Oil Patch Gossip About BP

Special Chinese Yuan Revaluation Issue

How US Job Losses Will End

By The Mad Hedge Fund Trader | 23 June 2010

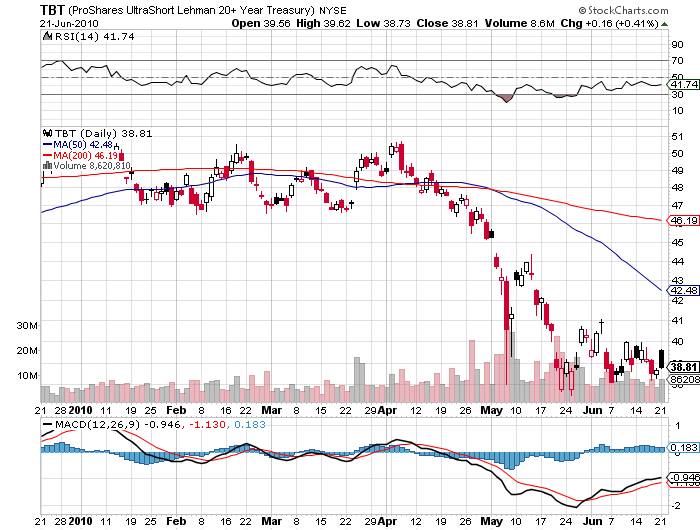

The Bond Market is Blind to Risk. After promising to deliver you a nicely marbled, medium rare, prime rib, I am the first to admit when I actual come up with a piece of tasteless, salt water injected Costco turkey. I am talking about my suggestion that Treasury bond prices would fall this year, and that the best way to play it would be through the leveraged short ETF (TBT).

Nimble traders were able to wrest three round trips out of a $46-$51 range in Q1 before a flight to quality broke it down to $36 during the April-May sell off. But if you didn't keep stop losses in place, which I always highly recommend, you got hammered. Still, after listening to The Ascent of Money author and Harvard business school professor, Niall Ferguson, this morning, I am more convinced than ever that this trade will have its day in the sun.

The next financial crisis will be a chain reaction that has already started in small, peripheral European countries, and will spread to large European countries, eventually hitting Japan and the US. From a fiscal point of view, the US is no better off today than Greece or Spain. [[In the U.S., : normxxx]][t]he next crisis has already started at the state level, where there is little choice but to dramatically cut spending and increase taxes.

Debt service will soar from the current 11% of the federal budget to a gob smacking 28% as early as 2014. When this happens, the Treasury bond market will become extremely sensitive to even the smallest changes in interest rates. A reassessment of American credit worthiness could tip us into crisis very quickly, possibly as soon as two years. Washington is doing nothing to avert the impending crisis, and with ten year yields now at a paltry 3.24%, the bond markets are clearly blind to these risks.

Prices will [[must?: normxxx]] eventually head downtown on an express train. I'm not wrong on this one, just early.

Click Here, or on the image, to see a larger, undistorted image.

|

.

Oil Patch Gossip About BP.

By The Mad Hedge Fund Trader | 22 June 2010

Over the years, I have invested so much time wildcatting in the oil patch that I will never be wanting for great steaks at Nick & Sam's in Dallas, skyboxes at Cowboys games, and personally signed 8 X 10 glossy photographs of George W. Bush. So to get the skinny on the BP mess, I spent the weekend catching up with old friends who live with a permanent oil stain under their fingernails. Some of the chatter that came back was amazing. BP has discovered the largest and most powerful well in history, and control of it may be outside existing technology.

The previous record gusher was Union Oil Co.'s Lakeview well in Maricopa, California, which spewed out a staggering 100,000 barrels a day at its peak in 1910, and created an enormous oil lake in the central part of the state. Estimates for the BP well now range up to 50% more than that. The pressures at 18,000 feet are so enormous, that drilling two more relief wells might only result in creating two more oil spills. If Obama doesn't want to take the nuclear option, (click here for my piece), then there will be no other alternative but for the spill to continue until the field exhausts itself or becomes cappable, possibly some time next year. This is not the end of the world.

Less than 1% of the spilled oil is ending up on the beaches. Watch TV, and that is not 150,000 barrels on the beach in Pensacola, Florida. Most of the crude is being moved parallel to the coast by the current and will eventually end up in the mid-Atlantic, where it will break down or dissipate. Using the high end estimates, and assuming that it takes a year to run out, possibly 36 million barrels will end up in the sea (pressure is declining).

This is the same amount of oil that was dumped into the Atlantic during WWII, when 452 tankers were sunk by German U-boats, mostly along the US east coast, and when tar on the beach was a daily occurrence. This is on top of the 1.5 million barrels a year that leak into the Gulf through natural seepage, which no one ever notices. One way or the other, this will end, and Western civilization will survive.

And by the way, the crude price rise brought by the spill also marked up the value of BP's reserves, easily allowing it to cover the cost of the clean up, no matter how big it is. This is how profitable this company is, and why they were so generous with a $20 billion contingency fund. For a fascinating peek on how BP's management initially responded to the Gulf oil spill, watch this video taken by a secret camera inside their board room, which I obtained from a confidential source on pain of death. Brace yourself. And you wonder how it got so bad.

.

Special Chinese Yuan Revaluation Issue

By The Mad Hedge Fund Trader | 21 June 2010

Specifically, China has announced that it will "further reform the RMB exchange rate regime and enhance RMB exchange rate flexibility." To me, this is Chinese for "let it go up". [[Maybe; maybe not.: normxxx]] If you think you can get more out of this statement than I can, please read the full statement on the People's Bank of China Website by clicking here). There was a rising crescendo of chatter that the Middle Kingdom would finally make its move at the upcoming G-20 meeting in Canada, which traders in the ETF were clearly sniffing out all last week (see chart below).

I made a major call for the appreciation of the Chinese currency on February 16 (click here for the call), and that investors should use the ETF (CYB) as a back book position or a place to park cash. I warned that the Chinese Ministry of Commerce was computer modeling the effects of a stronger Yuan on their economy on March 1 (click here for the piece). Finally, my old friend, Eisuke Sakakibara, or "Mr. Yen", nailed it on April 28, he predicted a 5% appreciation by the end of June (click here for the call ).

China took the move, not because it wants to win friends and become an admirable global citizen, but to get a handle on its runaway inflation. I pointed out only last week, that at the current rate of wage increases, China would match half of America's minimum wage in only five years, tossing its comparative cost advantage (click here for that piece). The impact on the Chinese stock market (FXI) is debatable.

Exporters will take a big hit, but more foreign money may start pouring in now that the Yuan has been unshackled. It is safe to say that this is just the first of many more revaluations in the years to come. You can't keep a good currency down. The last time the Yuan floated in 2005, it rose 21% over three years. By my count, the Chinese currency is currently undervalued by 50%. Those who heeded my advice will no doubt be waiting with baited breath to see how the Chinese currency opens Monday morning. But it's safe to say that you can chalk this one up in the "win" column.

.

How US Job Losses Will End.

By The Mad Hedge Fund Trader | 18 June 2010

I am not in the habit of regularly lifting data out of the Wall Street Journal, but even a blind squirrel occasionally finds an acorn. I was tempted by the comparative Asian wage data they published yesterday, which I just have to get into my data base. Textile workers earn $2.99 an hour in India (PIN), $1.84 in China (FXI), and $0.49 in Vietnam (VNM).

This is an 18 fold increase in labor costs from ten cents an hour since Chinese industrialization launched in 1978. This compares to the $8 an hour our much abused illegals get at sweat shops in Los Angeles, and $10 in some of the nicer places. What's more, the Indian wage is up 17% in a year, meaning that inflation is casting a lengthening shadow over the sub continent's economic miracle.

A series of strikes and a wave of suicides have brought wage settlements with increases as high as 20% in China. This is how the employment drain in the US is going to end. When foreign labor costs reach half of those at home, manufacturers quit exporting jobs because the cost advantages gained are not worth the headaches and risk involved in managing a foreign language work force, the shipping expense, political risk, import duties, and supply disruptions, just to get lower quality goods.

Chinese wage growth at this rate takes them up to half our minimum wage in only five years. This has already happened in South Korea (EWY), where wage costs are 60% of American ones. As a result, Korea's GDP growth is half that seen in China. These numbers are also a powerful argument for investing in Vietnam, where wages are only 27% of those found in the Middle Kingdom, and where Chinese companies are increasingly doing their own offshoring.

This is why I have pushed the Vietnam ETF (VNM) on many occasions, with great success (click here for the call). I know every time I do this I get torrents of emails from that country bitterly complaining how difficult it is to do business there, and how the hardwood trees are still full of shrapnel left over from the war, and why I shouldn't buy a 50 acre industrial park there. But the numbers don't lie.

Click Here, or on the image, to see a larger, undistorted image.

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

Nuke the oil well? The Nuclear Option

ReplyDeleteGiven that BP is still sitting on both the detailed situational and geological data, it is difficult to tell from a distance what will or will not work to stop the Deepwater Gulf oil spill, therefore everything should be on the table. Here is an interview with a leading U.S. expert on Peaceful Nuclear Explosives, Dr. Milo D. Nordyke, who suggests that it should be carefully considered under the circumstances. Dr. Nordyke was interviewed June 11 on CNN’s The Situation Room.

http://www.larouchepac.com/lpactv?nid=14943