By Doug Casey, International Speculator | 22 April 2008

written Apr 18, 2008

Welcome to "The Room" The subscribers-only home page of Casey Research.

Dear Readers,

I am running quite late this sunny New England morning. But I have a good excuse: my wife has left me.

Well, it's not all that dramatic... it is just that she has hived off for Europe for a ten-day gallivant with friends, leaving me in sole charge of the children, pets and sundry household duties. Survival under such circumstances has required me to rethink standard operating procedures. First and foremost, rather than rolling out of the sack at a leisurely 7:00 am in order to make it to school by 8:00 am, the kids are now rousted awake at 6:30 am. Under my new regime, all forms of maternal cosseting have been vanquished. Instead, following the required morning absolutions, they find themselves, sleeves rolled up, feeding and walking the menagerie, setting and clearing plates, helping to prepare meals and dashing brooms this way and that.

Then it's off to the playground for a solid course of healthful chasing after a basketball before the school bell rings.

All in all, I'm quite proud of how well I am managing to whip this place into shape. A self-satisfaction that slipped into the morning call with my wife yesterday. After listening silently as I related how I have whipped the place into good order, she commented, a bit coolly, it seemed to me, "Very nice, dear. Now when I get home, perhaps you could remember this new routine of yours and stick with it versus, say, sitting about over a nice cup of coffee while reading the morning news on your computer."

I have long believed that pride cometh before the Fall and suspect that, provided I am not ousted in a coup by the grumbling natives before my wife returns home next week, I shall find myself hoist by my own petard following her return.

| But to the extent that my service as Mr. Mom has undeniably disrupted my schedule this week, I am going to have to get right to it. While I am never sure where my wanderings will take me, I suspect this will be a fairly eclectic issue. |

The Energy Picture

Yesterday I had a long and interesting conversation with Jeffrey Brown, the petroleum geologist who spoke so authoritatively on the topic of peak oil at our Scottsdale Summit. As it was only recently that I touched on Brown's studies of the Export Land Model in this column, I won't go into a lot more detail today. But I did want to share the gist of a couple of comments that he made which stuck in my mind.

On the topic of those who dismiss the peak oil believers as kooks, he said something to the effect of, "It is, in my view, ironic that some people believe peak oil theorists are delusional. That's because it is the height of delusion to think that we can treat a finite substance, oil, as if it is available in infinite quantities. It is not."

He also commented that, as is reflected in the $115 price, things are going in the wrong direction, and fast. As he put it, even the most determined pessimist couldn't have foreseen even a few years ago that things would get this bad, this fast.

Where does he see the price going from here?

"I think we are going to see a geometric progression in oil prices: $50, $100, $200, $400. It's just a question of how short the periods are between doublings." He went on to discuss that it now looks as if global crude production peaked in 2005. Since that time, the production of total liquids has been basically flat. And, per comments reported here a few weeks ago, his model shows that Mexico, on any given day the 3rd largest source for imported oil into the U.S., will stop exporting oil in 2014... at the latest.

There was much more to our conversation, which I recorded and will work up into a longer article soon. Meanwhile, you can read a research paper on the topic of the Export Land Model by following this link. Peak oil is not about running out of fuel. It is about running out of cheap fuel. Unless and until there is a serious technological advancement (see the Kurzweil article at the end of this column for one promising area), this is a trend you can make your friend... versus letting it kick you around each time you visit the petrol pump or pay the electricity bills.

While we are on the topic of energy, here's a brief look at what's going on in coal, the world's third most important mass energy source (after oil and gas) from Chris Gilpin of our Energy Research team...

Coal's Comeback

It wasn't too long ago— just 2006 actually— that coal had been written off as an old, dirty fuel that had no place in the 21st century's energy equation. What a difference a year makes...

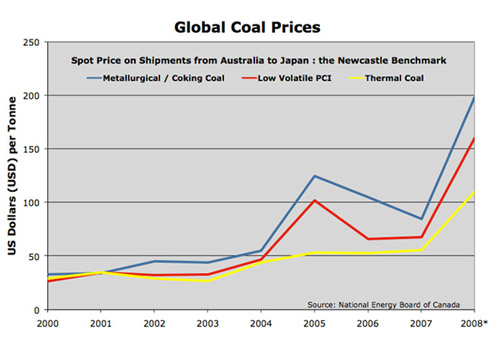

* Values for 2008 are preliminary reported numbers subject to revision

The prejudices against coal were largely based on allegiances to the idea that actions taken to prevent global warming— such as carbon controls— would crush the coal industry. It turns out that the practicality of a simple-to-extract, easy-to-ship fuel like coal outweighed these wishy-washy ideals, and the international coal market went into overdrive. The price paid for a particular type of coal varies considerably, according to moisture, ash, sulfur, calorific value, and the availability of user-specified grades at their time of need. Australia is the main supplier of coal to some of the world's biggest importers— namely Japan, Korea, and Taiwan— and the price for thermal coal at its Newcastle port has become a global benchmark. The Newcastle benchmark doubled for all grades of coal in 2007, and spiked to dizzying heights in the early part of 2008 when heavy rains forced the closure of several major coal mines in Australia. Thermal coal at Newcastle went for as much as US$129, and has now pulled back slightly as the flooded mines have been drained and resumed operations, but the price remains well over US$100.

Coal is no longer the stealth play that it was in 2007, but there are still opportunities to be had. One area to keep an eye on are U.S. coal prices, which remained dormant through much of 2007, but are waking up in 2008, influenced no doubt by coal's international resurgence.

[Ed. Note: If energy is not yet part of your portfolio, you are out of sync with one of the most important trends in generations. At the risk of seeming boastful, I think the new and improved Casey Energy Speculator is, by an order of magnitude, the most comprehensive service available for investors looking to keep closely in touch with everything now going on in energy and, more importantly, the best ways to profit. You don't need to take our word for it, though, click here for details on our 3-month, 100% money-back guarantee.]

So, How Are Things Going?

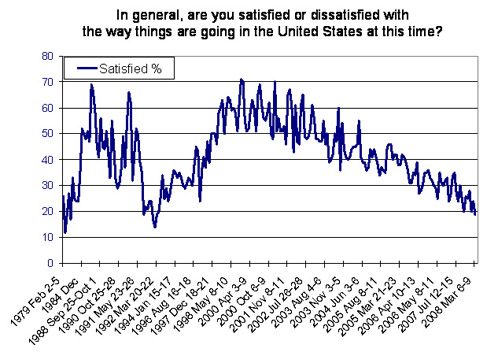

Bud Conrad dropped me an email with the following chart reflecting a recent survey on the level of satisfaction felt by the citizenry as to how things are going in the U.S. While I suspect the trend expressed in the chart has more to do with a general dissatisfaction in the level of personal largess transferred to the respondents by Uncle Sam, this sort of Jimmy Carter level of dissatisfaction won't go unnoticed by the politicians.

In fact, I'll go on record here and now that we are on the verge of seeing a New Deal announced. It won't happen this year, but almost immediately after President Obama takes power. I will bet that, trying to draft off the heuristic connotations of that phrase, Obama will even use the term "New Deal." But, in the same way that a Hollywood movie producer names his movie sequels, it will likely be called the "New Deal II"" which will then be used to excuse all manner of re-jiggering of, well, everything. You heard it here first"

Here's a Trading Idea...

I have an idea that is very risky, but potentially very profitable. Starting with one of the biggest trends of the day, soaring food prices, we should ask ourselves how we can profit.

The obvious is to buy food commodities. But there may be a better play. Namely, only a drooling idiot can be supportive of bio-fuels at this point.

Even the greenest of greens must have come to the realization at this point what a huge screw-up this notion of "growing our way out of the gasoline shortage" has been. The play, therefore, is to figure out what market is going to be most affected by the government pulling the plug on bio-fuel subsidies... and play that angle. Everything being equal, the dolts that conceived this moronic idea in the first place [[and the farm belt, of course: normxxx]] could be expected to stubbornly remain with it for years to come. But everything is not equal. Instead, we now have all sorts of reports by quasi— and supra-state organizations pointing the finger at bio-fuel as a major factor in the rising food prices. We will soon have photos of starving children underscoring the damage caused by this latest example of government folly.

Most importantly, we have a change in the presidency coming. That allows whomever is next to cancel the subsidies and blame it all on Bush and his cronies. The only question in my mind is, what's the best way to play this? As far as I know, no one else is looking at this angle just now... which leaves the opportunity wide open. I ran this idea by options and futures expert Steve Belmont, a partner with the RMB Group (RMBgroup.com). Here's his response:

|

While Steve's strategy is certainly contrarian just now, primarily because you risk being (way?) too early, the general idea that bio-fuel subsidies will end is, I believe, a good one. What are your thoughts? Drop me a line at david@caseyresearch.com.

| [Note: Steve's mention of interest rates, a call that we featured recently in the International Speculator and that I mentioned last week. A couple of weeks ago, I bought EuroDollar puts— a strategy recommended by Steve and his team— and am happy to report my position has almost doubled already. Both Doug Casey and Bud Conrad are on record as saying that playing rising interest rates may be the single best move you can make today. This, and other crisis strategies, will continue to be closely followed in our flagship International Speculator.] |

On The Topic Of Interest Rates

Not sure if you caught this story, but the Wall Street Journal ran a piece this week questioning whether or not the widely used LIBOR was actually valid, or if it was being manipulated by the banks to downplay what they are really paying for short-term money. You can read the full article by clicking here.

