Was He Talking About The Current Great Depression That Is Sprouting Under His Watch? Lessons From The Great Depression: Part XIII. The Federal Reserve.

By Dr. Housing Bubble | 18 August 2008

Federal Reserve Chairman Ben Bernanke this week once again mentioned that the Federal Reserve was "strongly committed" to financial stability and is considering options like keeping the lending facilities open to primary dealers. In short, they are going to continue to bailout banks and Wall Street firms while Americans get the shaft. This is an important statement and the futures markets are now not expecting any rate rises this year. After all, we are now firmly in a bear market with the three big indexs, the DOW, S&P 500, and NASDAQ, down substantially from their recent peaks.

It is crucial to understand the psychology of Ben Bernanke in order to understand his motives in the current economic crisis. Bernanke is a 'student of the Great Depression' and much of his belief is that the Federal Reserve was a principal (if not the primary) cause of exacerbating the problems at that time. He feels they didn’t react quickly and strongly enough to stem the economic collapse that soon followed. Few Americans have a sense of history, much less financial history.

For example, many think that the Great Stock Market Crash was essentially limited to one bad month in October, 1929. That is not true, the bottom didn’t hit until years after. Also, many forget that we had a massive real estate bubble and collapse that occurred in the early to mid-1920s with Florida real estate looking rather similar to what is currently occurring in the coastal states; in particular, California and, once again, Florida.

The Federal Reserve was initially envisioned as a lender of last resort. Economic busts and depressions were very common in the past [[principally because of the constricting effect of the "gold standard" on a rapidly expanding economy: normxxx]]. The idea was to have a government sponsored, central authority which would be able to step in during these moments of crisis to inject the required liquidity to handle any 'run' on an otherwise 'sound' bank. [[The idea from the beginning was for the Fed to act as a bank's bank, to save otherwise sound banks from succumbing to a run on their assets.: normxxx]] But make no mistake, it was designed to be used as a very last resort only when things got absolutely horrific, and it was NOT intended to be used to 'diddle' with the broad economy!

Shift now to today. Officials say we aren’t even in a recession, so how is it possible to have the Federal Reserve bailing out a specific publicly owned investment bank in Bear Stearns, exchanging U.S. Treasuries for questionable mortgages, and lowering interest rates even while consumer inflation is running rampant?

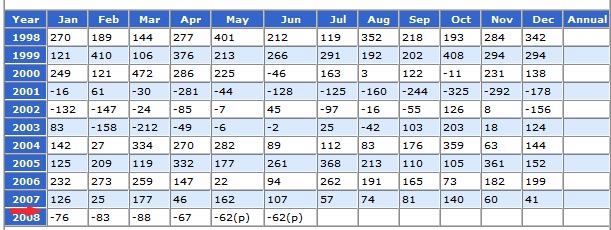

Take a look at the current job losses this year:

Click Here, or on the image, to see a larger, undistorted image.

This is not a sign of a healthy economy. If we parse the employment data further, we quickly realize that we are losing better paying jobs in financials and construction, while sharply reducing hours of employment (to involuntary part-time in many cases), and loading up with lower paying service and government jobs. Given the radical actions being taken, the current Fed Chairman must feel that we are on the precipice of another major recession or Great Depression. After all, why intervene so extensively and aggressively if problems in the economy were only of 'normal' stature, ie, relatively minor?

We are living in a house of cards that can no longer support the facade of solvency. At no time in our nation’s history have we been in so much debt. The way many of the banks and lenders book revenues is absolutely optimistic in thinking we are at the bottom. In fact, many are anticipating a 'second half recovery', without being specific about where this will come from [[or, indeed, in which year's 'second half' that recovery will eventually surface.: normxxx]]

The fact that lenders are being inundated with REOs and foreclosures is only another form of wealth and money destruction. If a lender had a mortgage listed on their books at $500,000 that is now defaulted, they now have to go through the expenses of marketing and selling the home or note. What if they can only get $300,000 for the home in the current market? In that instance, $200,000 just evaporated into thin air. And we've barely begun the commercial real estate bust. How are people going to continue spending now that credit has become much more restrictive and people are losing their jobs? Even Las Vegas is feeling the pinch:

|

I imagine it would be hard to plunk down $500 on Roulette if you knew your family back home needed that money for fuel and food, whose prices are rising as quickly as the Las Vegas thermometer. To understand Ben Bernanke it is also useful to examine the former chairman Alan Greenspan. The former chairman Alan Greenspan was known for his convoluted responses and ability to keep people guessing about his next move. He received much praise during the boomtime but now is on a mission trying to revise history to preserve what little is left of his legacy. Alan Greenspan was the champion of adjustable rate mortgages which are now the bane of the entire housing economy.

Understanding who Alan Greenspan grew up with helps to frame the psychology of his monetary philosophy. During the 1950s Greenspan got to know Ayn Rand, the novelist and philosopher, and this relationship would last until her death in 1982. Greenspan also wrote for Rand’s newsletter and wrote a few essays for her book on capitalism. This is important to understand because Rand’s ideals show up in much of her work including one of her most popular novels, "Atlas Shrugged". Rand advocated the following:

-Individualism

-Laissez-faire capitalism

She rejected socialism, altruism, and religion. In reading "Atlas Shrugged", you can see her disdain towards politicians and respect for survival of the fittest in business through her characters. If the former Fed chairman did believe in objectivism and the philosophy that Ayn Rand advocated, Alan Greenspan lost his way in the last few years of his tenure. For one, lowering rates to prop up the economy is not survival of the fittest. Using the Fed as a promotional tool for politicians would have Rand turning in her grave. And this would lead us to Bernanke and his views and philosophy.

This is part 13 in our Great Depression series:

1. Personal Story by a Lawyer from a Previous Asset Bubble. Can we Learn from the Past and How will the Housing Decline Impact You?

2. Lessons From the Great Depression: A Letter from a former Banking President Discussing the Bubble.

3. Florida Housing 1920s Redux: History repeating in Florida and Lessons from the Roaring 20s.

4. The Menace of Mortgage Debts: Lessons from the Great Depression Series: Part IV: Where do we go After the Housing Crash?

5. Business Devours its Young: Lessons from the Great Depression: Part V: Destroying the Working Class.

6. Crash! The Housing Market Free Fall and Client #10 Contagion.

7. Winston Smith and the Bailouts in Oceania: Lessons from the Great Depression Part VII.

8. Sheep Back to the Slaughter: Lessons from the Great Depression Part VIII: All the Change and Bear.

Market Rallies.

9. A Bubble That Broke The World

10. The Sham Of Our Current Unemployment Numbers

11. Understanding the Impact of Asset Deflation and Consumer Inflation.

12. Is the DOW now Tracking with the California Housing Market?

Destiny Sometimes Finds You— The Coming Economic Collapse

For a person who has studied the Great Depression in great deal, it must appear as a weird sense of destiny for Ben Bernanke to confront the current economic climate. Here he is, this is our 1929 and Bernanke is going to have the chance to put his theory into practice. One of Bernanke’s great heroes is the famous economist Milton Friedman. Bernanke in November 8 of 2002 at a conference honoring the 90th birthday of Friedman had a chance to say a few words:

|

Ironically somewhere from the 1913 inception of the Federal Reserve the idea started to emerge that the Fed was not simply a lender of last resort, but also a method of controlling markets. It is without a doubt that the Fed has now morphed into an agency beyond its initial scope. And recently with comments from Hank Paulson, it would appear that they want to increase powers even further. The irony of the current situation is that a large part of blame falls on the shoulders of the Federal Reserve [[specifically, that all during the runaway housing and credit years, the Fed exercised no part of its existing powers: AG famously "never saw a regulation that was necessary or that he liked": normxxx]].

They are the culprit here and not the solution. This bubble could have been stymied long ago by raising rates and ensuring that lenders had adequate capitalization to make the ridiculous loans they were making. Bernanke is now allowing the Fed to exchange horrific, worthless mortgage paper for liquid Treasuries and has also slashed rates once again to historical lows. He is finally putting that Friedman theory to work. But what we have here is beyond monetary policy, folks.

To think that an economy as global as we currently are, as heavily in debt as we are, and as irresponsible financially as we have been could be solved by a few rate cuts is Fed hubris. Look where we now stand. Bernanke must be thinking, "okay, we’ve bailed out an investment bank, we’ve lowered rates at a historically unprecedented level, we’re exchanging good paper for junk which is new, and why isn’t the economy moving like I had predicted?" Let us see what else Bernanke had to say:

|

It is the case that during the Great Depression there were many smaller banks that failed. This was partly due to the fact that we had a much more localized economy back then. That is, if you wanted a mortgage you went to your local bank. Your business normally catered to your small niche. That is now not the case. We are a mega service oriented society. One of my loans for a home was completely done without a face to face meeting. The loan originated in one state and was for a property in another.

That lender is now out of business. Doesn’t impact the local economy here in Southern California but I bet it impacts the economy in their neck of the woods. This is the new reality. We have mega banks that consume a large portion of the market so the idea of measuring the coming bank collapses in sheer number is a poor indicator of distress. Many of these mega banks are the equivalent of 1,000 small banks.

So the Fed right now is fighting the 21st century banking problem with theories suited for a market in the 1930s. This is why the Fed is now being exposed as a paper tiger. They can do nothing in such a large global marketplace aside from helping a few select friends. To think they can convince everyone that they somehow have the Midas touch is absurd. The mystique that once reigned at the Fed with Greenspan is completely shattered. Bernanke thinks the Fed has the ability to stop any panic or in today’s case, any recession:

|

You got that right Ben. You did it alright. Forget the Great Contraction absurdity. It was the Great Depression. They’d probably like to call what is happening today as a "market reshuffling"— but we are in a recession. This softening of the language [[and dishonesty in the economic numbers that can hide a recession: normxxx]] is pure propaganda and a setup to downplay the magnitude of our current problems. This housing crisis is the worst ever, even dwarfing the speed of drops during the Great Depression.

Personal debt is at the highest ever. Job losses are mounting. Yet they want you to believe that this is a minor correction. Those that believe in the '2nd half recovery' might as well believe that monetary policy alone will get us out of this mess. $500 billion in pay option loans are set to recast and foreclosures are at record highs, the destruction of wealth will continue. That is what faces us in the 2nd half.

Chairman Bernanke, what do you call a theory that doesn’t work?

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

Ben Bernanke, the consensus-building academic who toiled in Alan Greenspan's shadow, is emerging as the most powerful--and inventive. From Bernanke's standpoint, there are two major lessons to be learned from the Fed's reaction to the market crash of 1929 that are relevant today.

ReplyDelete----------------

Tanyaa

Advisor