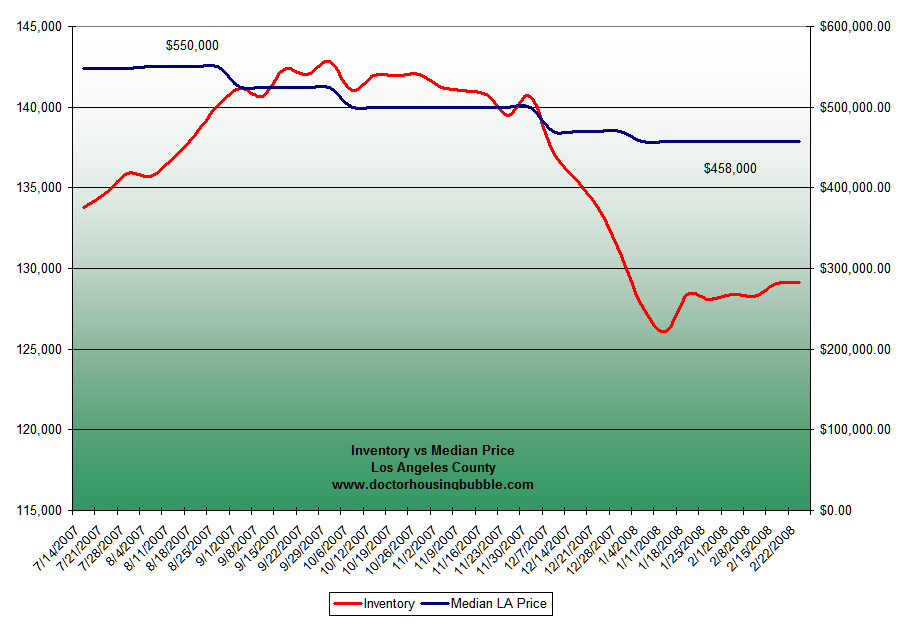

Click Here, or on the image, to see a larger, undistorted image.

This chart shows that from the peak of $550,000, Los Angeles County is now off its median peak by nearly $100,000. The importance of this chart is that it is an excellent predictor of where things will be heading. As you can see, inventory is increasing. Until inventory starts decreasing or sales start going through the roof, prices will not be going up. Aside from the credit crunch can it be that inventory is growing also because of reluctant sellers not realizing the reality of the current market? Are they swimming in a Freudian dream of housing delusion?

Do they not realize that California is in a $16 billion short fall and we are now using cockamamie ideas of balancing the budget such as closing schools (good for our future), firing teachers (higher unemployment), and letting out inmates (more home buyers!). The list of Real Homes of Genius only keeps expanding and the tide is now receding and we are going to be in housing purgatory for a very long time. The stories only get weirder and more complex as in any bubble. Greed makes people do absurd things. I recall reading a story about a farmer selling his entire livestock for a handful of tulip bulbs during that historical bubble only to realize that the one cow he kept snuck into his home at night and ate the entire tulip stock.

In this insane market we have to come to terms not only with high housing prices and defunct mortgage products, but we also have to admit that a majority of the population became speculators with the single biggest asset class in America whether they acknowledge it or not. This is a problem. First it was only a subprime thing. Then it was a subprime and credit market thing. Now it is a national emergency and every homeowner needs to be bailed out with Hope Now, Project Lifeline, Free Money Express, Wal-Mart Vouchers, 7-11 Ice Cream Relief, Mortgage Moratoriums, and every other Orwellian type of concoction you can think of. I won’t be surprised if some of these things fly since Americans are so addicted to credit they will fight tooth and nail once they realize they are maxed out.

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment