By Colin Twiggs | 3 June 2010

| These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use. |

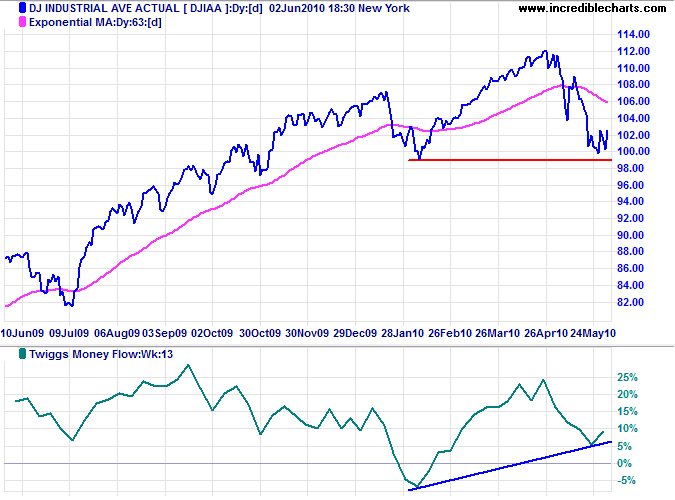

Dow Jones Industrial Average

|

The Dow is at a critical watershed. Having found support at 10000, completion of a bullish divergence on Twiggs Money Flow (13-week) would signal the end of the correction. Failure of support at 9900, however, would warn of a bear market.

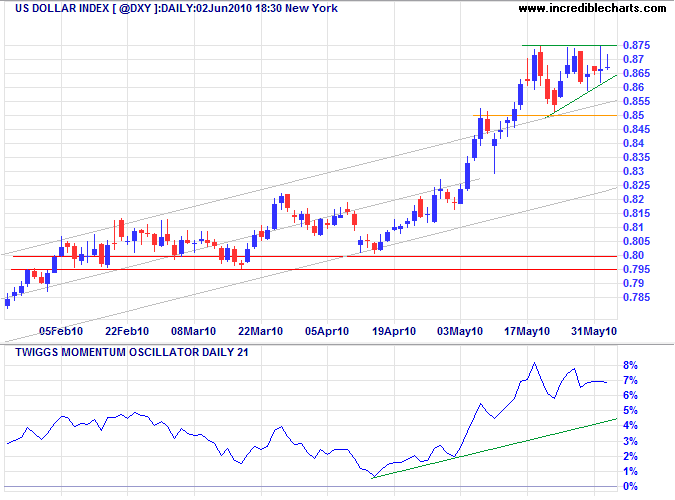

US Dollar Index

The US Dollar Index formed a large pennant below 87.5, signaling continuation of the recent advance. Upward breakout would confirm, offering a target of 95*. Failure of support at 85 is unlikely, but would indicate the end of the rally and a test of the lower trend channel.

* Target calculation: 87.5 + ( 87.5 - 80 ) = 95

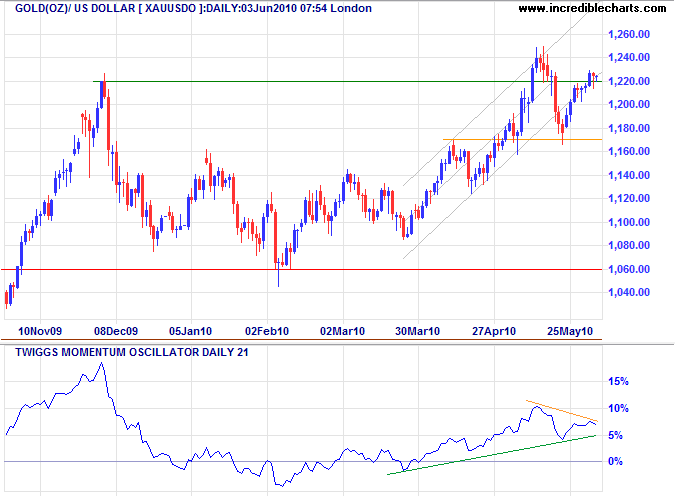

Gold

Gold closed above short-term resistance at the December 2009 high of $1220, but the breakout is not yet convincing. Wait for retracement that respects the new support level or follow-through above $1240. Reversal below $1200 would warn of weakness, and breakout below $1170 would confirm a a down-swing to primary support at $1060. The long-term target for an advance is $1380*.

* Target calculation: 1220 + ( 1220— 1060 ) = 1380

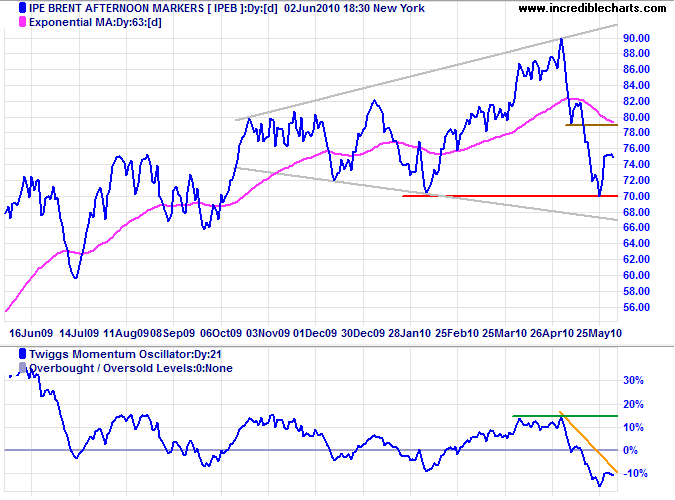

Crude Oil

Crude is retracing for another test of primary support at $70. Failure would signal a primary down-trend with a target of 50*. Twiggs Momentum respecting the zero line from below would warn of a bear trend.

* Target calculation: 90— ( 90— 70 ) = 50

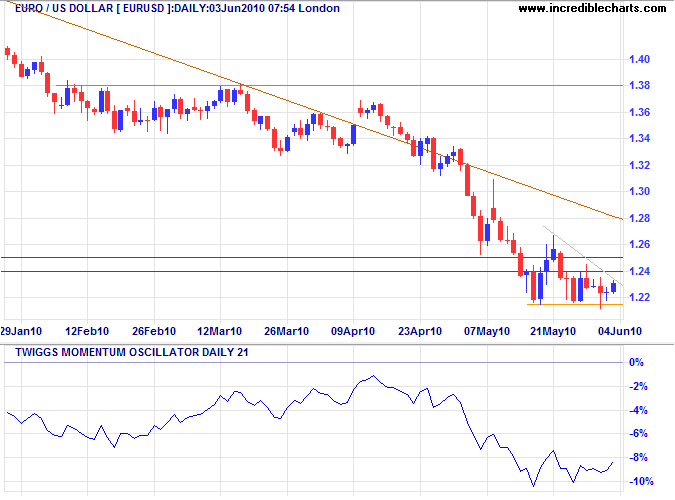

Euro

The euro formed a bearish pennant above short-term support near $1.22, warning of another down-swing. Downward breakout would confirm, offering a long-term target of parity*. Recovery above $1.27 is unlikely, but would suggest a bear trap.

* Target calculation: 1.25— ( 1.50— 1.25 ) = 100.

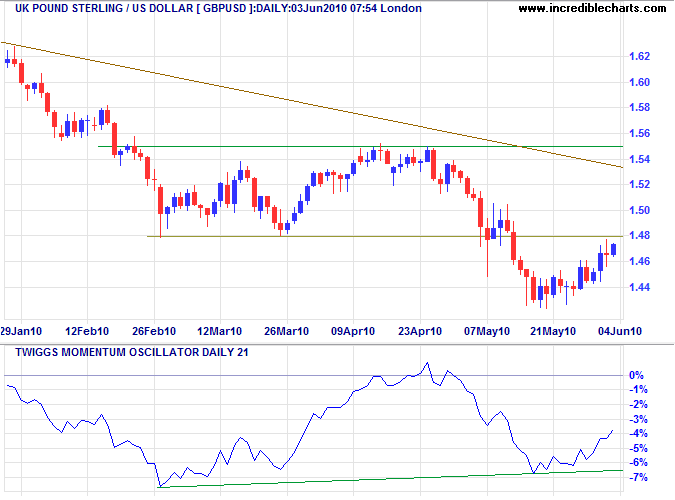

UK Pound Sterling

The pound is testing the new resistance level at $1.48. Respect would confirm the medium-term target of $1.38, but bullish divergence on Twiggs Momentum (21-day) favors a reversal.

* Target calculation: 1.48 + ( 1.58— 1.48 ) = 138.

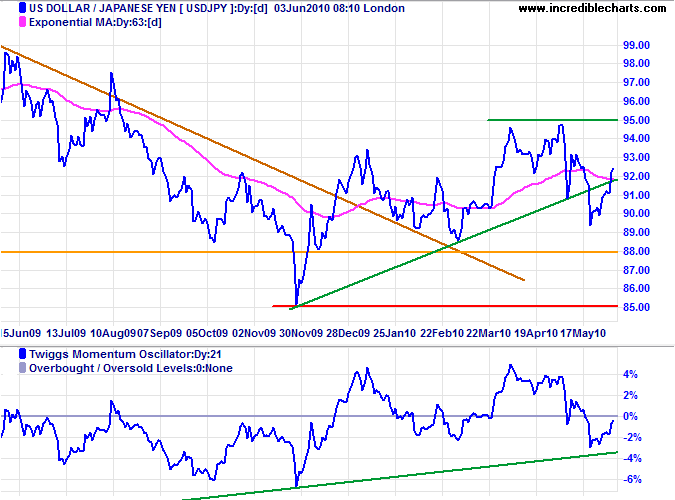

Japanese Yen

The dollar is forming a long-term base against the yen, but has yet to show much of an up-trend. Rising Twiggs Momentum confirms the signal. Breakout above ¥95 would signal an advance to ¥100*, while failure of support at ¥88 would warn of further weakness.

* Target calculation: 94 + ( 94— 88 ) = 100

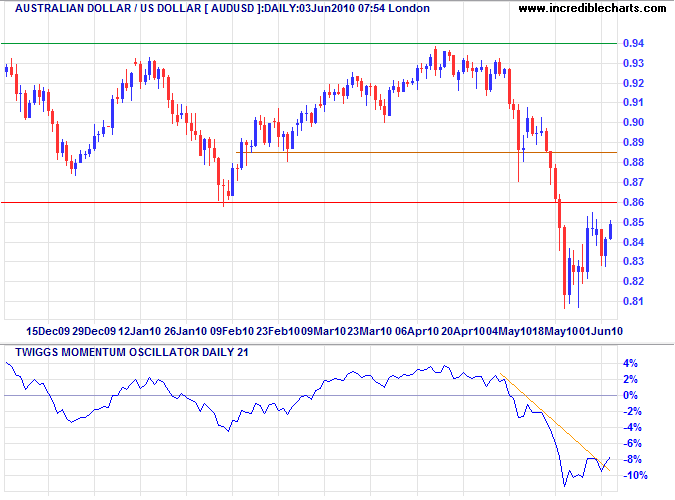

Australian Dollar

The Aussie dollar is testing the new resistance level at $0.86. Respect would confirm the primary down-trend, with a target of $0.76*, while recovery above $0.86 would warn of a bear trap. A Twiggs Momentum rally that respects the zero line (from below) would confirm the bear trend.

* Target calculation: 0.81— ( 0.86— 0.81 ) = 076.

|

No comments:

Post a Comment