But here's the nub of the problem, according to the WSJ:

|

In this market, at this time, you have to be on guard against, well, just about everything. People are desperately hoping that the banks will stop performing like broken Whack-A-Moles, taking it on the head over and over. But we are nowhere near out of the woods at this point.

President Obama?

Above, and in other editions of this weekly missive in the past, I have expressed the view that it will likely be President Obama who next sets his heels on the Resolute desk in the Oval Office (the desk, a gift from Queen Vic herself back in 1880, was built from the remains of the British frigate HMS Resolute). This week one of you wrote to say, "Not so fast, I think you are jumping the gun on Obama." For entertainment purposes only, I will risk offending the politically sensitive by sharing why it is that I think Obama will be the next prez. Here's my calculation at this point. Despite the contention by many in the Democratic party that Hillary's stubborn refusal to get out of the race is hurting Obama's chances in the general contest this fall, I think the opposite is true. In fact, every day she stays in the race improves Obama's chances.

That's because Hillary's attack dogs are turning up every possible stone trying to get the dirt needed to bury Obama. Provided he can prevail (and at this point it is almost a statistical certainty he will), then the Clintonistas' constant attacks will serve to inoculate him in the public mind against these very same charges, should the Republicans later try to dredge them up ahead of the November vote. Put another way, everyone will have heard all the bad stuff available about Obama and so will mentally relegate it to yesterday's news. Further, he will have had the opportunity to practice the messaging that will best allow him to dodge whatever charges the Clintonistas raise.

Meanwhile, back at Sunny Acres, McCain is enjoying a nice long holiday. But once the contest between Hil and Bama is settled, that holiday will come to an abrupt end and the massive dossier compiled by the Democrats on his many faults will be unleashed... just in time to do the most damage ahead of the final contest. While some of what McCain will face when the general election kicks off in earnest did briefly surface during the Republican contest, that was pre-school for what is coming. He has, if you credit the fairly credible reports, alienated a lot of people with his temper, people that won't mind a little payback. Then there was the fact that he was caught with his hand in the proverbial cookie jar with that whole Keating S&L scandal, his rendition of Bomb, Bomb, Bomb Iran (seemed funny at the time, but I have to believe it won't play well in a 60-second attack ad aired over and over). And then there was the whole cozying-up-to-the-lobbyists thing and his apparent confusion over the key players in Iraq and Afghanistan, etc., etc.

Who knows, maybe Obama's folks will borrow Hillary's 3:00 am ad and repurpose it against McCain. "It's 3:00 am in the morning, who do you want answering the phone?" Cut to John McCain thrashing, confused, for the telephone. "Who the hell's calling at this time of the damn morning! And who am I, again?" (Sorry, McCain fans, I just couldn't help myself.)

And so his holiday will come to a screeching halt, just in time for the popular vote. That's how I read it and, if I can find the right counterparty, how I'll bet on it. At least, if I win, I'll have some small head start on the higher tax bill Obama's perfect world will require.

Q&A

As usual, I received a number of letters from readers this week. Here's a couple I thought you might find interesting.

Hi David,

Thank you for your thought-provoking, funny letters. As a new subscriber, I'm trying to wrap my head around a few issues raised in the April 11 issue of "In the Room." My first question is technical, the second historical/philosophical.

Doug Casey writes, "If the money supply is stable and one commodity goes up a lot, the price of others must drop— the general price level, in terms of dollars, stays the same." What is the relationship between the effect of currency inflation on commodity prices, and the effect of the cycle of supply and demand (and the resulting state of the infrastructure) of each individual commodity?

More philosophically, in reference to your discussion about the housing bailout, you champion the virtues of free-market capitalism. I have to be the devil's advocate here, for no one else is. Isn't it free-market capitalism, unrestrained by governmental oversight, that makes sweatshops possible? Notice that when regulation tightened in this country, working conditions improved, wages went up, and the "free market" hightailed it to the Third World, where anything went, and despite occasional boycotts, still goes— at least as compared to labor standards here.

Wasn't it a lack of preventive, regulatory oversight that allowed the housing crisis to brew and erupt? The "free market" wasn't so free after all, even to those who preyed on ignorant and marginally solvent borrowers— and who then, attempting to "spread" (hide and pass on) the risk, sliced and diced these shaky loans into pieces too small to recognize, thus giving new meaning to "death by a thousand cuts,"— and then sold these 'toxic' packages to other, unsuspecting and largely innocent lenders as 'triple-A' rated!?!

No matter how wonderful, everything has its dark side, an unrestrained market as well as governmental regulation.

Yours truly,

Linda

Given my time restraints, I asked our own Terry Coxon, a senior editor who works on the International Speculator and BIG GOLD, to respond. For those of you who are unfamiliar with Terry, he was Harry Browne's partner and editor for years and, among other accomplishments, founded the Permanent Portfolio Fund. Here's his response..

Linda:

1. Commodities and inflation. The initial effect of an increase in the rate of monetary inflation (an increase in the growth rate of the money supply) is to lower interest rates. This tilts the demand for goods in general toward capital goods (long-lived assets, such as buildings and machinery) and away from short-lived, consumable goods (such as socks and toothpaste). That's why the recent run-up in housing prices outstripped the rise in consumer prices.

Among commodities, the earliest to be affected by an increase in the rate of monetary inflation will be commodities associated with the production of capital goods— such as lumber and metals. Consumable commodities, such as foodstuffs, will lag behind and then later catch up. This closely matches what we've seen over the last few years— the monetary inflation that pushed short-term interest rates down to 1% and produced a boom in housing construction also set off a rise in the prices of metals, but only more recently has fueled a rise in the prices of wheat, rice and other foods.

2. Sweatshops. Milton Friedman remarked that if his parents hadn't worked in sweatshops in Chicago, he would never have gotten an education. What could he have been thinking?

If by sweatshops you mean people working in rough conditions for low wages, it is possible for determined, energetic government action to change matters. The government can, for example, require that every workplace maintain a temperature of 80 degrees or less. And it can prohibit paying any employee less than a certain wage rate. Sounds nice. But the effect on employees ranges from bad to catastrophic— because the cost an employer is willing to incur for a person's labor is limited unbendingly by the value that labor adds to output.

Air conditioning and other workplace amenities (even fans) come with a cost, which is a cost of maintaining an employee. It is inescapable that if the government requires such amenities, then it imposes such costs— which reduce the wages the employer is willing to pay. The employees might like the air conditioning, but the fact that it is installed only by government mandate is proof that the employees would prefer sweat and higher wages.

The effect of minimum wage laws is even worse. Name any minimum wage rate and there are people whose labor doesn't add that much value per hour. So no one will hire them. In the U.S., these victims of government are generally teenagers, who tend to be short on the education, reliability and work experience that make labor productive and valuable. Some of them never get their first job, and with time they become chronically unemployed and eventually unemployable. Not even slavery is as effective at keeping the poor poor as vigorously enforced minimum wage laws.

Outside the U.S., measures to shut down sweatshops would have even worse effects. The children sewing clothes in Bangladesh only get 50 cents per hour because that is about what they add to the value of the factory's output. Requiring a minimum wage of 75 cents per hour would destroy their jobs and leave them earning nothing. Some would die. An effective boycott would be just as cruel. Boycott the clothes they make because you don't like the terms of their employment and you boycott their opportunity to live.

Terry

In Defense Of Marx

I also received the following email message, in response to my less than flattering description of Karl Marx last week.

David

Based on your following statement:

"Thus wrote Karl Marx, by reliable accounts a penniless, unpopular, slovenly loser throughout the entirety of his miserable existence. Yet, avoiding any deep contemplation, the masses gravitated to his slogan, resulting in hundreds of millions of deaths and untold misery that carries forward even to this day."

It's clear that you are an absolute cretin. Marx's slogan is a fabulous one, and any civilized culture would do well to aspire to it.

But being a bourgeois imbecile, it's no wonder you deride it. As for Marx being responsible for millions of deaths, uh, no, I think you'll find that those responsible were people with names like Stalin, and Mao, who distorted Marx for their own ghastly purposes. Now grow up or shut up!

Ross

At 53 years old, I suspect the whole "grow up" thing is simply not going to happen. And I don't really feel compelled to shut up, either. So I will comment, albeit briefly, that while Marx didn't actually pull the trigger on the uncountable millions who have died based on his fine-sounding ideas, he might as well have.

That's because the slogan that popped to his mind one day, and which you are so deeply fond of, "From each according to his abilities, to each according to his needs" contains within it a clear and implicit promise of coercion and even violence. Any platitude, even Marx's, might be used by an individual as a reminder to act in a certain way toward their fellow man. But when it is adopted as government policy, which was clearly Marx's desire and goal, it becomes an entirely different thing altogether.

Simply (as a "bourgeois imbecile," I am capable of no complex thoughts), what happens if I, as the individual in Marx's equation who is able to produce more, am unwilling to give of my bounty to others unable to produce more? There may be any number of reasons why I might not want to hand over goods I have earned, or shoulder extra work so that others less able may live more comfortably. For instance, I might want to save money to start a new business. Or, I may be concerned about the future and want a little extra padding to assure my immediate family doesn't have to go without. Or, I may simply enjoy the feeling of fine Corinthian leather on my car seats.

But regardless of my reasons, I may decide that, no thanks, I'd rather keep the fruits of my labor all to my selfish self. Leaving the government in Marx's utopian world with only one option... coercion. They can forcibly take the goods from me, or they can send me to a work camp. And they can take away the controls of production, which was Marx's proposed solution. But when they do, they will be taking away the incentives to innovate and to produce, leading inevitably (just check the history books for proof) to an economic meltdown. Just as inevitably, the government— looking to protect itself— then resorts to anything and everything to stay in power. Stalin and Mao are not the exceptions in this form of government, but the most likely consequences.

There is more to this discussion than I have the time or the inclination to go into here. But if you, Ross, have reached this stage of life still believing in Marx and communism, then I'm betting you are still pondering how Santa Claus manages to slide down your chimney each Christmas [[and, think of the work conditions of those poor elves! : normxxx]] So, it's Official: I'm Out Of Touch

|

I read this morning, as I watched the stock market rise, that the reason for the rally has to do with the fact that Citigroup's first-quarter revenue plunged "only" 48 percent.

According to Bloomberg:

The New York-based firm's first-quarter net loss of $5.11 billion, or $1.02 a share, compared with earnings of $5.01 billion, or $1.01, a year earlier. Analysts estimated the company would report a loss of $4.75 billion, according to a survey compiled by Bloomberg.

So, a year-over-year swing, in the wrong direction, of about $10 billion is GOOD news? I must be out of touch with the new reality, because I just don't get it. Apparently, however, the rationale for such ebullience— which has the Dow up 197 points as I write— is because people are, once again, seeing Citigroup's results as not quite as bad as they could have been. This, apparently, signifies the beginning of the end [[a bit of irony here? : normxxx]]. And because things are going to improve, the Fed can now be less aggressive in cutting rates... which has strengthened the dollar, taking a (temporary) bite out of gold[[didn't last all that long, did it? : normxxx]].

Now, one could comment endlessly on these sorts of market movements. But I think it is a waste of time. No question that traders will continue trying to spot the patches of blue through the thick gray overcast. But this storm, according to everything we see and reliably report on in our various publications, is just getting rolling and before you know it, lightning and hail the size of grapefruit will be sending the equities market running for cover.

Inflation Watch

It is getting harder by the day to keep up with all the negative inflation reports. The latest, out of the UK, has it that the government there is waaaaaay understating the real inflation rate. Specifically, that instead of it bouncing along under the 3% rate, it is actually running closer to 15%, based on a basket of items that the Daily Mail categorizes as "must pay." You know, those annoying things like food and fuel which governments like to leave out of their inflation indicators. Here's the story.

Meanwhile, Faith, one of your fellow subscribers, sent along the following link to a YouTube confrontation between Ron Paul and Fed Chairman Ben Bernanke. While I would rank the caliber of most questions asked of Bernanke by most Congressmen on a level with those that might be asked by a grammar school social study class, Ron Paul gets into Bernanke with both elbows. It is a very interesting exchange, stunning almost. Check it out here.

Political Pandering

How low will a presidential candidate stoop to pick up a vote? If you trust the evidence, the answer is, pretty low. Among that evidence are the promises of the Democrats that, if elected, they will change the current regs so that union organizers will be able to unionize a company based on a signed petition, versus the secret ballot that companies can now insist on. Now picture this. With the secret ballot system, you step into a private booth and vote to unionize, or not. Under the proposed rule change, George from down in the shop stands in front of you, toothpick between his teeth, proffering you a sign-up sheet. "Here, sign this," he says. So, what are you going to say? "No thanks? I have noticed how so many of the unionized industries have been destroyed and moved off-shore to be competitive." I don't think so.

