By Brad Zigler | 11 August 2008

|

There has been, among gold bugs, more than a little pooh-poohing of Gartman's notion. Gartman's pronunciamento was made when COMEX gold traded at $912. Since then, prices have gyrated between $977 and $849. Friday, as gold settled at $858, Gartman took to the airwaves on CNBC's "Fast Money" to intone darkly about gold’s prospects once more. Gold’s failure to make new highs and the long-building bottoming in the dollar, he says, will keep him out of gold for a long time to come.

So what of those folks who followed the pre-April advice of Gartman and others to buy gold’s mining stocks, but hung on, hoping that things would turn ‘round? How have they fared? I had a chance to meet some of these folks at the New York Hard Assets Conference, a venue in which Gartman himself spoke ("Hard Assets Heresy"). At the conference, I gave a presentation on hedging mining stock holdings against gold’s volatility ("Hedging Gold’s Volatility").

The hedge examples given back then deserve an update.

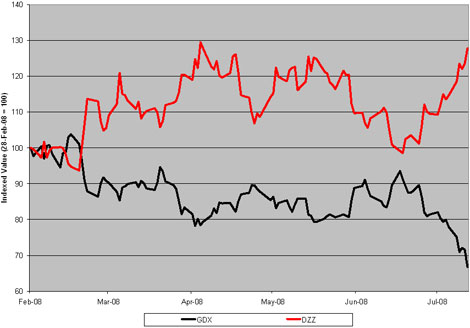

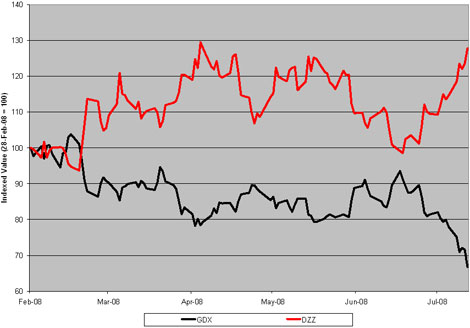

What if, for example, we look at how the risk of remaining long in the Market Vectors Gold Miners ETF (AMEX: GDX) could have been managed in the GPP (Gartman Post-Pronunciamento) environment with a purchase of the Deutsche Bank Gold Double Short ETN (NYSE Arca: DZZ). The DZZ note is designed to deliver twice the inverse performance of the futures-tracking DB Gold Index. From the February 28 launch of DZZ trading through the eve of Gartman's gold’s reversal (April 18), the ETN cranked out an annualized volatility of 54%; the gold mining ETF's standard deviation over the same time was 45%. As the ETN was more volatile than the ETF, an investor needs fewer ETN shares— in this case only 84%— for a full-dollar hedge.

GDX closed at $49.30 on April 18; DZZ finished the day at $27.24. A 100-share GDX position could thus be hedged by 152 shares (($4,930 ÷ $27.24) x .84) of DZZ.

GDX vs. DZZ

By the time Gartman made his CNBC performance Friday, GDX shares has swooned 26% from their April 18 level. DZZ, meantime, had appreciated 14%, reducing the hedged shares' loss to only 8%. Now, an 8% loss is certainly better than a 26% drubbing. But why not just sell the GDX shares? Why not, indeed. I asked that very question of many investors in New York and most wouldn't countenance the idea of abandoning their gold stocks.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment