Click here for a link to complete article:

By Dr. Housingbubble | 30 January 2008

Well it shouldn’t come as a surprise to you that the market was expecting new home sales to come in at 645,000 but the actual number came in at 604,000. Being off by 41,000 isn’t a big deal given how horrible the establishment is at predicting the will of the people. Just a few short months ago, it was almost a given that the front runners in the 2008 presidential race were going to be Hillary and Rudy. It was hard to see anyone else in the race (that is if you only listened to the 'scientific' pollsters). Yet, just these past few days, we just saw how frustrated the public is with the status quo and with following in the footsteps of the past. They gave a resounding vote to someone new (in S.C.) and someone utterly different (in Fla.). Yes, we’ve heard it a million times, but people do want change. Even Joe and Susie public realize that when they hear "tax cuts stimulate the economy" and watch corrupt corporation leaders walk off scot free, with massive severance packages to boot, they understand that that a trickle down "tax cut" (two weeks groceries?) does not translate to a healthier economy or better wages.

Many are becoming convinced that the country is devolving more and more into a plutocracy— and looking at wealth statistics, especially distributions, this belief seems well founded enough. Corporate welfare/bailout is alive and well (with a few crumbs for the masses [[and isn't it only fair that we share out the same amount among the upper 1% as among the remaining 99%— fair's fair! : normxxx]]). The housing bubble just went mainstream with a cover report on 60 Minutes called "House of Cards." You can click on the link and watch the clip if you did not watch it during the weekend. It is well worth your time and plays out like any bubble blogger post. Take a wild guess at what city was the main focus? Stockton, California! In fact, they were showing folks going on repo bus tours to buy homes.

Sort of like a Universal Studios tour except instead of Jaws coming out to eat you alive, you have overpriced McMansions waiting to sink their teeth into your wallet. For any of you who have taken trips to the Inland Empire to what are now defunct new subdivisions, this will not come to you as a surprise. The 60 Minutes' piece didn’t shed any new light in regard to numbers and economics that many 'housing blog' readers wouldn’t know, but it cemented the fact that, yes, housing is in a historical bubble everywhere in the nation. It is a good piece and well worth your time.

The thing that really hits home (pun intended) is how willing people are to game the system. Learning from the best on Wall Street, many recent American homebuyers are giving the middle finger to (often innocent) lenders (it was mostly the brokers and "loan originators" who did the scamming) and are willingly going into foreclosure. They show two couples that bought homes with exotic mortgages. One couple talked about buying another (less expensive) home in a better area and about not knowing or understanding the terms of their current note— that was their justification for not trying very hard to keep their home. Another couple added to our insight into the psychology of recent buyers, telling us they are allowing their foreclosure to happen because "the home isn’t appreciating" and therefore just isn’t worth it. If you think about the psychology behind this and dig deeper, we have a nationwide epidemic of people looking for free lunches. People from Wall Street to main street are expecting profits each and every time they take on any risk, whatever the odds of payoff; then when losses appear, they expect everyone else to bail them out.

A reader (Linda) sent in this piece about "Intentional Foreclosure" from CBS News in Sacramento:

|

I imagine that this strategy will become more and more pervasive as the market declines. A large number of people try to build up good credit to have the ability to purchase a home. And for many this is the end-game of good credit. So if you can get out and buy another home while your credit is still good, lock in a good rate (thanks to Boom Boom Bernanke), move into your new place and simply try to sell your previous home or just let it foreclose, then you've succeeded. And you wonder why there is such an uproar for rate cuts. Suddenly that poor family being kicked out in the street is mixed in with a boatload of folks that speculated in real estate, got burned, and now want you to pick up the tab. No need to mince words, this is a bailout. You wouldn’t be receiving your $600 check in the mail (payoff?) and allowing those golden parachutes to greedy companies and recent 'buyers' else. How do you feel about raising mortgage caps to $625,500 now?

The Psychology Of Housing Greed

From Calculated Risk we get a glaring statistics summing up the current market:

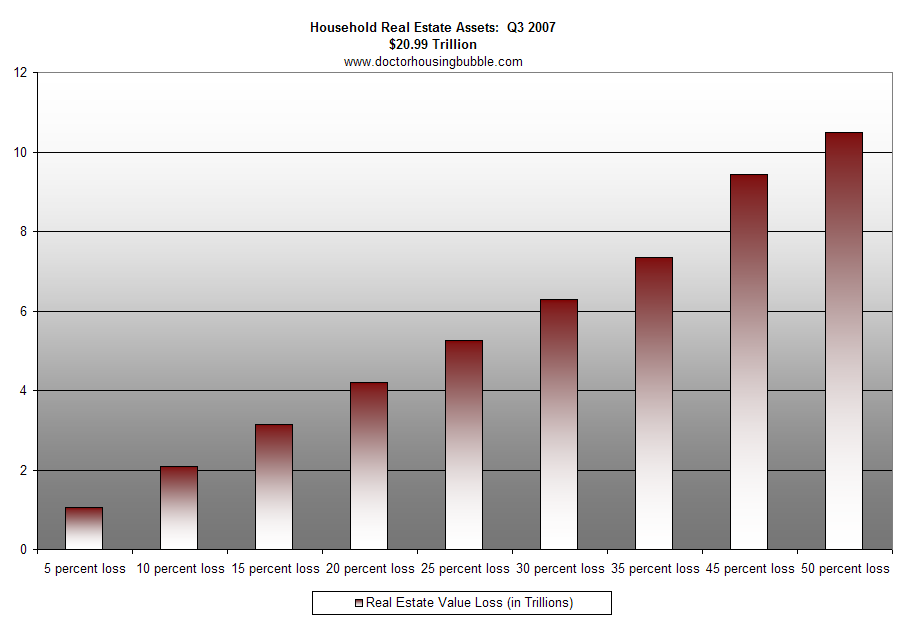

“From the Fed’s Flow of Funds report, household real estate assets totaled $20.99 trillion at the end of Q3 2007. So a 30% decline in prices would reduce "housing wealth" by about $6 trillion (Merrill’s number).”

Let's run a few scenarios to see potentially how much damage can occur:

Click Here, or on the image, to see a larger, undistorted image.

Merrill Lynch has already stated that it is very possible that we will see a decline of household real estate wealth by 30 percent. In Southern California we have already seen 10 to 20 percent drops in all counties. I would imagine simply by the sheer size of the homes and the extent of bubble prices, California will be a large percentage of that $6 trillion loss. Statistics! Go back to the presidential polls of a few months ago. The media and pollsters were utterly off and even [just before Iowa or S.C.], they were predicting Hillary losing by only a few percentage points (10 points at most) but things didn’t work out exactly as planned. And this was days before the vote!

Anyone using current housing prices is going to get burned because once you enter into a major bubble and you try to use peak prices to measure your decline, you are using artificially inflated price measures to predict the future. Did anyone see California housing going up nearly 200 percent in some regions over this decade? Of course not. Yet that is the definition of a bubble. Prices disconnect from reality and it becomes a question of "homeowner dreams", consumer behavior, and the frontiers of what is legal and/or moral. Add to this a semi-corrupt industry where the corruption and greed spread from speculators, banks, brokers, agents, Wall Street, politicians, to builders and even normally ultra-conservative foreign investors, and you realize that everyone wanted a free lunch. As the 60 Minutes piece highlighted, at each step of the process someone was getting a cut.

Now we have this pervasive mentality (of unrequited greed) where people are not only willing to let their homes be foreclosed on and walk away from their contracted debt obligations, but we have people that are prepared to do things (and self-justify them) that border on the criminal. In the piece cited above, we also read about people taking out "some equity" just before knowingly letting their homes go to foreclosure. Think about the mindset that occurs when this is happening. "Hey honey, we signed a contract, but so what? How about we tap into our HELOC and take out $50,000 and let this home go into foreclosure. By that time we'll have bought our new home and taken out some cash, so who cares what happens to our 'credit'. After all, Wall Street is just one crooked scam anyway and the lenders are more than willing to give us the money. Take that Wall Street!"

I assure you this conversation (or something very much like it) is happening at many households in the US as we speak. That is why fierce regulation and enforcement are utterly impotant. Rushing to raise caps is a knee-jerk reaction to the deeper and more profound problems with the economy and the psyche of many homeowners, who (often rightly) feel they have been scammed (by the 'system'). People are mostly willing to go to almost any lengths as long as they believe they can get away with it. All of these 'get rich quick books' cater to this free lunch mentality ('everybody's doing it!'). Once at the fringe of late night infomercials, now a majority of Americans think 'nothing down' is a birth right. Ben Bernanke was surprised that a trader in France was able to milk $7 billion from the markets. Why is that so shocking? If you allow people with no appreciable assets or income to take out $2 million loans in California, I assure you they will. When will the Fed and politicians stop to think: does this next move actually make any sense (especially long-term)? I guess that is a lot to ask in an election year.

Subprimed For Disaster: A blast heard 'round the world!

Irrational Housing: Insiders out Early and The Duesenberry effect.

Is Housing the Next Rocky Balboa? Only 2007/8 Will Tell…

M O R E. . .

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment