MLS In Southern California Going Up? Distress Inventory 3 Times The MLS Data. Big Salaries Of Mortgage Brokers Gone.

By Dr.HousingBubble | 17 March 2010

In recent months we have seen many articles talking about the lack of predictability in big bubbles like the current credit crisis. Some of these authors argue that bubbles are impossible to predict and therefore preparation is futile. This observation is simply false because history is littered with people that have predicted events including the Great Depression [[and, moreover, have pretty good overall records of prediction of certain special classes of events; ie, these are not "one-off" shots: normxxx]]. And it is nonsense on the surface because if you see your friend having 20 shots of tequila it is very likely that it will not end pretty even though it is fun in the moment.

What makes bubbles seem impossible to predict during the mania is this collective groupthink where the herd dominates most of the conversation drowning out opposing views. We've highlighted many homes during the years here in California and the obvious explanation was a bubble was here and it would burst at a certain point. Yet there was little reward for being the messenger of bad news in antiquity, and this continues to be the burden of any modern day Cassandra.

I've noticed a few people in other articles and blogs talk about how great a deal they got on a California home. 30, 40, or even 50 percent off the peak price. Yet this discount in itself is meaningless unless we put it into the context of the local economy, incomes, and inflation-adjusted home prices for that area. Even today, we see the same psychological trappings of those that bought in 2006 and 2007.

"Well it has to go up because it went up in 2002, 2003, etc" and this was the basis of prices heading higher. Today, it is more like "I got a home for 30, 40, or even 50 percent off therefore it is a good deal". But price alone does not tell you everything. If a low price was the measure of value, then Detroit would be the ultimate value play but there is a reason that homes that once sold for $100,000— which seemed cheap even a decade ago— are now going for $1,000 or even $500.

Now why bring this up? We are seeing some strange activity in the housing market. For example, there has been a large amount of sale activity in the Inland Empire:

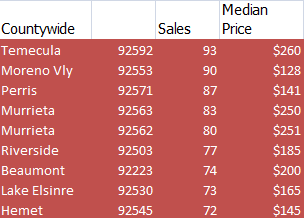

Source: DataQuick

Source: DataQuick The number of sales in distressed markets is astounding. From data showing financing on these purchases, we see that many investors are rushing to buy homes. But are prices making sense even in these areas where prices are down 50 or even 60 percent? It is hard to tell because these are in local economies that are feeling the brunt of the recession.

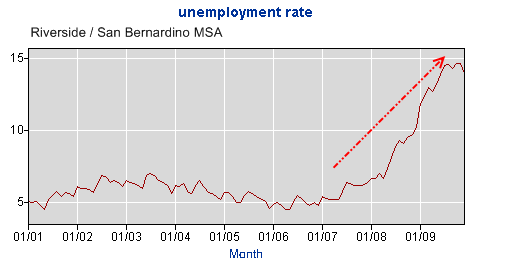

For example the above chart shows some areas in the Riverside County part of the Inland Empire. The sales volume above is intense. In the Temecula zip code more than 38 homes sold in December of 2007. Today the volume is three times that. The Hemet zip code above is running at double the pace. So the volume is there. But take a look at the unemployment rate in the Inland Empire:

There is a reason for the extraordinarily cheap housing prices when headline unemployment is 14 percent (meaning the underemployment rate is upwards of 25 percent). As an investor it is hard not to be tempted by low prices. But going out there to view the market, you see in some cases, home after home either boarded up or completely uncared for.

Many of these communities are dealing with a large surge of Section 8 renters. Just look at how many rentals are available in these areas and you can see that many investors are in over their heads. They are only focusing on one side of the equation with price. They are failing to examine the local economy or trends in the area.

MLS

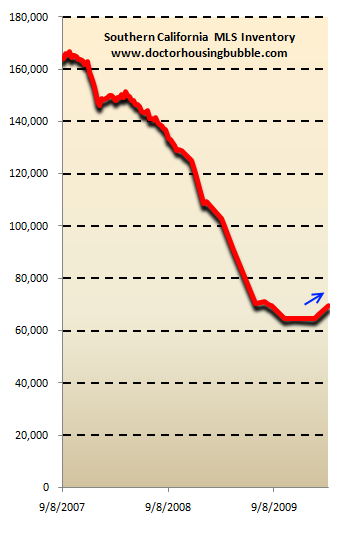

For the first time in three years of tracking the MLS data have I seen a significant jump in inventory for Southern California. The six counties in Southern California currently have 69,000 homes listed on the MLS. This is up from the low reached in October of 2009 with 64,000 properties listed. Part of this has to do with a large number of short sale properties hitting the list but also, the expiration of HAMP offers for many who simply do not qualify.

For the first time in three years of tracking the MLS data have I seen a significant jump in inventory for Southern California. The six counties in Southern California currently have 69,000 homes listed on the MLS. This is up from the low reached in October of 2009 with 64,000 properties listed. Part of this has to do with a large number of short sale properties hitting the list but also, the expiration of HAMP offers for many who simply do not qualify.The housing market has gone from a manic casino to a slow payout slot machine. But only looking at the MLS data is misleading, as we already know. We recently found out the massive gimmick Lehman Brothers was using to hide toxic assets. Well the MLS does not tell the entire story, either.

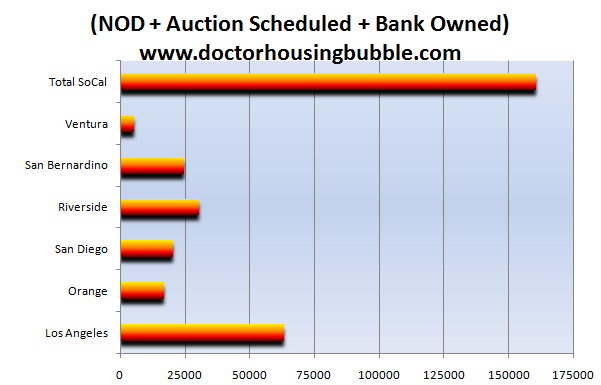

If we look at distress inventory, we find out that it is true that many Southern California communities have a large amount of distress properties:

Source: Foreclosure Radar

This is being reflected in the median sale price. The median sale price in Southern California has gone up since it hit a low in January of 2009 of $250,000 for almost a year. However, last month it dipped by $17,500. Part of it has to do with the fact that California has a 12.5 percent unemployment rate.

A lot of the housing volume came from 'investors'. Last month 28.9 percent of all Southern California home purchases were all cash. So either people are looking to flip again or purchase to create rentals. But the rental market is already saturated:

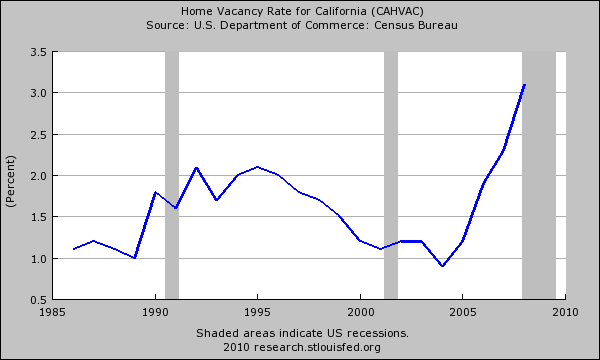

Click Here, or on the image, to see a larger, undistorted image.

The California vacancy rate is the highest on record. So if these investors plan on turning these units into rentals, supply and demand dictates that prices will be pushed lower; hopefully they are factoring this in. Some are taking solace that there will be no 'tsunami'— they assume that there will be no further price corrections.

This is but one large current fallacy. Despite tsunami, trickle, or other comparisons with 'weather' events, prices will continue to correct in many areas simply because they do not reflect the current market. (Oh, and did we also mention the massive California budget deficit?)

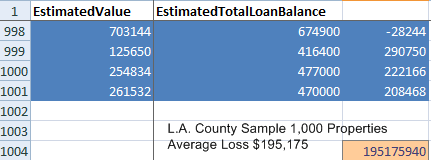

Estimated Balance On Distress Properties

To get a sense of how much 'correcting' we have to undergo, I dug deeper into the distress data. Take, for example, the top 1,000 properties in Los Angeles County that are scheduled for auction and/or are bank owned:

These homes haven't hit the market. A handful are on the MLS but not many. If these homes sell today for their estimated value (unlikely since they are a bit high) we would see an average loss of $195,175. Now this is only a sample of the 63,000 distress properties in Los Angeles County.

Banks clearly have this data so they rather keep on people that have stopped paying their mortgage than realize that $195,175 loss. But this has a timeframe attached to it. Just look at a couple of the mortgage balances. $470,000 would carry a $3,000 to $4,000 total housing payment depending on the interest rate. The loss on that property is roughly $210,000. So they can hold off for 4 years ($4,000 x 48 months)— but this won't happen.

The most I've seen has been 18 months from when the NOD was filed. Yet the loss will be realized at a some point. And make no mistake, the reason banks are not lending is because of this. Their internal cash flow is bleeding. They are simply hoping for a bubble resurgence which obviously is not going to happen. Why?

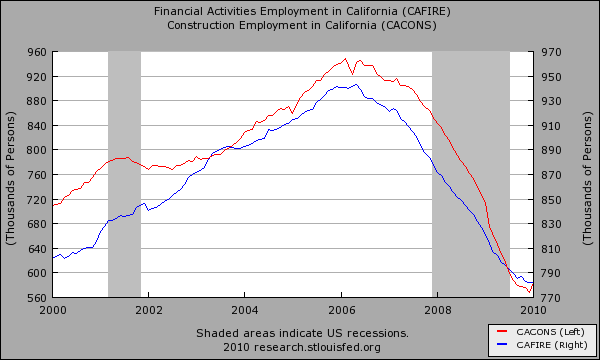

California Big Salaries Down

What people don't want to talk about deals with the reality that many of the high paying jobs [[that have since disappeared: normxxx]] were basically cogs of the bubble machine. Many mortgage brokers, agents, and bankers were getting lucrative income for being active participants in the financial mess, the biggest since the Great Depression:

|

With option ARMs outlawed and other toxic junk finding no market in Wall Street, the only game in town is government backed loans that certainly do not carry a $12,000 commission. So what we have is this:

Click Here, or on the image, to see a larger, undistorted image.

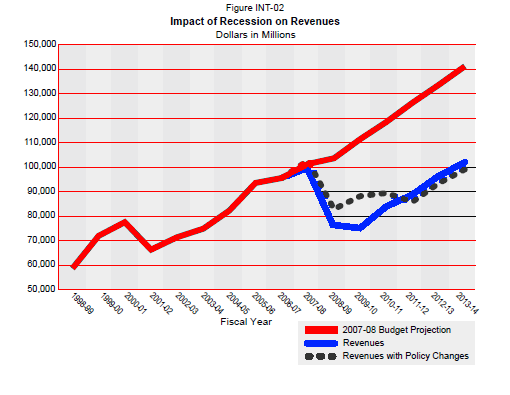

And many of these people were buying in prime areas such as the Westside with inflated bubble salaries that are now [[forever?: normxxx]] gone. So the pool of qualified buyers is down for mid to upper tier markets. Going back to the Cassandra effect, the state was 'satisfied' with the earlier activity as well because they were collecting large amounts of taxes from these people. They were getting good money from payroll taxes, but also solid revenues from properties that were being assessed at absurd prices.

There was no incentive for the state to stop the party. California was an economy that was built by the housing bubble both in employment and housing values. It is now suffering on both ends of the spectrum. That is why our unemployment rate is still rising while nationwide the unemployment rate seems to have leveled off. It is also the reason why our state government finances are in an absolute mess. They counted on the bubble revenues:

Click Here, or on the image, to see a larger, undistorted image.

So what this means is: get ready for higher taxes or more service cuts. Unless we decide [[and are able: normxxx]] to recreate the housing [boom] infrastructure to start another bubble— but Wall Street is already done with the housing 'game' and is on to playing newer, more lucrative games with (nearly free) taxpayer money. In other words, California is going to have a stagnant housing market for many years to come.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment