How Depressions Happen By

Fred, Itulip Administrator | 11 January 2008 - First there is the credit bubble. Then there is the credit bubble collapse. Then there is the political haggling as Rome burns. Then there is the Depression. But former Treasury Secretary Lawrence Summers has a plan.

|

He spelled out the problems facing the U.S. economy and proposed solutions in a speech "Risks of Recession, Prospects for Policy" yesterday at The Brookings Institution in Washington, D.C. In summary:

- "I am speaking here today because I believe that our current economic situation requires a comprehensive program of measures to contain the fallout from problems in the financial and housing sectors and to assure sufficient policy support for economic growth over the next several years. Perhaps because of a failure to appreciate the gravity of our current situation and the problems our political process has in responding quickly and collaboratively to emergent threats, such a comprehensive program is neither in place nor in immediate prospect."

|

AntiSpin: Summers is right.

AntiSpin: Summers is right. A comprehensive reflation plan is no more certain for the US economy during our debt deflation than for Japan in 1990.

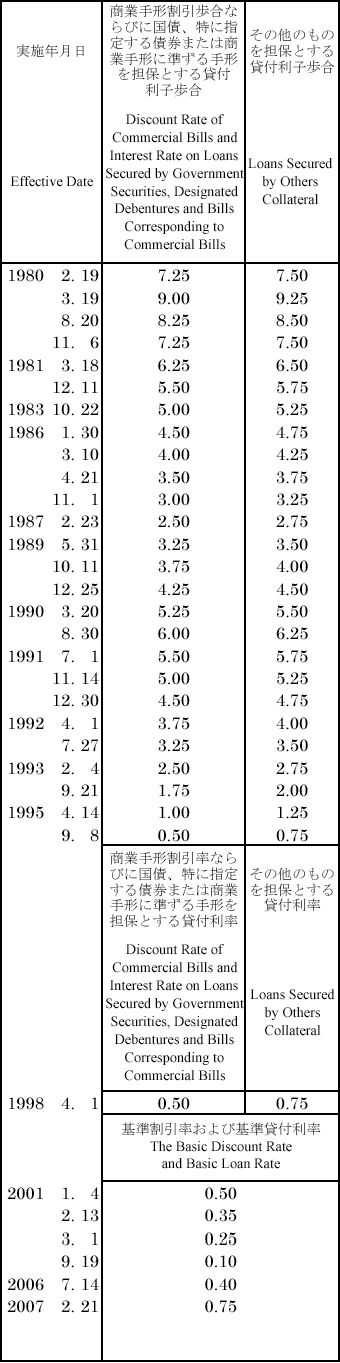

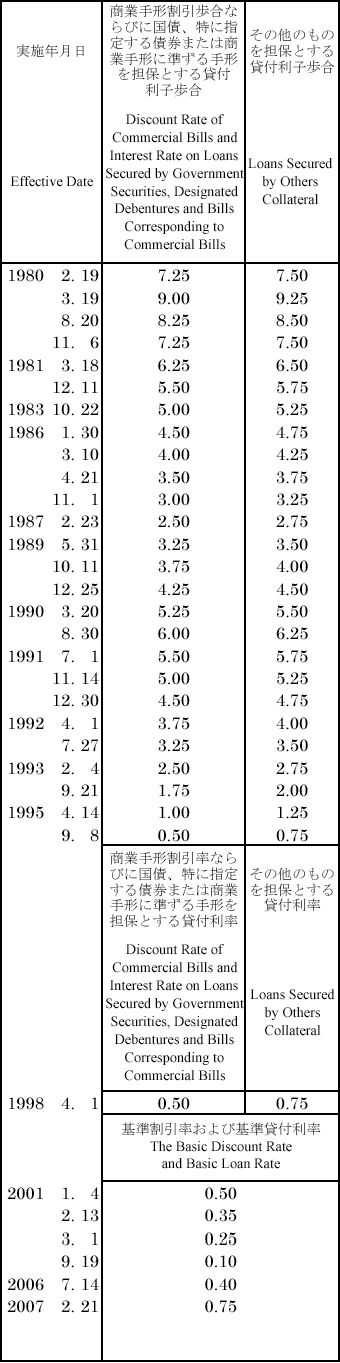

For this reason we continue with excerpts of Summers' speech beside a pic showing the history of Bank of Japan interest rates before, during, and after the 1990 Japanese debt deflation. Summers continues, with our comments:

"For the last year, the economic consensus, and the policy actions that have flowed from it, has been consistently behind the curve in recognizing the gravity of the problems in the housing and financial sectors and their consequences for the overall economy."AntiSpin: You can say that again. The high likelihood of a post housing bust recession has been apparent to us for over a year.

"This continues to be the case. In my view it is almost certain that we are headed for a period of heavily constrained growth, quite likely that the economy will experience a recession as technically defined and distinctly possible that we are headed into a period of the worst economic performance since the stagflation of the late 1970s and recessions of the early 1980s."AntiSpin: Summers appears to agree with our assessment that this recession will be inflationary."The late Rudi Dornbusch was fond of remarking that in economics 'things take longer to happen than you think they will and then they happen faster than you thought they could.' So it has been recently. The related but distinct patterns of excessive valuations in housing markets and excessive complacency in credit markets were pointed out for years by experienced observers. The cracks took longer to appear than many expected and have now proven to be far more structurally damaging than almost anyone supposed."AntiSpin: Summers agrees with our Myth of the Slow Crash. - "Economic downturns historically come in two categories. For most of the post war period, economic expansions did not die of old age. They were murdered by the Federal Reserve in the name of fighting inflation. This was the story in 1958, 1971, 1974 and 1982 as sharp increases in credit costs drove the economy into downturns.

"Before World War II, and in recent years as inflation has come under control, expansions have ended as a consequence of the workings of the financial system, sometimes in conjunction with oil shocks. After a period of optimism, asset prices expand beyond fundamental values, credit expands, investors embrace financial innovations that allow greater leverage so as to better take advantage of rising asset values. At some point the party ends, asset prices fall, financial structures that once looked impregnable become vulnerable, confidence collapses, propensities to consume and invest fall off, and the economy turns down."

|

AntiSpin: Summers agrees with our theory that The Bubble Cycle is Replacing the Business Cycle. - "Experience suggests that downturns driven by falling asset prices and credit problems tend to be recognized relatively slowly and to be quite protracted. Two extreme examples are the American experience after 1929 and Japan’s experience in the 1990s after the 1989 asset price collapse. Our last two recessions associated respectively with the bursting Savings & Loan real estate bubble and the NASDAQ collapse revealed gaps of several years between asset price peaks and the restoration of satisfactory rates of economic growth. Nationally housing prices peaked less than a year ago, and credit spreads reached their minimum levels only about six months ago.

"History’s caution that situations like our current one are likely to surprise on the downside for a considerable time and prove quite protracted is confirmed by forward looking indications regarding the economy...

|

AntiSpin: Summers goes on to list a bunch of ugly statistics about foreclosures, housing prices, commercial real estate prices, credit spreads, and default risks. He concludes:

- "The economy is at as critical a juncture as it has been in many years. Policy must balance risks at a highly uncertain moment. The lives of millions of people who will never think about countercyclical policy, moral hazard, lending facilities or the federal funds rate may be profoundly affected by the policy choices made in this city in the next few months. I hope they will be made both urgently and wisely."

|

ߧ

Normxxx ______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

AntiSpin: Summers is right. A comprehensive reflation plan is no more certain for the US economy during our debt deflation than for Japan in 1990. For this reason we continue with excerpts of Summers' speech beside a pic showing the history of Bank of Japan interest rates before, during, and after the 1990 Japanese debt deflation. Summers continues, with our comments:

AntiSpin: Summers is right. A comprehensive reflation plan is no more certain for the US economy during our debt deflation than for Japan in 1990. For this reason we continue with excerpts of Summers' speech beside a pic showing the history of Bank of Japan interest rates before, during, and after the 1990 Japanese debt deflation. Summers continues, with our comments:

No comments:

Post a Comment