Since The 1930s And 4 Projections For What's Going To Happen

By Bud Conrad, Casey Research | 4 September 2008

I identify the foundational forces now driving our economy to establish a basis for the investment recommendations you'll read in this advisory in the months to come. The role of the U.S. as the world's dominant economic superpower is now challenged by an out-of-control growth in debt and a deterioration in its reputation as a financial haven. The dollar is losing its special status as the global "reserve currency," is leading, in turn, to higher inflation, higher interest rates, weakening financial assets (stocks and bonds) and runaway prices for commodities. Let's get the charts and let them speak for themselves, with some (additional) interpretation along the way:

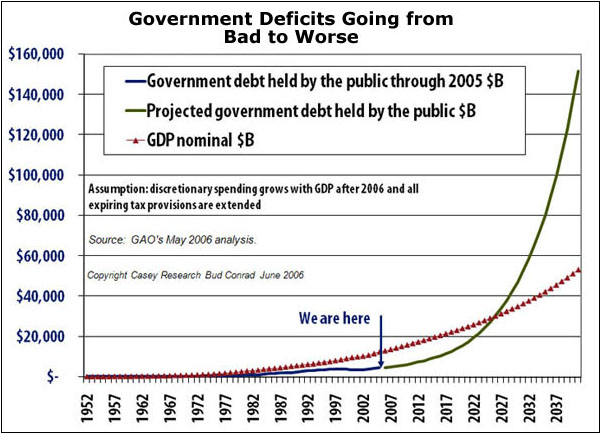

1. U.S. Government Deficits: From Bad to Worse

Government deficits are the root source of the creation of money... and its eventual debasement. Simply, when the federal government spends more than it raises in taxes, it eventually has to create more money (in complicity with the Fed) in order to pay the bills.

Click Here, or on the image, to see a larger, undistorted image.

Of course, it can borrow the money, but that often includes borrowing newly created money from the Fed. The deficits remain and they accumulate and in time. They must be resolved, either by payment or default, either overtly or covertly through the mechanism of inflation. While some level of government deficits may be acceptable over modest periods of time, the U.S. deficit is now well past the point of being acceptable.

The deficit will soon grow to monster proportions as the baby boomer retirement obligations exceed the ability to tax the declining number of workers contributing to the Social Security and Medicare funds. Projections of the likely deficit compared to GDP growth make it clear that the government is faced with hard choices. The easy path of just letting the dollar fall is the most likely.

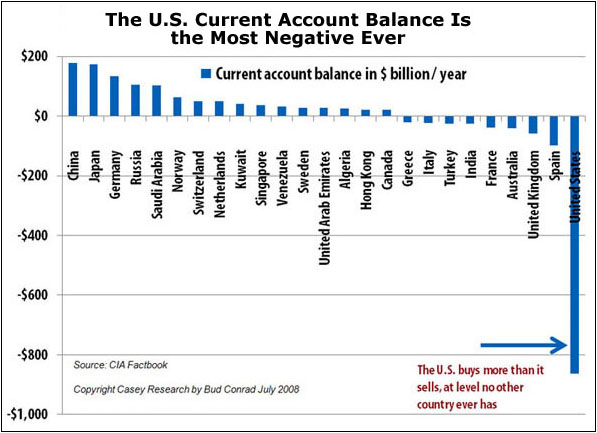

2. The Expanding U.S. Trade Deficit

It is consumers who primarily receive the money provided by U.S. government deficits. In this globally interconnected world, they then spend a portion of that money on foreign goods. An unintended consequence of the ballooning government deficits, therefore, is a large and growing trade deficit.

The foreign recipients of those dollars— whether Chinese manufacturers or Middle Eastern oil sheiks— have, in recent years, turned around and reinvested those dollars in U.S. Treasuries. They have done so because of the perceived safety of those instruments, and because of the sheer volume of the dollars they have to invest. In addition, it has been in their commercial interest to help finance the U.S. deficit.

Click Here, or on the image, to see a larger, undistorted image.

With the trade deficit now running at $750 billion per year, and much of that money coming back into U.S. Treasuries, the U.S. government has grown dependent on foreigners to sustain the continuing deficits. That level of debt would normally cause extreme weakness in a currency— just as it would in the value of debt owed by a deeply indebted individual. However, the sheer magnitude of the foreign holdings provides something of a bastion against a total collapse in the dollar.

Even so, some foreign holders are easing toward the exits... through the purchase of an operating company or resource deposit here, or a landmark New York building there. They might make a billion-dollar equity investment in a brand name company, or exchange some dollars for a basket of currencies or a ton or two of gold. It's a delicate balancing act, because if they get too aggressive, they risk triggering a mad dash for the exits, a nightmare scenario where the value of their trillions of dollars in holdings would be devastated almost overnight.

3. Rising Oil Prices Affect... Everything

The growing global demand for oil, coming as it is against a backdrop of limits being hit in production growth, is a major contributor to today's big price rises. The clear and present danger is that we are now using several times more oil than we are discovering. The world currently produces about 310 billion barrels of oil per decade. That amounts to about three times the current discovery rate of 100 billion barrels per decade.

According to the Peak Oil calculations, we have already used about half of the energy stored over the last 100 million years. Against that, we have a steady increase in demand emanating from population growth and economic development, especially in Asia. This, coupled with the dearth of major new discoveries, assures that energy markets will remain at high prices, for the foreseeable future. The current big drop from almost $150 to $110 has happened from a slowing economy and from some conservation at the extreme high gas pump prices.

But the long term view is that the lack of reasonable alternative to petroleum argues for continued higher prices returning to the previous peak in the year ahead. As energy is a component in the manufacture of all goods and services, this is of no small consequence. Energy has been the basis of the abundance of our current existence and has allowed human population to grow from 1.5 billion to 6 billion over the last century.

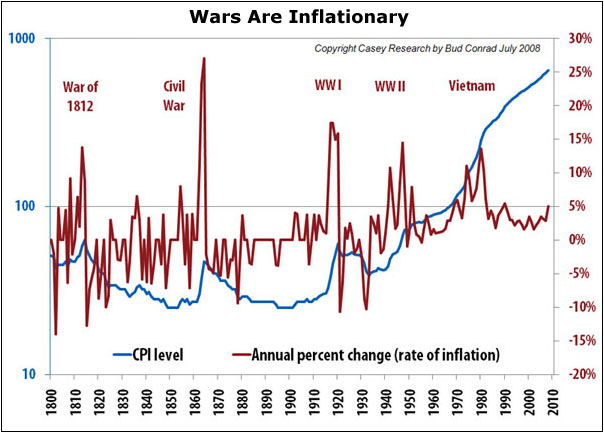

4. War Affects the Deficits and Hurts the Dollar

The war in the Middle East adds unwanted pressure on oil and ratchets up government spending. Less obvious is the damage to U.S. prestige that is important in the ability of the U.S. to attract much-needed foreign investment.The Congressional Budget Office estimates the war will cost 3 to 4 trillion dollars, an amount of sufficient size that it will affect the U.S. financial system. Regardless of the short term political ups and downs of even a new administration, the pressures from war for big deficits and for dollar depreciation are inescapable.

Click Here, or on the image, to see a larger, undistorted image.

Where Is the Economy Going in the Next Six Months? Projections

1. The housing decline is not yet done, because we will need [[at least: normxxx]] another year just to unwind foreclosures in the pipeline. The housing bubble still has another 10% to 20% to go to fully deflate.

2. Consumers in the U.S. are not able to expand credit and are increasingly concerned about the outlook for the economy, so they will slow spending both at home and on imports, which means we are in a recession or about to confirm one.

3. The financial/banking system is weaker than understood. [[Certainly less than anyone on Wall Street, the Fed, or the Administration understands or acknowledges.: normxxx]]The global system and literally trillions of dollars in derivatives [[marked down to $0.00, or less than $0.10 on the dollar: normxxx]] has left the world's banks teetering on the edge. Don't jump back into financials.

4. A slowing economy— recession— coupled with inflation, creates a grim condition referred to as stagflation, as the simulative bailouts compete with the debt implosion of overleveraged financial institutions and real estate, to leave us with stagnation and still high costs.

The result of this is that the inflation rate, interest rate, food, energy and precious metals are heading higher as the dollar is debased.

Higher rates are not good for housing and stocks.

Finally, it is important to recognize that the world remains in the throes of a deep and serious crisis. While many analysts will express the view that the worst is over or that, after a modest downturn, things will bounce back just like they always have, our view is that what we will actually witness going forward is a fairly steady erosion of paper currency purchasing power [[probably masked by ALL paper currencies going down against the PMs : normxxx]] and sluggish economic growth. The crisis will accelerate, moving faster, even, than in previous major shifts such as that witnessed in the 1970s.

While history may find we are too pessimistic at this point in time, in our view it is far better to prepare for a worsening crisis and hope that it does not materialize, than to expect business as usual.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment