Guess Who's Winning!?!

The New Financial Overlords: The Debt Class And Those That Provide The Debt For The Serfs. Understanding The New Structure Of The American Financial Landscape.

Click here for a link to ORIGINAL article:

By DrHousingBubble | 19 April 2009

The stock market at least in its current form is a horrible indicator of the actual economic carnage falling upon the majority of Americans. Most Americans are witnessing the current rally and wondering why the massive run up (largely in financial related stocks) is going forward while they are getting called into supervisor offices behind closed doors and being laid off or seeing their hours cut back. Wall Street has completely disconnected from Main Street.

It is also hard for many to understand how they are having their limited income taxed to finance the bailouts of Wall Street and its financial cronies while they are asked to do more with less. They are seeing these same institutions, alive only because of the massive funding from the American people, nevertheless shut off credit lines and raise rates while the government through the U.S. Treasury and Federal Reserve showers the banks and Wall Street with easy low rate financing thanks to the American taxpayer. And our government ideally should reflect the will of the majority?

Welcome to the new America. Where unemployment is good news for Wall Street and bailouts are now seen as a new source of revenue for financial companies. New accounting students will learn how to incorporate bailout funds as a new source of revenue.

It is easy to turn a profit as a financier when trillions are funneled into the financial system. This is like jumping into the blue ocean and being shocked you got wet. Yet the problem of course is very little of this money is trickling down to the real economy— you know, that economy that doesn’t involve Bloomberg Terminals and pinstripe suits? Imagine a giant person eating at a table and the mice are running around on the floor hoping to pick up the scraps. Guess who the mice are?

The last few weeks have been great for the financial companies because they are now operating in a pseudo reality that is for the privileged few. These are the new financial overlords and all it took was the collapse of debt to show them for what they truly are. Many people for the last few decades have confused debt with actual wealth. That is a mistake we are now coming to terms with.

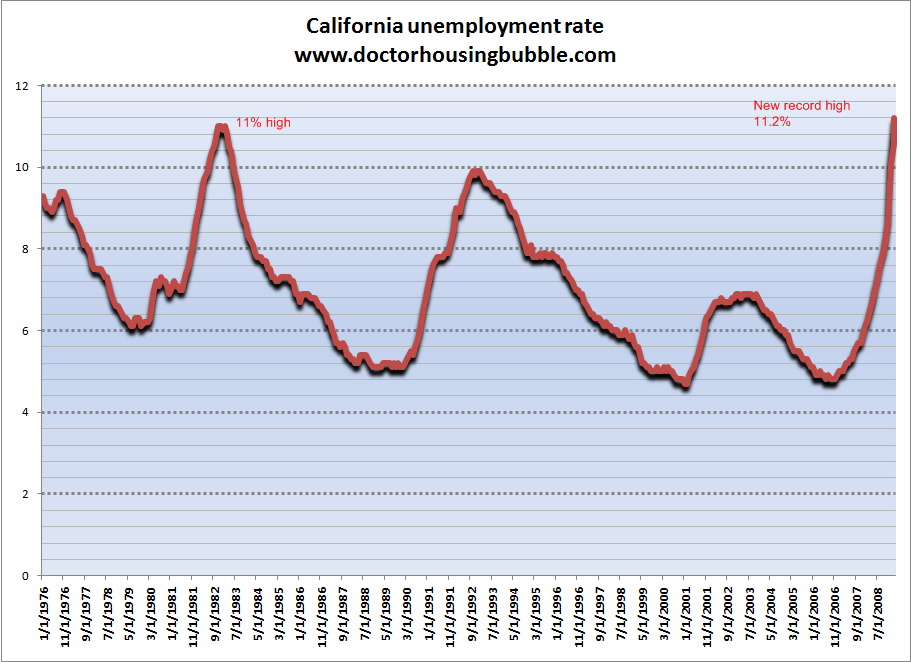

Many families now are seeing $5,000 in credit card debt at a reasonable rate— that has suddenly jump to double or more, just because the banks have— willy-nilly— decided to change terms. They are doing this on a massive scale while simultaneously cutting the credit lines of many Americans (and adding penalty fees if the used credit is not instantly brought within the new limits). Just to highlight this split, let us look at the unemployment numbers released for California on Friday, 17

April:

Click Here, or on the image, to see a larger, undistorted image.

The unemployment rate for California is now 11.2%, the highest on record. While the markets are rallying states are reporting higher and higher unemployment rates. In California, this translates to 2,131,200 unemployed and the trend is moving still higher. Most Americans would say that their biggest source of income is their job.

So how can an economy be healthy if people are losing jobs and unemployment is breaking all records? Again, the small elite circle of financial kingpins are squeezing the debt laden serfs to pay as much as they can even though they are confronting one of the worst employment markets in history. And the government has been throwing money at this problem for many months now.

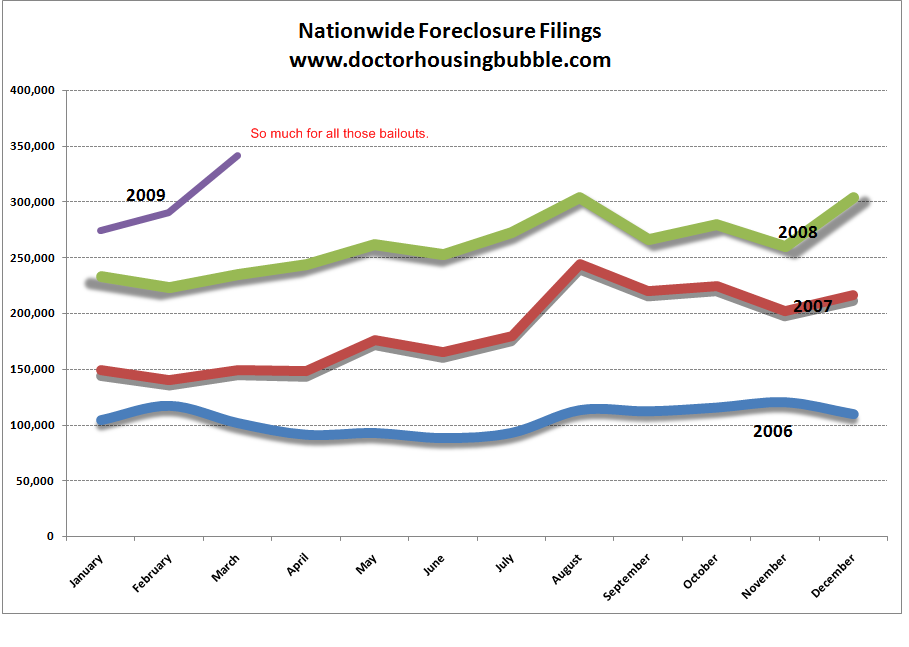

The TARP was created in the fall of 2008 and that has been an abject failure. Remember that most officials have been saying that it has been crucial to stabilize the housing market. You would think that $12 trillion in committed bailout funds would at least stem some foreclosures. In fact, the opposite has occurred. The latest data shows foreclosures breaking all time records:

Click Here, or on the image, to see a larger, undistorted image.

Even with all the moratoriums, incentives to banks, and other smoke and mirrors, foreclosures keep on moving up— meaning more and more Americans are losing their homes. So what have all those bailouts accomplished? They have kept the banking feudal lords sitting pretty while the rest of country finances their massive losses.

I hesitate even to call this 'corporate welfare' because many corporations have also to face the grim reality like the rest of us non-bankers. I call this crony financial capitalism run by a small group of plutocrats. If you are looking at the stock market as some sign of the overall health of the economy you are really looking in the wrong place.

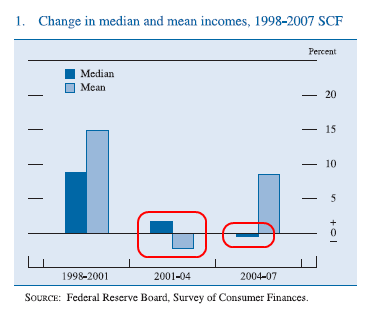

So what has happened to the income of most Americans? Let us take a look:

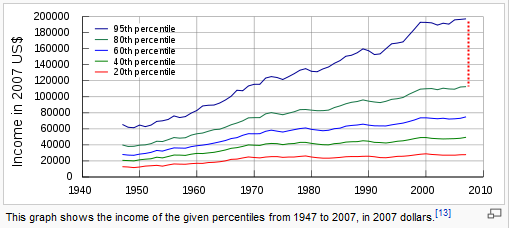

Keep in mind the above data does not include the destruction of $11.2 trillion in financial wealth because of 2008. Even without that cold hard fact, American families overall have seen their income not only stagnate, but go negative when adjusted for inflation. So who has done well in the last decade?

Click Here, or on the image, to see a larger, undistorted image.

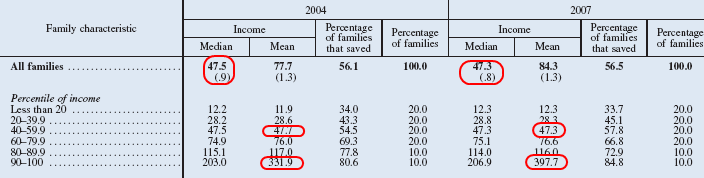

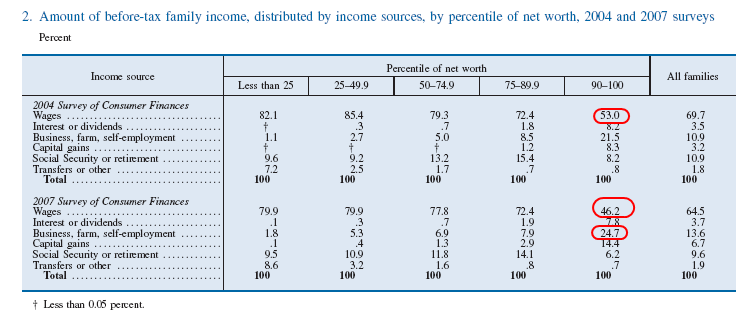

While most families have seen their income move sideways or decrease, the top 10 percent of wage earners have seen gigantic shifts in their income upward. Even with the top 10 percent, you see most of it being skewed by the top 5 percent of all incomes. And the more money you have, the less you depend on wages:

Click Here, or on the image, to see a larger, undistorted image.

So while 90 percent of Americans depend on their wages for 70 percent of their income or higher, the top 10 percent of wage earners only depend on wages for 46 percent of their income, a drop from 53 percent in 2004. What does this mean? They get more money from 'passive' sources.

Passive sources like fleecing the 90 percent of American taxpayers to make sure their bond income or stock portfolio pays enough in dividends so they don’t have to mix out there with the other 90 percent of poor schmucks trying to make a living. And keep in mind, those at the higher end of the curve are not part of that elite group. Let us look at the income break down for the U.S.:

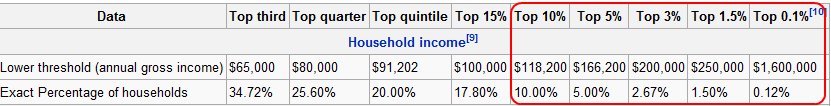

Click Here, or on the image, to see a larger, undistorted image.

In order to be in the top 10 percent your household will need to bring in $118,200 or more. Here in California that is basically a household of two working professionals. But given the high unemployment rate, the number of such families here is decreasing. I would argue that you will see a bigger difference if you look at household incomes of more than $200,000. That is where the separation begins.

The problem with the current system is the abject hypocrisy. Most Americans for the most part, believe in the basic tenets of capitalism. Competition. Supply and demand. But here you have a system that does not favor competition. In fact, the top five banks control upwards of 60 percent of all banking. How is that competition?

How about AIG posting the biggest quarterly loss in history? Their punishment is having to accept more money. In addition, the core belief of competition is that the best businesses will survive and thrive. In our current environment, we are rewarding the worst and most corrupt businesses. It is contrary to everything most have been told.

That is why we are seeing such anger and frustration out in the country. Wall Street and the politicians (who were in bed with them) can’t admit to what is going on, but if you have two eyes and a bit of logic, you will realize that all we have been doing is transfering wealth from the majority to a tiny minority. To show this even clearer, look at the income growth over the last 70 years for the various brackets:

Click Here, or on the image, to see a larger, undistorted image.

It would be one thing if the top earners made their money from solid businesses producing things of value for the majority. There are many that did do this. But there is also a huge number that created their wealth through AIG, Lehman Brothers, Fannie Mae and Freddie Mac, and other complete business failures. Many hedge funds thrived because they placed bets on casino like profits in finance and real estate.

If you want to see who the biggest failures are just look at the TARP recipients— yet they are the companies gaining most benefit from the current rally. They are all trying to prance around in this parade with their first quarter 'profits'— but those are thanks to the taxpayer, not them. If it wasn’t for the bailouts [[and a quick change in the accounting rules by FASB to allow them to further hide their losses: normxxx]], they would be in bankruptcy themselves. As they would, if they didn’t have control of an oligarchical system of finance.

The best course of action should have been receivership. [[But, of course, that is NOT possible. "w" and his minions largely saw to it that any government capability to act independently of the bankers and Wall Street was deleted from government— you are talking about a handful of largely low-level 'regulators' left to handle many hundreds of banks and other financial institutions (a task that would likely take thousands of regulators as long as a decade).: normxxx]]. But that would cut into this 'select' group of people and their income so we couldn’t do that.

Therefore the next logical step was to snow the masses into believing the world would end if we didn’t step in [[as well it might— they've seen to that! : normxxx]] They should have qualified that their financial world would have ended which isn’t necessarily a bad thing. But, since the government has 'stepped in', unemployment has been skyrocketing, foreclosures are at all time highs, and we are to believe that this is good for us? For many people things are ending: jobs, home ownership, healthcare, families, etc.

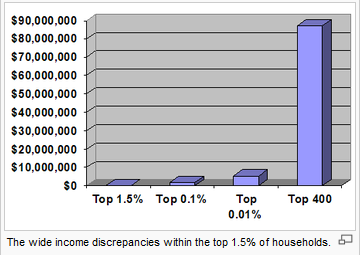

And even amongst the wealthy, there is a caste system:

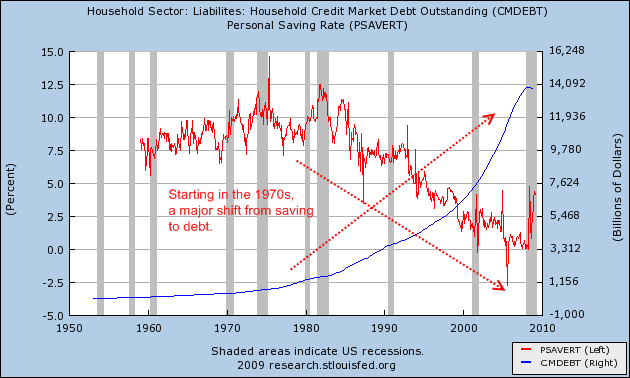

We can throw in a few hedge fund managers and bond managers in this group. Ultimately, the system is flawed. Most Americans have been under the illusion that they were wealthy. They are not. In fact, we can pinpoint this decline on a graph:

Click Here, or on the image, to see a larger, undistorted image.

Starting in the 1970s, we began to see a massive decline in the savings rate and an explosive jump in consumer debt. Debt per se isn’t bad. In fact, for nearly 50 years the 30 year fixed mortgage served us well when borrowers came in with a down payment (which they had saved). That all changed of course. Now, debt was being used as a supplement for the lack of real wage growth.

It was like a fake Hollywood set. It was only a matter of time before we walked up to the cutout of a building and pushed it over. Time to put that Fiji vacation on the credit card. Let us put the Jacuzzi on the American Express. Time to put those breast implants on the card. 'Credit' (a nicer name for debt) was used for everything and anything. And that was the problem.

Debt was permitted to all with the implicit notion that if everything went boom, the government would step in to backstop it. No one explicitly said this, but the inner circle 'knew' this. Everything has gone boom and here the government is bailing out decades of frivolous spending financed by the loan sharks on Wall Street. As a society we setup the environment to create Frankensteins like Bernard Madoff.

He got away with it for so long because the system rewarded people like him. He merely played the game better than most. Don’t hate the player, hate the game. There are many that are worse than Madoff but they played within the 'rules' [[in particular, he made the mistake of robbing too many rich people: normxxx]]; therefore everything is fine. But is it? Is this the kind of system we want where gains are privatized and losses are socialized onto the backs of the population?

I know many people are screaming about socialism now, but they are late to the game (like a few decades late). Also, what exactly is the mass of the population getting for this new expensive socialism? Employment security? Healthcare? If this is socialism we are getting very little out of it. For a history lesson, Mussolini’s government was supported by the military, the business class, and the extreme wings of the political branches. Sound familiar?

In fact, in 1935 Mussolini pushed for government control of business. By 1935 nearly 75 percent of Italian business was under state control. We have AIG, Fannie Mae and Freddie Mac, all the TARP banks, and what else? We definitely do not want to go down this path. Are we looking at Japan and there 2 lost decades as an example? The crowd that is getting silenced here is the moderate majority.

In fact, I talk with both moderate Democrats and Republicans and we have more in common than many think. Yet you have the extreme wings of both parties hijacking the issues. Like the tea parties that started with anger toward the bailouts. Many protesters added other wedge issues having nothing to do with the bailout. These latter are distractions. Keep your eye on the ball. The first news station that does a two hour piece shredding the Fed and U.S. Treasury gets a massive high five (hint hint CNBC).

The current administration has two widely respected financial experts in Paul Volcker and Elizabeth Warren. Both should be unleashed on the financial industry. Last I heard is they are putting Volcker on the task of reforming the tax code which is incredibly important. But why not have him tackling the current banking crisis as well? He can walk and chew gum.

Elizabeth Warren showed up on The Daily Show and said all the right things. Yet when John Stewart asked her what her power was, she really couldn’t say. All she could say is "I talk about it." What use is 'transparency' without the ability to act on what you find? Now I realize a fiscal problem 30 years in the making won’t be fixed in 3 months, but I do hope we start seeing some progress in protecting the American people because, ultimately, we are all going to pay dearly (as many already have) if we continue down this path.

The bottom line is there is a two class system in the U.S. and it doesn’t separate along party lines. Those that rely on and use debt and those that create it with the aid of the government (aka Wall Street). Banking should be a utility that provides capital for the most efficient resources. That is it.

Banks should not be seen as a large segment of the economy for either employment or wealth earning purposes. They are like a parasite that depends on the host growing ever larger. Now that defaults are hitting (and the host has taken to shrinking rather than growing), they are looking for a new vector and new ways to feed— so now they have latched onto the government as a more direct way to feed off the masses (via the taxpayers). There was a reason banking became a boring enterprise after the Great Depression.

If we learn any lessons from our Great Recession, banking will go back to being a boring, highly controlled, and tiny part of our economy. In the meantime, enjoy the stock market rally for the feudal lords while unemployment keeps skyrocketing for the serfs. During the Irish Famine, the feudal lords of Ireland were a net exporter of food, while potatos rotted in the field and whole families starved to death or set sail for America. Where is America's America?

M O R E. . .

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment