By Eric Sprott and David Franklin, Sprott Asset Management | August 2009

Are you stimulated yet? We hope you are, because we've just witnessed the largest economic stimulus in the history of the world. Never before have so many government dollars been thrown at the economy to prevent a depression. When added together, the combined financial, monetary and fiscal stimuli in the US are more than the cost of the two World Wars and "The New Deal" combined.1

Stimulus spending worldwide has taken the form of a combination of tax cuts, transfer payments (free money) and infrastructure investments on roads, schools, railroads etc. In the US, the financial and stimulus contributions have been especially impressive in scale. According to CNN's bailout tracker, the various US government departments have committed to stimuli worth $11 trillion dollars and have issued cheques totaling $2.8 trillion dollars thus far in 2009.2

Neil Barofsky, the Special Investigator General for the TARP program, has estimated that the total cost to the US taxpayer could be as high as $23 trillion.3 The vast majority of this stimulus has been directed at the financial sector— a complete waste of money in our opinion, supporting a segment of the economy that never deserved to be bailed out. Nonetheless, the US taxpayer has 'spent' massive sums, committed to promises worth even more and may ultimately owe debt in the double-digit trillions when all is said and done. Nice of them to spend so generously, wouldn't you say?

Although the stimulus has been fantastic for the stock market, it has generated very little benefit for "Main Street". To make matters worse, the effects of the stimulus packages have already started to wear off. To explain why, we must mention the American Recovery and Reinvestment Act of 2009 (ARRA), which was specifically directed at stimulating the real economy as opposed to "saving Wall Street".

ARRA calls for a total spend of $787 billion, which breaks down into $287B in tax breaks, $192B in direct aid and $308B in discretionary spending. According to Christina Romer, a White House economic advisor, 70% of this stimulus will be spent by the end of September 2010. What impact will this stimulus have on the economy? Chart A presents results from Moody's that is representative of several private forecasts that we have reviewed.4

The right chart illustrates the ARRA's impact on real GDP by quarter, and reveals that right now, in Q3 2009, the US is experiencing the maximum impact of the Obama stimulus package. That's right— this is as good as it gets. The majority of the Act consists of tax cuts and transfer payments to citizens, the impact of which was felt within the first two quarters of being received.5

By the end of September 2009 this stimulus will have worn off, and along with it will vanish the greatest marginal impact of the entire stimulus package itself. According to economic forecasters like Moody's, by 2010 the net impact of the stimulus package to real GDP will be barely over 1%. This is not good news for "Main Street", especially considering the dramatic increase in unemployment that we've witnessed recently. If the effects of stimulus wear off as quickly as they were injected, we could be in for a very difficult Fall (no pun intended).

To make matters worse, this scenario is not limited to the US alone— it could potentially impact any of the other large economic powers who have instituted their own massive stimulus packages, most notably China, resulting in a simultaneous global economic decline that would make 2008 look pleasant by comparison. China deserves special mention here, because on a percentage of GDP basis, they are far and away the greatest stimulator of all. While the US has made significant commitments, their $2.8 trillion capital deployment to date only represents a mere 20% of their 2008 GDP. Chinese government spending (combined with Chinese bank lending), on the other hand, is completely unprecedented in the history of banking, and far outweighs the US stimulus in scale and scope.

The Chinese have deployed 4 trillion yuan in stimulus spending through to 2010.6 In concert with this stimulus, the Chinese central bank has scrapped its 'national lending quotas' in order to jump start their economic engine. In the first half of 2009, Chinese bank lending hit a record high of 7.37 trillion yuan.7 Assuming their stimulus package is evenly split between 2009 and 2010, it equates to 8.37 trillion yuan of fiscal spending and including lending by Chinese banks.

For perspective, the Chinese economy generated 13 trillion yuan in the first half of 2008.8 So in effect, the Chinese have injected a stimulus equivalent to 64% of their first half 2008 GDP in the first half of 2009. Please understand us when we tell you that this is unprecedented.

The Chinese government has effectively spent and lent enough in six months to buy 122 Ford Class aircraft carriers at US$8.1 billion a piece. It is akin to the US government injecting (and US banks lending) almost $4.5 trillion USD to its citizens and businesses before July 2009… an ungodly sum that would impact every asset class under the sun. Is it any wonder then that the Shanghai stock exchange has more than doubled from trough to peak since its November lows?

What is perhaps even more surprising, however, is the fact that the Chinese stimulus has had a seemingly lackluster impact on the Chinese economy. Despite its massive size, the stimulus program has only generated a 7.9% increase in their 2009 GDP. For perspective, this represents a mere 1 trillion yuan return on a 9.37 trillion yuan stimulus— not a good return on investment.

So if the money hasn't generated GDP growth, where did it go? It's gone everywhere. Their government-induced liquidity flood has "soaked" virtually every speculative asset class in China. Copper, nickel, steel, Chinese equities, Chinese real estate— they've all appreciated in spite of the obvious and acknowledged weakness in the global economy. It's been great in the short-term— but this money was LENT OUT remember, and must eventually be paid back. It is not a sustainable long-term growth model, and in the words of Wu Xiaoling, a previous deputy governor of the Chinese central bank, "will sow bad seeds for [China's] economic adjustment".9

It is our view that the world's combined government stimuli have completely distorted the global economy in the short term, and have encouraged a false sense of hope in the stock market. While the market has rallied, the real economy continues to struggle, and is notably worse in many areas. Rates of employment, corporate revenues, US housing prices and retail sales all continue to decline in the face of 'shock and awe economics'.

In our assessment of recent economic data, there are only two possible explanations for the recent market rally. Either investors are discounting an incredible economic recovery that is just around the corner (hard to believe), or the extra liquidity injected into the economy has 'found its way' into the stock market [[while the Fed and SEC "look the other way": normxxx]]. We're leaning towards the latter alternative.

So what happens next? Will the Keynesian miracle take hold? Will the recovery be strong enough to pay back the increased debt load that was needed to jolt the economy back to life? It seems unlikely.

On July 29th two Chinese banks announced that they would limit loans in the second half of 2009. Since the announcement, Chinese stocks have reversed into a considerable down trend. This is reflected in the chart of CSI 300 stock index, which tracks the performance of the largest and most liquid stocks traded on the Shanghai and Shenzhen stock exchanges (see chart B: click here for chart B). Now that the excess stimulus liquidity has been removed, all asset classes that previously benefited will begin to fall. The CSI 300 suggests this process is well underway.

The Federal Reserve has embarked on its own monetary injections, called 'quantitative easing', by buying $1.745 trillion worth of debt issued by Fannie Mae, Freddie Mac and treasury bills issued by US government. On August 12, 2009 the Federal Reserve provided guidance on their plans to ease the program. Interestingly enough, they extended the completion date from September to October 2009 in order to keep the option of boosting purchases later this Fall.

If the Chinese experience is an early lesson, removing the stimulus liquidity from the market could be a dangerous proposition. We have already proven there are not enough buyers of US debt to support the budget deficit this year (please see "The Solution…is the Problem"), and we suspect that much of the US monetary stimulus used to purchase debt issued by Fannie and Freddie has actually made its way into the new US Treasury auctions— thereby supporting the record US budget deficit in 2009. This two step debt monetization process is a complicated topic that we will address in a future MAAG.

In the world of government stimulus, the size and speed of the injections are critical to their impact. Once the taps are turned on full bore, any reduction to the stimulus will have almost the same negative impact as removing it entirely. We are now seeing this reduction on three fronts: the Federal Reserve threatening to close the window on its 'quantitative easing' program; the tax cuts and transfers already paid out to US citizens; and the Chinese banks now reining in their excessive lending. In trader terms— we will soon have no "dry powder" left to burn.

In their 2008 annual report, the Bank for International Settlements (BIS) recently reviewed previous banking crises and suggested that a sustainable recovery would require the banking system to take losses, dispose of non-performing assets, eliminate excess capacity and rebuild capital bases. The BIS concludes that "these conditions are not being met and any stimulus will therefore only lead to a temporary pick up in growth followed by protracted stagnation."10 We agree wholeheartedly, and have seen nothing yet to suggest that the real problems plaguing the world's banking system are being addressed.

In our view, the threat of a double dip recession remains real. When the stimulus effects wear off there will be nothing left to replace the artificial demand they have induced. Investors should be prepared for what awaits us beyond the stimulus.

==========================

1 Inflation adjusted in 2008 dollars; the cost of World War I is $312 billion, World War II is $3.6 trillion, "The New Deal" which was legislation to aid

the US during the Depression is $500 billion. These and other costs can be found at:

http://www.ritholtz.com/blog/2008/11/big-bailouts-bigger-bucks/

2 CNNMoney.com's bailout tracker. Retrieved on August 16, 2009 from: http://money.cnn.com/news/storysupplement/economy/bailouttracker

3 Kopecki, Dawn and Dodge, Catherine (July 20, 2009). U.S. Rescue May Reach $23.7 Trillion, Barofsky Says. Retrieved on August 16, 2009 from:

http://www.bloomberg.com/apps/news?pid=20601087&sid=aY0tX8UysIaM

4 Zandi, Mark (June 22, 2009). U.S. Fiscal Stimulus Revisited. Retrieved on August 16, 2009 from:

http://www.economy.com/dismal/article_free.asp?cid=116000&src=economy-hp-dismal-article

5 The Congressional Budget Office (CBO) reviewed the impact of the 2001 and 2008 tax rebates under the Bush Administration which would concur with economic model estimates that impact is felt very quickly. This can be found at:

http://www.cbo.gov/ftpdocs/96xx/doc9617/06-10-2008Stimulus.pdf

6 (November 11, 2008). World markets buoyed by massive Chinese stimulus plan. Retrieved on August 17, 2009 from: http://news.xinhuanet.com/english/2008-11/11/content_10341108.htm

7 Wang, Aileen (August 11, 2009). INSTANT VIEW 5— China's July lending and money growth slows. Retrieved on August 17, 2009 from: http://www.forbes.com/feeds/afx/2009/08/11/afx6763394.html

8 (July 17, 2009) China's GDP up 10.4 percent in first half of year. Retrieved on August 17, 2009 from:

http://english1.people.com.cn/90001/90776/90884/6452204.html

9 Garnaut, John (August 12, 2009). China pulls back on bank-credit throttle. Retrieved on August 16, 2009 from:

http://business.smh.com.au/business/china-pulls-back-on-bankcredit-throttle-20090811-egzv.html

10 Bank for International Settlements, Annual Report 2008/09 (June 29, 2009). Retrieved on August 16, 2009 from: http://www.bis.org/publ/arpdf/ar2009e6.pdf

==========================

It’s The REAL Economy, Stupid

By Eric Sprott and David Franklin, Sprott Asset Management | July 2009

We are now in the early stages of a depression. The economic indicators we follow to track real economic activity are all signaling a slowdown of massive proportions. You wouldn’t know it from reading the mainstream papers of course— they all focus on the 'relative decline' in the slowdown’s intensity. Reading about the slowdown ‘slowing down’ is not the same as growth however, and does not warrant great excitement in our opinion.

Our Title This Month Paraphrases One Of Bill Clinton’s Presidential Campaign Messages From 1992.

As one of the three key themes in Clinton’s campaign, "The economy, stupid" was printed on a sign in his headquarters in Little Rock to help campaign workers stay on message. This month we’re keeping it simple by focusing on the real economy and its implications for the stock market.

Here is the real economy summarized in numbers:

Industrial Capacity Collapse:

• US industry used only 68.3% of available capacity in May 2009, according to a monthly report from the Federal Reserve.1 That represents almost one third of all US industrial capacity sitting idle. Prior to the current recession, the lowest rate recorded since the Fed started this series of records in 1967 was 70.9% in December 1982.2

• CHART A depicts worldwide industrial production, stock markets, and volume of world trade, then and now, in a comparison from June 1929 and April 2008 on.3 Very similar trajectories. As Eichenberger adds,

|

CHART A.1 - A.3

Government Tax Revenue Declining:

• 32 of the 46 states whose fiscal year ended midnight July 1, 2009, did not have budgets signed by their Governors. States are grappling with deficits totaling a collective $121 billion, and all states but Vermont require that their budgets be balanced.

• Personal income tax, which accounts for more than a third of state revenues, dropped by 26% in the first four months of 2009, according to the Albany, New York-based Rockefeller Institute of Government.4

• The US government has spent $2.67 trillion thus far in fiscal 2009, but has only collected $1.59 trillion.

• The US government collected $685.5 billion in individual income taxes so far this year, a 22% drop from the $877.8 billion the government took in during the first nine months of 2008.

• US corporate income taxes plunged 57% to $101.9 billion in 2009, down from $236.5 billion in the first nine months of fiscal year 2008.5

Retail Sales Slump:

• The International Council of Shopping Centers (ICSC)/Goldman Sachs same-store sales tally for June was down 5.1% from June 2008, worse than the latest forecast for a 4.5% decline.

• Privately held luxury department store Neiman Marcus Group Inc. posted a 20.8% drop in same-store sales. Abercrombie & Fitch Co.'s same-store sales fell 32%, even more than the 26.6% decline Wall Street had projected.6

Unemployment Catastrophe:

• The June 2009 jobless rate reached 9.5% (BLS: U3), the highest since 1983. [[But, using the calculation methods for unemployment used in 1983, the current unemployment has now topped 20%! (see John Williams' Shadow Government Statistics) Even the BLS' own U6 statistic shows it to be over 16%.: normxxx]]

• 4 million Americans have been looking for work for more than 26 weeks, representing 29% of the unemployed— the most since records began in 1948.

• During the last 30 years, Americans who lost their jobs took an average 15.8 weeks to find new positions. In June 2009, the average duration of unemployment was 24.5 weeks, the longest since records began in 1948.

• The number of people collecting unemployment benefits reached a record 6.88 million in the week ended June 27, 2009.

• Approximately six people are seeking work for every job opening, the most since the government began keeping such records in 2000. A year ago, the ratio was a little more than two-to-one.7

US Housing Market Failure:

• The annual pace of new home sales is now 342,000, a whopping 32.8% below the rate in May 2008. At the current sales pace, there is 10.2 months worth of inventory overhang sitting on the market, dragging down prices and encouraging potential buyers to wait it out as prices deflate.8 [[Plus perhaps another 10 months of delinquent mortgage (over 3 payments in arrears) houses being held by the banks off the market… : normxxx]]

• New home sales are down 73% from the all time high of 1,283,000 new homes sold in 2005 (mild recession?). See Chart B.9

CHART B

Rail Car Loadings Suffering:

• For the first 26 weeks of 2009, US railroads reported cumulative volume of 6,806,892 carloads, down 19.2% from 2008.10 An excellent quote included in the June report from the Association of American Railroads stated:

|

• Carloads are down 22.5% from the all time high set in the first 26 weeks of 2006.12

Dow Jones Industrial Average:

• Chart C below plots a return comparison of the Dow Jones Industrial Average between 1929 and 2007. Another frightening comparison to 1929.13

CHART C

The big question now is what effect all this bad data will ultimately have on the stock market. Stock valuation can often be wonderfully complex— but it ultimately rests on two main foundations: earnings and investor sentiment. The ‘earnings’ component is concrete; it is a stream of profits that companies expect to generate in the future for their shareholders. The ‘investor sentiment’ component, however, is not concrete. It dictates what investors are willing to pay to buy corporate earnings, and can fluctuate widely depending on perceptions of future growth. The relationship between these two components is vital in gauging market direction. The price-earnings (P/E) ratio is the classic investment fraction that combines these two factors into a usable metric. It deserves mention here because its analysis helps to illustrate the point we are trying to make.

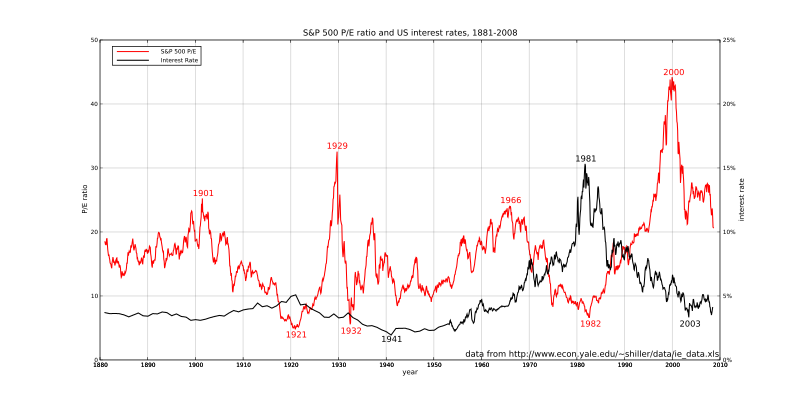

In Chart D, we provide a plot of the real, inflation-adjusted P/E ratio of the S&P 500 stock index from 1881 to 2008.14 As adjusted using Robert Shiller's data, at the end of June 2009, the S&P 500 traded at an inflation adjusted P/E ratio of 16.08, implying that investors were willing to pay an average of 16 times earnings for a share in the S&P 500 index.15 Sixteen times earnings is well below the all time, inflation-adjusted high of December 1999 (44 times), but also well above the lows of 1932 (5.57) and 1982 (6.64). As it turns out, 16 times is almost exactly at the 109-year monthly average P/E ratio— so stocks are trading at their long-term average P/E level in the current environment. But, are earnings really around $63 as avertised for the last four quarters?

Now that we are into 2Q earnings season, the first quarter earnings are clearer and look to be just above $10. You can see these earnings estimates by clicking on this link You have to add up the four quarters in order to come up with the annual number. As you can see, the "operating" earnings for the first quarter have come up far short of the estimates and the "reported" earnings (the only ones that make any sense at all to us— see the special report "What is the Real P/E?")— have also come up short of expectations. They were expected to be about $9 in March and early April and they came in at $7.53.

Another thing we would like to point out, and that you can find on the S&P website, is the discrepancy between the two advertised 'estimated' sets of "operating" earnings for 2009 and 2010. S&P shows "operating" earning as both "top-down" and "bottom-up". Both of these "operating" earnings exclude 'write-offs' [[i.e., all of the "bad" stuff: normxxx]]. The top down numbers are reflective of the various strategists on Wall Street who look at the macro economic factors as well as profits and profit margins in general. The bottom-up methodology adds up the result for each stock in the S&P 500, as estimated by the Wall Street analysts. [[There seems to be more room for error, as the bottom-up methodology always boasts a higher number than the top down— and both almost always beat actuals (i.e., 'as reported' numbers) by a wide margin! When (as in the second quarter), the estimates are worse than actuals, it is a cause for great celebration on Wall Street.: normxxx]]

The "bottom-up" process is expecting the earnings to be about $56 (we are rounding all the numbers) in 2009 (down from the $63 'estimated' above for the 12 months prior to June, 2009), while the "top-down" methodology would have the earnings for 2009 at about $43. The real surprise, however, are the estimates for 2010. The bottom up approach has an estimate of about $74 while the top down has an estimate of $47. That is a $27 difference!! We believe the top down analysts will still be too high, but closer to reality than the bottoms up analysts. This $47 number would still put the stock market at about a 20 times multiple, and that multiple is associated more with stock market peaks than with the norm or with troughs.

Nevertheless, the only earnings that make any sense are "reported" earnings and the discrepancy there is incredible. Reported earnings were about $15 in 2008 relative to $50 of "operating" (bottom-up) in 2008. And "reported" earnings in 2009 are expected to be $29 and $38 for 2010. This means the difference between "reported" earnings and "operating" (bottom-up) earnings for 2008 was $35, in 2009 it is expected to be $27, and for 2010 it is expected to be $36.

These differences total $98 of "write-offs" and will be excluded from the "operating" (bottom-up) earnings of $180 over the years 2008, 2009, and 2010 that are focused on by almost all of Wall Street. This also means that the $98 of write-offs which should be included in the "operating" earnings (meaning they would be reduced by that amount) over the past year, this year, and next is greater than the total of "reported" earnings of $82 ($15 for 2008, $29 for 2009, and $38 for 2010) over this same period!

The P/E on the "reported" earnings of 2008 of $15 is over 61, on estimated "reported" earnings of 2009 of $29 is over 35, and on estimated "reported" earnings of 2010 of $38 is over 24!!

CHART D

Click Here, or on the image, to see a larger, undistorted image.

Note: Red is the P/E ratio; black is the interest rate (Fed: 1913 to June, 2009)

But if 16 times earnings is average— how low is low if investors turn their backs on stocks? There’s the real economy which generates the earnings, and then there’s the investor sentiment/perception which dictates the multiple they are willing to pay for those earnings. We already know that the real economy is in severe decline. What happens if investor sentiment changes? We assess five scenarios below:

1. Earnings stay constant; P/E ratios hit cycle lows: We assume a scenario where investors are nervous, people need to sell stocks to pay for lost wages, or for retirement, but the companies continue to perform as of June 2009. Assuming a P/E of 6, which is close to the all time low, and using an earnings value of $63.04 for the S&P 500 Index, we derive an S&P 500 Index value of 378.16

2. Earnings get halved; P/E stays constant: Earnings have been half of their current value three times over the last 30 years— so it is entirely within the realm of possibility that they could be halved once again. In the late 1970’s, early 1980’s and early 1990’s the S&P 500 Index generated half the earnings per share that it did this year in 2009 dollars. Using today’s P/E multiple of 16.08 results in an S&P 500 value of 506.

3. Earnings get halved; P/E ratios hit cycle lows: "double trouble".If we combine these cases where earnings are cut in half from today and the P/E ratio drops to a cycle low, it implies an S&P 500 Index value of 189 (depression territory). What about inflation? All three of the above scenarios are calculated using 2009 dollars. Doing so adjusts for the effects of inflationary periods over the last 109 years and allows for the historical comparisons we have discussed. As we mentioned, a stock price is based on pricing the future stream of a company’s profits. Over the long-term, inflation erodes the value of those earnings and with it the multiple that investors are willing to pay for them— ultimately lowering the value of stocks.

4. Glancing at the typical ratio of earnings to dividends, if the index is earning ~$30 (earnings get halved), one should expect dividends to be about $10-$30. There is no record here of another time when dividends were higher than earnings, as they are at present. This says to me that the sustainable yield today is not even 2.5%, but more like 1% to 1.5%, comparable to the peak of the peak dot-com bubble. [[Remember, you can only pay dividends out of reported, i.e., "real" earnings!: normxxx]]

From this level of overvaluation in the face of declining fundamentals, stocks could fall hard for another 18 months to restore value fast (1929-1932 model), in which case the 200-300 level is likely by 2011! Another outcome is to trade in a range for a decade or more and wait and hope for a bout of inflation [[or growth?: normxxx]] to increase the nominal/actual bottom line (1968-1982 model).

5. Finally, there is the Japanese model, where the S&P would get to 200— but over 20+ years! Deflationists and Elliott wavers expect the 1929-1932 outcome, with the most stunning phase of the bear market soon to come.

|

Moreover, if we plot the real P/E ratio of the S&P 500 Index fifty months out from 1929 and compare it to the recent real P/E ratio performance from April 2008 to June 2009, we find the similarity between the 2008 economic collapse and the 1929 economic collapse disturbingly close. Don’t get sucked in… the real economy is still struggling and the market has yet to reflect this. In 1932, the Dow Jones Industrial Average bottomed 90% below the September 1929 peak— but not until 1932.

The S&P 500 Index peaked in October 2007 at 1,576, and from our brief analysis above we can easily calculate a drop in the S&P 500 of as much as 88% from that peak using our "double trouble" scenario. At the very least, under all of our scenarios it appears that the S&P 500 Index will test the March 2009 low of 666. Judging by the continued declines we are seeing in the real economy, we expect that test to happen sooner rather than later.

In our view, the only thing propping this market up is investor sentiment. [[And Wall Street hype!: normxxx]] Earnings have not improved. Keep it simple, stupid— investing is and has always been about the real economy [[eventually, anyways: normxxx]], and this market is so far ignoring the hard data. You can invest in sentiment if you want to, but as we have said before, we prefer to invest in real things.

| In the short run, the market is a voting machine. In the long run, it's a weighing machine. — Benjamin Graham |

1 Federal Reserve Statistical Release, Industrial Production and Capacity Utilization— G.17 (June 16, 2009). Retrieved on July 10, 2009 from: http://www.federalreserve.gov/releases/G17/Current/default.htm

2 Gallagher, Thomas (June 16, 2009). Industrial Capacity Use Hits Record Low. Retrieved on July 10, 2009 from: http://www.joc.com/node/411908

3 Eichengreen, Barry and O’Rourke (June 4, 2009) A Tale of Two Depressions. Retrieved on July 10, 2009 from: http://www.voxeu.org/index.php?q=node/3421

4 Randall, Kate (July 1, 2009). US states budget crisis fuel massive spending cuts. Retrieved on July 10, 2009 from: http://www.wsws.org/articles/2009/jul2009/budg-j01.shtml

5 Clifford, Catherine (July 13, 2009). Uncle Sam is $1 trillion in the hole. Retrieved on July 13, 2009 from: http://money.cnn.com/2009/07/13/news/economy/treasury_budget/?postversion=2009071315

6 D'Innocenzio, Anne (July 10, 2009). Weak retail sales in June raise worries. Retrieved on July 11, 2009 from:http://www.google.com/hostednews/ap/article/ALeqM5jEUOBuLQexhEw6Sbb1sU7mSLR6iAD99B0MO01

7 Miller, Rich (July 10, 2009). Obama’s Jobless Safety Net Torn by Rebecca Alvarez (Update1). Retrieved on July 11, 2009 from: http://www.bloomberg.com/apps/news?pid=20601109&sid=atnjG1uvDprY

8 New Home Sales Stagnate. April Revisions Mitigate May Decline. Retrieved on July 10, 2009 from: http://www.mortgagenewsdaily.com/06242009_new_home_sales_stagnate_april_revisions_mitigate_may_decline.asp A Look at Case-Shiller Numbers, by Metro Area http://blogs.wsj.com/economics/2009/06/30/a-look-at-case-shiller-numbers-by-metro-area-april-2009-update/

9 US Census Bureau— New Residential Sales. Retrieved on July 13, 2009 from: http://www.census.gov/const/soldann.pdf

10 American Association of Railroads (July 9, 2009). Rail Freight Traffic Remains Down During Holiday Week. Retrieved July 10, 2009 from: http://www.aar.org/NewsAndEvents/PressReleases/2009/07_WTR/070909_Traffic.aspx

11 American Association of Railroads (July 2, 2009). Rail Freight Traffic Down in June. Retrieved on July 10, 2009 from: http://www.aar.org/NewsAndEvents/PressReleases/2009/07_WTR/070209_Traffic.aspx

12 American Association of Railroads (July 6, 2006). Led by Coal and Intermodal, U.S. Rail Traffic Up in June. Retrieved on July 14, 2009 from: http://www.aar.org/NewsAndEvents/PressReleases/2006/07/Led%20by%20Coal%20and%20Intermodal%20U,-d-,S,-d-,%20Rail%20Traffic%20Up%20in%20June.aspx

13 Lundeen, Mark J. (July 3, 2009). Bear Markets and Horror Movies. Retrieved on July 10, 2009 from: http://www.gold-eagle.com/editorials_08/lundeen070509.html

14 Shiller, Robert J (2005) Irrational Exuberance [Princeton University Press 2000, Broadway Books 2001, 2nd ed., 2005]. See also Shiller's site. Data set downloaded on July 3, 2009 from: http://www.econ.yale.edu/~shiller/data.htm

15 Bloomberg reports the P/E for the S&P 500 Index in June 2009 as 14.58. The discrepancy with Shiller’s data is for several reasons:

a) Shiller reports using a June 10 closing data

b) Shiller uses a rolling average value for Real Earnings when calculating the P/E ratio

c) Shiller uses extrapolation for estimates of the CPI data when calculating real earnings for June 2009.

Despite these minor variances, we found this publicly available data set to be the most complete comprehensive historical review of P/E ratios.

16 Bloomberg S&P 500 earnings per share for June 2009 not included in Shiller dataset.

The opinions, estimates and projections ("information") contained within this report are solely those of Sprott Asset Management LP ("SAM LP") and are subject to change without notice. SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information.

SAM LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP.

These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Funds may be lawfully sold in their jurisdiction.

No comments:

Post a Comment