It reminds me of the close friend of a former partner of mine who set up a vegetable stand by the side of the LI Expressway. After a week or two, a guy in a big caddy drives up and gets out. Toothpick between his teeth, he says, "Looks like a nice business youse got here. Whaddaya do wit your garbage?" "Oh, nothing much. It's just a couple of garbage bags' worth that I toss in the trunk of my car and take home." "Dat right. Well, you know what? I think you could use a dumpster." "Really, it's no trouble at all," my partner's friend replied. To which his new acquaintance said, cracking his knuckles as he spoke, "No, you don't understand. You NEED a dumpster. It will be here in the morning. You just pay us rent for $500 a month and everyone's good, right?"

But back to the present, while I have nothing against unions, I understand enough about human nature to understand what a fundamentally flawed idea it is to force businesses to unionize based on a petition. The last thing the U.S. needs at this point is yet more reasons to ship industry overseas. One can only hope this is one of those situations where the politicians are doing the only other thing they do better than pandering... lying, in this case to the heads of the unions.

The Price Of Gold

In my closing comments last week, I wrote the following...

A final check of the numbers as I prepare to put the tools to rest has it that gold is hovering around the $926 level, while the DJIA is taking a hard shellacking, down 223 points. For entertainment purposes only, I'm going to bet that gold is going to go over$950 in the coming week. In fact, I'll go one step further, and say it will peak at $953 for the high next week (as of noon next Friday, April 18). If you want to get in on the game, send in a specific guess of gold's high for the week (also by noon Friday). If you are right, we'll comp you for a year of BIG GOLD... with a tie, going to whoever sends in their prediction first. Drop me an email with your prediction, and any other comments you have about this week's edition, to David@caseyresearch.com.

The high for the week, using intraday spot prices, rang in at $953.90... so I'd have to give my crystal ball high marks. But I was outmaneuvered by Anne V., who actually nailed it right on the head, winning herself the free one-year subscription to BIG GOLD. Here's her entry:

"David I think gold will touch 953.9 next week. And I hope some of our gold juniors follow suit!"

As for the juniors, the next and most important trigger will be the next round of quarterly reports issuing forth from the large producers. Those reports will start coming out within a week or so, and will continue into mid-May. If they are as positive as I think they will be, the attention on the mining sector will ratchet up considerably. Stay tuned, things are about to get interesting.

Miscellany

A friend in need. Say what you will about Colombia, they have had more than their share of turmoil and trauma. And think what you will about the War on Drugs— the Colombians, at least to this casual observer, seemed to have jumped on the team, supporting the U.S. effort to interdict supplies at the source by, among other things, allowing U.S. soldiers to tromp all over the place and engage in blanket dusting of crops using various insecticides. I also have no doubts they paid close attention to the admonitions of the U.S. government to build a diversified economy. But when it came time to approve a new free trade agreement with them, politics trumped and the Colombians were turned back at the door. Not sure what message the rest of the world will take away from this, but I think the bigger point to pay attention to is that the trade barriers are only beginning to go up. And not just in the U.S., but around the world. Not a good trend if you ask me.

Ascent of humankind— continued. Underscoring his optimistic view on the world we live in— or soon will— our globetrotting chairman sent along a link to an excellent article by Ray Kurzweil. Kurzweil, who is well known and respected in the science community, points to the exponential advances in computing power, and how that same level of technological leap-frogging is now being applied to other crucial fields as well. I have often commented to my kids that their generation may live to 200 years of age. And if you credit Kurzweil, the odds in favor of that happening are improving daily. Here's a link to the article.

Crisis, what crisis? According to Bloomberg, "The amount of distressed corporate bonds jumped to $206 billion April 11 from $4.4 billion in March 2007, according to a Merrill Lynch & Co. index of bonds yielding at least 10 percentage points more than Treasuries." Read those numbers again. $4 billion to $206 billion in a year? Look for cover if you haven't already found it.

And that is that for this week's particularly rushed edition of The Room. I apologize for any poorly worded or ungrammatical expressions, as at this point I have the choice of doing another pass through what I have just written, or picking the kids up from school. As always, I greatly appreciate you taking the time to read this weekly missive. As I sign off, the DJIA is up 234 points and gold is trading at $916. Time to worry? Hardly. But it is time to pick up the kids and so I will sign off for this week.

Until next week...

Sincerely,

David Galland

Managing Director, Casey Research, LLC.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment