By Andy Sutton | 27 May 2010

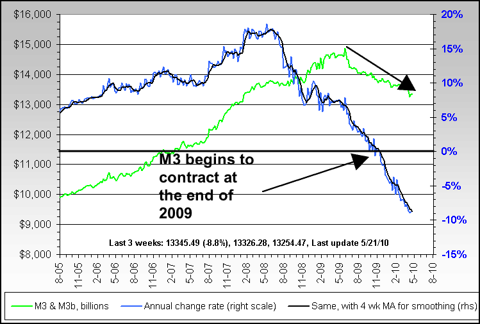

Given the fact that we sit on the precipice of a holiday weekend, every attempt will be made to keep this short and to the point. M3 growth has collapsed. We had pointed this out several months ago and again more recently amidst a barrage of protest emails that the printing press always wins the battle with the deflationary black hole. To date, the black hole is winning hands down. The reasons are nebulous and complex, but the point is that our broadest monetary aggregate is now shrinking. This does not bode well for our economic prospects moving forward.

True to form, even the mainstream press is starting to take notice, long after the trend has been well established. Ambrose Evans Pritchard dedicated a piece yesterday to the collapse in M3 growth, something that hasn't been seen in the US since the Great Depression. Monetarists the world around are frightened about this trend, and with good reason. US interest rates are already essentially zero. The massive monetary and fiscal stimulus has been epic in nature. And all this has still not prevented the actual textbook deflationary trend we now find ourselves in. [[Well, the destruction of several hundred trillion dollars of derivatives should be expected to have some effect!: normxxx]]

|

The major reason for this is that the banking system has severely curtailed its lending activities, which are largely (but not entirely) responsible for the growth in the money supply thanks to the money multiplier. One must ask how this is possible since essentially the banks have the 'Taxpayer Put' in place where the US taxpayer is immediately hooked for any significant failure. For decades we have had an economy that relied on credit for its survival and now, like a drug addict in rehab, that credit is being limited. The result was fairly predictable.

Given the massive debts in our system, there are two obvious choices. First, hyperinflate away the debt. However, that ultimately ends in the destruction of the currency and the end of the current fiat age. Second, we could 'default' through deflation/devaluation [[eg, by restricting the redemption of government bonds and/or interest payments thereon: normxxx]], and try to, in effect, reset the system much as happened in the 1930's. The major difference between then and now is the relative financial position of both the nation and individuals. Both are considerably weaker here (than in the 30's) as we approach this next phase in America's existence.

I've argued for the coordinated default/devaluation outcome for some time now. The collapse of M3 growth is one of the biggest factors on this side of the argument. The second is history. The US already has a rich experience in fiat money, dating back to before Lexington and Concord. We also have a rich history of defaults thanks to the over-issuance of fiat money. Granted, the defaults consisted of ceasing to redeem paper money for specie (Gold/Silver), but a default is a default.

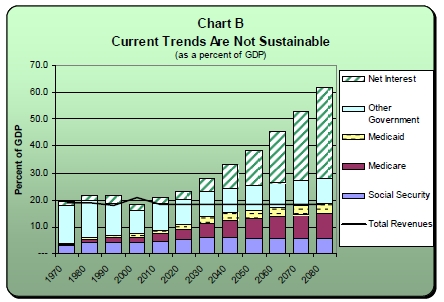

We are clearly out of control in terms of our debts, both internal and external, and don't seem the least bit concerned about real generational or fiscal reform beyond traditional Washington lip service. The Fed has been largely ineffective at doing anything but fattening bank cash flows by squeezing savers and allowing banks to collect generous margins on the performing consumer loans they do have. The bailout money sits in bank coffers, withheld from an economy that now depends on loans for its very survival.

Larry Summers, President Barack Obama's top economic adviser, has asked Congress to "grit its teeth" and approve a fresh fiscal boost of $200bn to keep growth on track. "We are nearly 8m jobs short of normal employment. For millions of Americans the economic emergency grinds on," he said. I wrote many moons ago that once the parade of stimulus started that it would never end. Summers' statement is tantamount to admission of the failure of his own Keynesian thinking. He is now acknowledging that in order to 'grow', we need [[artificial: normxxx]] stimulus ([[ie, low interest: normxxx]] debt). Every once in a while the truth does come out.

Given these undisputable facts, it is really hard to conjure up a scenario where we can have any type of broad, well-grounded economic recovery. The various economic reports I dissect on a weekly basis bear this out. However, the bottom line as we solemnly observe Memorial Day weekend is M3. Where it goes, so goes America. Such is the way of things in a fiat money system.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment