Click here for a link to complete article:

By Mike Whitney | 21 April 2009

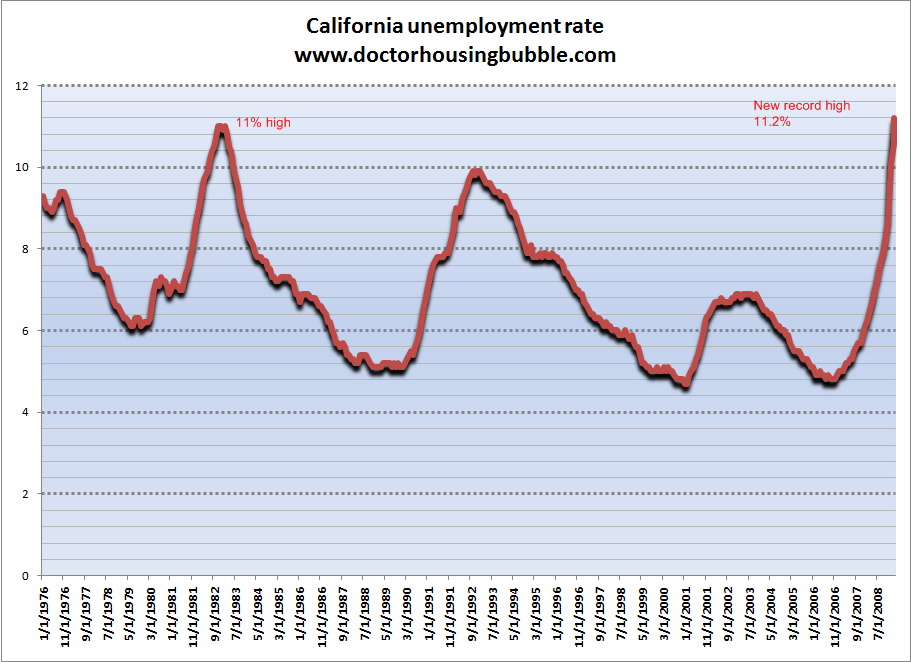

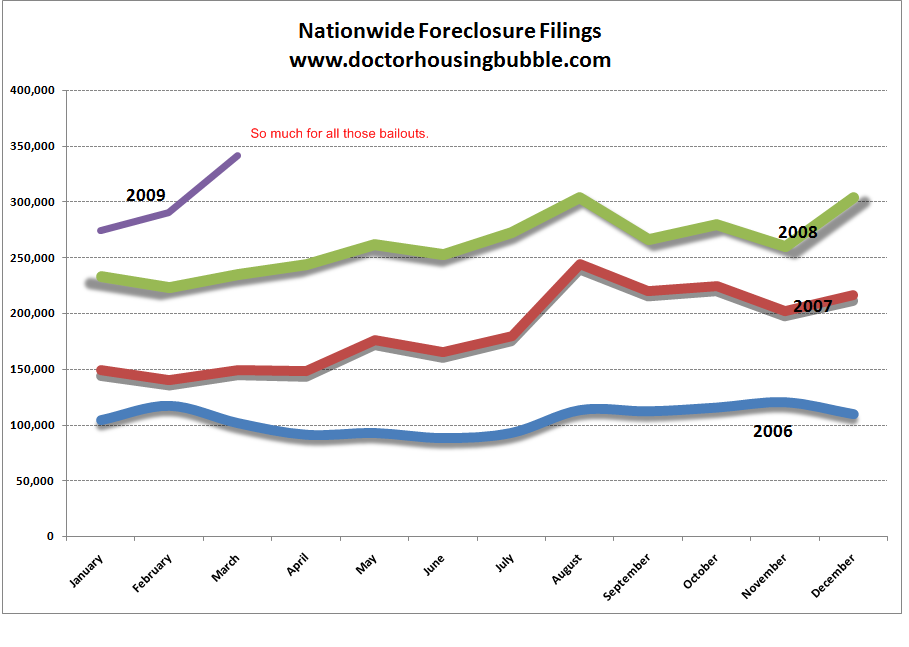

Due to the lifting of the foreclosure moratorium at the end of March, the downward slide in housing is once more gaining speed. The moratorium was initiated in January to give Obama's anti-foreclosure program— which is a combination of mortgage modifications and refinancing— a chance to succeed. The goal of the plan was to keep up to 9 million struggling homeowners in their homes, but it's clear now that the program will fall well-short of its objective.

In March, housing prices accelerated on the downside indicating bigger adjustments dead-ahead. Trend-lines are steeper now than ever before— nearly perpendicular. Housing prices are no longer falling— they're crashing and crashing hard. Now that the foreclosure moratorium has ended, Notices of Default (NOD) have spiked to an all-time high. These Notices will turn into foreclosures in 4 to 5 months time creating another cascade of foreclosures. Market analysts predict there will be 5 million more foreclosures between now and 2011.

|

It's a disaster bigger than Katrina. Soaring unemployment and rising foreclosures ensure that hundreds of banks and financial institutions will be forced into bankruptcy. 40 percent of delinquent homeowners have already vacated their homes. There's nothing Obama can do to make them stay. Worse still, only 30 percent of foreclosures have been relisted for sale suggesting more hanky-panky at the banks. Where have the houses gone? Have they simply vanished?

600,000 "Disappeared Homes?"

Here's a excerpt from the SF Gate explaining the mystery:

|

In a recent study, RealtyTrac compared its database of bank-repossessed homes to MLS listings of for-sale homes in four states, including California. It found a significant disparity— only 30 percent of the foreclosures were listed for sale in the Multiple Listing Service. The remainder is known in the industry as "shadow inventory." ("Banks aren't Selling Many Foreclosed Homes" SF Gate)

If regulators were deployed to the banks that are keeping foreclosed homes off the market, they would probably find that the banks are actually servicing the mortgages on a monthly basis to conceal the extent of their losses. They'd also find that the banks are trying to keep housing prices artificially high to avoid heftier losses that would put them out of business. One thing is certain, 600,000 "disappeared" homes means that housing prices have a lot farther to fall and that an even larger segment of the banking system is underwater.

Here is more on the story from Mr. Mortgage "California Foreclosures About to Soar...Again"

|

JP Morgan Chase, Wells Fargo and Fannie Mae have all stepped up their foreclosure activity in recent weeks. Delinquencies have skyrocketed foreshadowing more price-slashing into the foreseeable future. According to the Wall Street Journal:

|

Another 20 percent carved off the aggregate value of US housing means another $4 trillion loss to homeowners. That means smaller retirement savings, less discretionary spending, and lower living standards. The next leg down in housing will be excruciating: every sector will feel the pain. Obama's $75 billion mortgage rescue plan is a mere pittance; it won't reduce the principle on mortgages and it won't stop the bleeding. Policymakers have decided they've done enough and are refusing to help. They don't see the tsunami looming in front of them plain as day. The housing market is going under and it's going to drag a good part of the broader economy along with it. Stocks, too.

Real Homes of Genius: It Takes a Pink Home to Lose 80 Percent in Value. 3 Sample Compton Homes Showing the Magnitude of the Housing Bubble and Subprime Mess. Going back to 1990 Prices.

Click Here, or on the image, to see a larger, undistorted image.

Click Here, or on the image, to see a larger, undistorted image.

M O R E. . .

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment