Homes For The Holidays

California 2009 Economic And Housing Forecast

By John Jannarone | 8 April 2009

Shares of home builders have enjoyed an extreme makeover. But has the paint on their balance sheets begun to peel? KB Home said Friday that orders for new houses rose for the first time since 2005 after it reduced prices and trimmed the size of its new houses. But prices are still falling, with no sign of an improvement. That is worrying, because the industry's cash flow is about to get chiseled away.

One problem is taxes. Loss-making companies can collect refunds on tax payments made over the previous two years. The pain of losses for many in 2007 and 2008 was cushioned by hundreds of millions in cash tax refunds.

KB, for example, will be able to enjoy a $220 million refund this year. Next year, it will be out of luck. Another home builder, D.R. Horton, expects to get a $677 million tax refund this fiscal year. It actually paid tax in 2007, so it will likely collect a smaller amount next year. But beyond that, there is nothing to recoup. D.R Horton has $1.5 billion of net debt.

Low sales volumes also make it hard to scrape together cash. New-home sales improved slightly in February to an annualized 337,000, but remain well below the 482,000 sold in 2008 and 768,000 in 2007. D.R. Horton may have some extra steam, given its specialty in the relatively strong market for lower-price homes. Unlike some peers, a decent portion of its $4.4 billion of land and housing inventory may become cash soon.

But until prices begin to rise again, investors who pick up home-building stocks should remember to wear hard hats.

.

Homes For The Holidays

By ContraryInvestor.com | 5 January 2009

Homes For The Holidays… Unfortunately, yeah, and plenty of ‘em. It’s an understatement to suggest residential real estate was either directly or tangentially very important to both economic and financial market outcomes in 2008. It has been the cornerstone of solvency, or lack thereof, in so many quarters of the financial sector [[and in so many quarters of the globe: normxxx]]. And as such, has had profound influence on the character of the US and really global credit cycle.

It’s been a while since we’ve checked in [but] all of us know that residential RE will continue to be a key macro economic health watch point as we move into the New Year. The current reconciliation cycle drag that is residential real estate, affects financial sector balance sheets, household balance sheets (and P&L's for that matter), etc. [It's] not about to [diminish] in importance to [the] macro economic outcomes in 2009.

You’ve seen what has happened recently as the Fed has gone into a good bit of hyper drive in terms of trying to financially engineer some type of stabilization in what continues to be a downhill journey for the asset class. They’ve allocated $600 billion to 'buy' the agency debt (Fannie and Freddie paper) in the hopes of getting and keeping US conventional mortgage rates down. And so far that has indeed happened as post the establishment of this [latest] Fed investment endeavor, conventional 30 year fixed mortgage rates dropped a good 100 basis points, plus or minus, in a matter of weeks. We’ll spare you the graph, but in recent weeks we’ve seen new mortgage applications and refi apps spike meaningfully higher.

Mission accomplished by the Fed? We’ll see, as we need to remember that a lot of folks with 'rate-locked, in-process loans' could only have taken advantage of these new lower mortgage rates by first canceling the prior loan, then writing a new one, probably with another mortgage vendor. This would naturally count as a "new" mortgage or refi app in recent data.

Hence, there may be a bit of anomalistically higher counts in recent weeks due specifically to getting around the prior 'rate lock' issue. We’ll need to continue watching the data in the months ahead. Lastly, as you may already know, China and a few foreign friends have been big sellers of government agency paper since the summer of this year. The $600 billion the Fed has already so generously provided is in part simply offsetting current foreign selling of US agency paper.

Additionally, the Fed followed up on the $600 billion down payment, if you will, in trying to spark housing price stabilization/reacceleration. They 'announced' that they would like to put a program together (through wonderful taxpayer sponsored Fannie and Freddie) to provide 4.5% 30 year conventional loans to new home buyers. After all, it is the season of giving, no?

Bottom line being, the Fed is starting to pull out all the stops to arrest home price contraction. Upping the ante in a big way relative to prior efforts. We expect the Obama regime to likewise address this issue, and perhaps [at least equally] forcefully. They’ve suggested rewriting existing mortgages, but that enters into the very dangerous and cornerstone area of contract law.

Key question for both our economic monitoring and investment decision-making ahead then becomes, can the US government decree/legislate/manipulate home prices higher, defying the natural laws of asset class supply and demand, as well as the character and path of a generational credit cycle now in reconciliation? Defy? We doubt it. Temporarily arrest? The correct answer is, we’re going to find out.

Important in that, as we all know, the locus of the initial US credit cycle trauma was the 'mortgage securities' markets. Residential real estate was also the locus of consumer credit creation this decade and a current key driver of household net worth [first of a huge increase and then the more recent] decline, certainly along with equities, influencing household financial well-being. Lastly, we need to remember the importance of investor psychology and bear markets as this applies to housing.

Even temporary stabilization in residential real estate would echo [throughout the economy, resulting] in positive psychological influence on the financial markets. All part of the ebb and flow of cycles in both financial markets and investor psychology. A few macro overview observations about just where we are in the cycle itself.

Cutting to the bottom line, at least in our minds, inventory and price remain the two largest outstanding fundamental issues for residential real estate, so far unresolved in this cycle. Once inventories get in line at least with historical precedent, and prices stabilize, then we can begin to anticipate a better tone to mortgage credit markets, the housing industry itself, consumer [feelings of] well being and, hopefully, the macro economy. It’s when housing stabilizes that the unprecedented stimulus being force fed into the system by the Fed/Treasury/Administration may begin to bite and gain traction.

Let’s get right to a few simple and self-explanatory views of life. The following is a four and one half decade view of median family home prices relative to median family income. To get back to the average level since 1963 for this ratio (the red line in the chart), median home prices would need to drop [merely] another 12% from current levels.

Of course this assumes the cyclical correction stops at the historical average. Let’s face it; we’ve already lived through a lot of price correction. The problem clearly is that other factors are currently weighing on residential real estate prices. Weak labor and wage growth, a coordinated global economic downturn of historical significance, and a credit market contraction of very meaningful magnitude is colliding with a housing reconciliation cycle. To argue that the above relationship will be arrested at the 'average' of the last four and one half decades [is probably] wishful thinking. [[This is especially so when we remember that the really low quality loans that helped drive housing prices upward in the last decade are probably no more— at least for another generation.: normxxx]]

Is the Fed essentially trying to speed up the reconciliatory process implied by the above relationship in manipulating the important plug factor in the real estate equation that is financing costs? Of course this is exactly what they are doing. Whether they will be successful is the unanswered question. And in good part that depends on the ability of inventory to clear as a result of the character of both price and financing costs.

Let’s move right on to the equally important issue of inventories. In the past we’ve shown you a lot of raw numbers when looking at this data. Time to stop that. Below is a look at the number of homes listed strictly as "for sale" properties (in other words this does not include second homes, rentals homes, etc.). This go around we compare these per unit of inventory for sale numbers to the total US population to get a better sense of historical perspective.

We’ve heard "everybody’s gotta live somewhere" a million times by those trying to bull up the residential real estate markets over prior years. And since the population is ever growing, comparing current nominal inventories to past cycles is misleading because of the dynamic of population growth. Oh yeah? Well now we’re looking at the number of homes for sale relative to "everybody". Any questions?

As the chart tells us, when looking at per unit for sale residential homes on what is essentially a per capita basis, we’re looking at a current level that is just shy of twice the historical average of the last four-plus decades. Yes indeed, everybody needs a place to live. It’s just a good thing there are so many places to choose from at the moment relative to historical precedent, no?

The last chart [illustrating] current residential real estate inventories very much mirrors the directional pattern of what you see above. It’s very simply the number of vacant single-family homes relative to all single-family homes. Bottom line? We’ve never seen anything like current levels. Residential real estate as an asset class cannot begin fundamentally to recover until inventory clears, and this is far from an "all clear" view of life. Seems a matter of relatively basic common sense, no?

House That Again? …Before concluding, a few last housing related anecdotes we hope are of interest. As per the comments above, we know that housing prices and current residential real estate inventories remain key, open question mark issues. And [of this] the home building industry is more than aware. This is a very good thing in terms of cycle reconciliation.

As of the latest data, housing starts rest near half century lows in nominal terms. Residential real estate construction has essentially collapsed. [[With, perhaps, a little assist from banks no longer extending credit to builders (but rather calling in loans when they can). : normxxx]] Existing inventories and price have been very strong drivers of this collapse in new activity. Years of demand [have been] more than satiated in the prior mortgage credit cycle.

The view of per unit starts is seen in the top clip of the following chart. In the bottom clip we look at starts as a percentage of the total US population. A new record historical low at recent levels. Clearly, existing inventory [[including the seemingly never ending wave of defaults/repossessions: normxxx]] remains the issue for real estate, not new inventory.

As existing inventory clears, the asset class will heal. That process is well underway. The Fed just wants to speed things up a little with a big bit of financial engineering. Of course financial engineering has worked so well for them in the past, right?

Finally a very simple update of macro US homeowner equity as a percentage of the [current] market value of real estate. You already know this ratio has been plunging for [several] decades now, plumbing new lows at an accelerating [pace] with each passing quarter over the last two to three years. The Fed has been kind enough to manipulate credit market mortgage costs downward, but only the real economy and real world residential real estate cycle can change the trajectory of what you see below. And this is key to credit market collateral values: a sense of household financial well being, [reasonable] access to real estate based consumer credit, etc. Important? Yeah, we'd say so.

As we look at the chart above and contemplate what may yet be to come, we come to the issue of deleveraging, coursing through the domestic and global economy. How must homeowners act in order to turn the trajectory of the relationship you see above upward in an otherwise very tough pricing environment? Deleveraging. Paying down mortgage debt. We're pretty convinced that financial sector deleveraging is well underway and has been more than discounted by the markets.

[On the other hand], we'd suggest that US household deleveraging is [barely] getting started in comparison and we believe has [still] a long way to run. We expect this will be a major macro theme for 2009. Have the markets completely discounted this thought? We're simply not sure at this point. Residential real estate was incredibly important to economic and financial market outcomes in 2008. We expect exactly the same in 2009.

The message of the data above is clear, price and inventory cycle reconciliation is not yet finished. What is also clear is that the Fed/Treasury/Administration are stepping up their efforts as we enter 2009, to truncate unfinished cycle reconciliation at almost all costs. Although we'll save this for a future discussion, we're not only focused on the importance of residential real estate in our current economic and financial market circumstances and how it will influence the financial sector, credit cycle dynamics and the real economy, but also place great weight on the [yet to be realized but sure to follow] unintended consequences of Fed/Treasury/Administration efforts to truncate the natural cycle.

The markets know what the Fed/Treasury/Administration are doing and are discounting these actions [and 'predictable' consequences] in financial market prices. But it's the "at almost all costs" 'unintended' consequences of this truncation attempt that may turn out to be most important to 2009 investment decision making.

.

California 2009 Economic And Housing Forecast:

Examining 5 Areas Showing California Will Have A Tougher Economic Year Than 2008.

Click here for a link to complete article:

By Dr. Housing Bubble | 2 January 2009

I won’t sugarcoat it for you. 2009 will be a much more difficult year for California than 2008. I am astonished that many pundits are now claiming how 2009 will be an up year for the markets even though the Dow Jones Industrial Average just faced a pounding unseen since 1931, during the Great Depression. They’ll point to examples like 1907 when the market fell 37 percent only to rebound by 46 percent in 1908. This is absurd since 1907 was much more isolated in terms of global reach.

And, in 1907, J.P. Morgan stepped in, putting up some of his own money to instill confidence. You tell me who is putting up their own money today? What we have is a bunch of beggars— mostly Wall Street and financial firms going to Washington for a piece of the bailout money parade— but no one seems eager to be left behind while Uncle Sap is dishing it out.

This time is significantly different. I have already given you 10 reasons why nationally this recession will be the worst since World War II. Those 10 reasons still stand as we enter the new year. Yet California will face pain on a more pronounced level because it has cast its lot with real estate and finance. The heart of the housing bubble darkness started here in sunny California.

Click Here, or on the image, to see a larger, undistorted image.

Remember epic toxic mortgage dealers like New Century Financial out in Irvine California? Or who could forget the ultimate toxic mortgage factory Countrywide Financial which has miraculously disappeared into the belly of the Bank of America beast? Or what about the fact that the median home price in California flirted with $600,000 for a month in 2007? These examples have all vanished. New Century Financial is gone and so is Countrywide. That $600,000 median price is now $285,680 IAW the California Association of Realtors data.

Many people, including those once skeptical, now think that we have reached bottom because things became so sour in 2008. They will be shocked this year. Why? Just because things have fallen so quickly is not a good reason that things will now go right back up. This seems to be the argument of most mainstream pundits who believe 2009 will be a better year.

They use an iteration of the argument that goes something like, "2008 was such a brutal year, and things are now so cheap, that it is time to go 'bottom fishing'." Total non-sense. If you look at the data what you see is continued weakness in the markets— possibly for some time yet. And California still has many other issues to confront.

What I will discuss today is the 2009 forecast for California in terms of the economy and housing. You can dig through the hundreds of articles here if you want to see how accurate some of my past analyses have been. [[I'll save you the trouble. He has been way ahead of the curve.: normxxx]] The first problem we still have is much of our employment is still closely tied to real estate. That has not much changed.

Consumer psychology is much more fragile now. That is, many people now, finally, believe that no, real estate does not go up forever. This is probably irretrievable damage to the outlook for a generation, which should keep another real estate bubble from forming anytime soon. Housing prices are still tanking and believe it or not, many metro areas in California are still wildly overpriced. Another reason is that the state budget (and that of any number of cities and local communities) is in shambles. Do you think it is good that we are staring at bankruptcy in 2 months? Plus, the toxic Pay Option ARM reset tsunami will be hitting with full force this year.

Reason #1— Employment

As you can imagine, I look at tons of data. The only way you can determine future movements in this market is to glance at and absorb many, many data points, reference similar historical economic events, and try to forecast where things will move— but not by the 'straight line projection' method favored by the stupid and lazy. You need to be cognizant of history, understand economics, and know how mass psychology affects consumer behavior. With that, let us first look at the California employment situation:

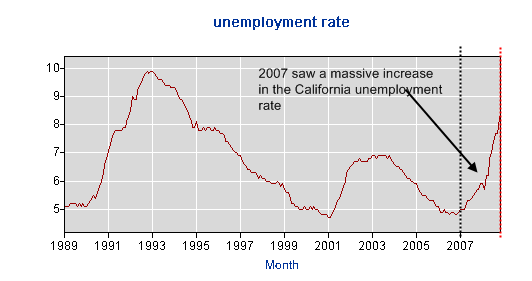

The unemployment rate in January of 2008 for California was 5.9 percent. The latest data we have is for November of 2008 and the current unemployment rate is at 8.4 percent. A 2.5 percent total increase in less than a year is amazing— that's more than a 40% increase in the number of unemployed! Without a doubt, the California unemployment rate will be well above 10 percent by the end of the year. Why? Well take a look at some of the latest layoff announcements being made: [[Note: these do not include those layoff announcements of the last two weeks in December: And, they have been accelerating in size and number! : normxxx]]

What you should immediately notice is this is well beyond a real estate and finance problem. Sure, the bulk of layoffs came from industries closely tied to these fields but the above list now tells you this is spreading to pretty much every industry you can imagine. Looking at the raw numbers of unemployed persons according to the BLS, it looks like California added 478,000 people in 2008 alone. Nationwide 1.911 million people were added to the unemployment statistics. What this means is California was 25 percent of all unemployment net-additions.

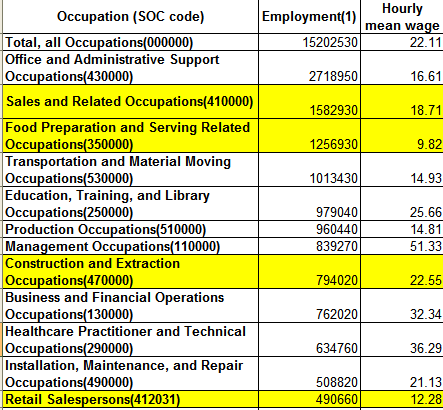

What you then need to do is look at which industries employ the most Californians:

The layoff announcements should tell you that practically every area is feeling the crisis. The above chart should give you a snapshot of how the employment picture pans out. I’ve highlighted areas that will be most directly impacted by this crisis. This does not mean other areas will not also suffer, but only that these areas will feel the pain most immediately and most significantly.

Together with the sales and food related fields, these are the lower paying industries. Many of these workers will have a tough time finding other work, should they be laid off. California’s unemployment insurance is reaching the breaking point. Construction will face pain as well. Who is building any large projects right now?

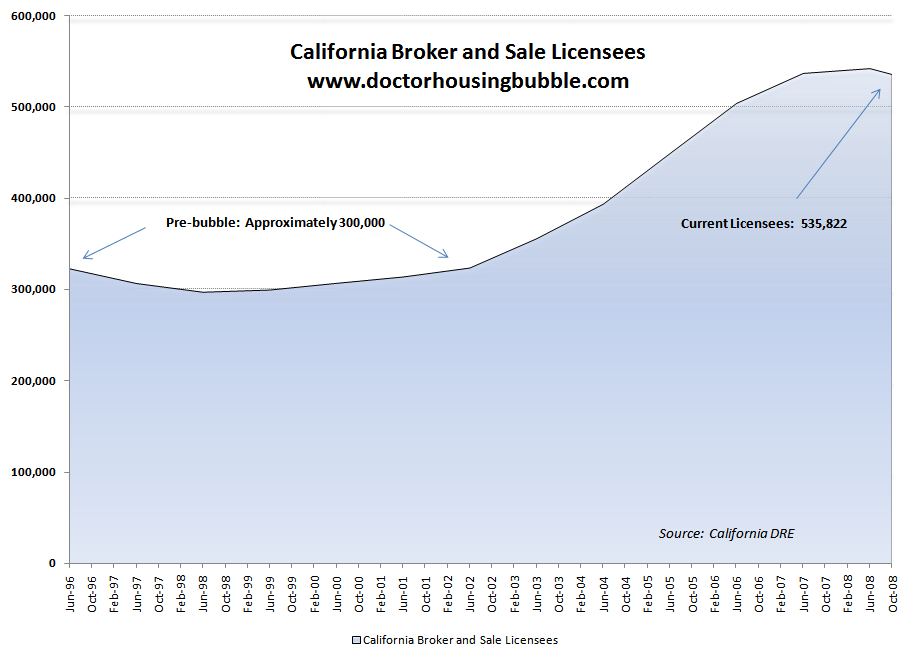

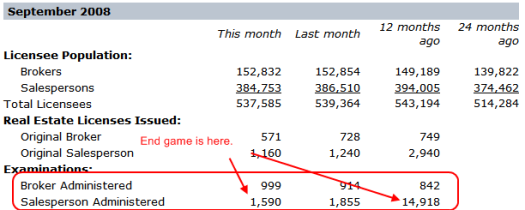

Reasons #2— DRE Licensees And Consumer Psychology

Click Here, or on the image, to see a larger, undistorted image.

For most of the 1990s, there were approximately 300,000 real estate licensees in the state active at any one time. We are currently at 535,000+ active licensees. What does this mean? People are still delusional regarding real estate. (I should point out that many DRE licenses last a few years so you may be seeing people still active on the rolls yet not likely to be renewing anytime soon.) Forecasting means looking at the future and we can already see that the real estate psychology is broken:

The above is stunning. In September of 2007 14,918 salesperson exams were administered. In September of 2008 only 1,590 exams were given! In October of 2008 only 1,480 were administered. Game over.

What this tells us is the allure of real estate has been broken. The once glamorous lifestyle portrayed on housing porn shows is now rapidly evaporating. Keep in mind this was another revenue (although tiny) stream of income into the state which will now be gone. How many people will stop renewing their licenses?

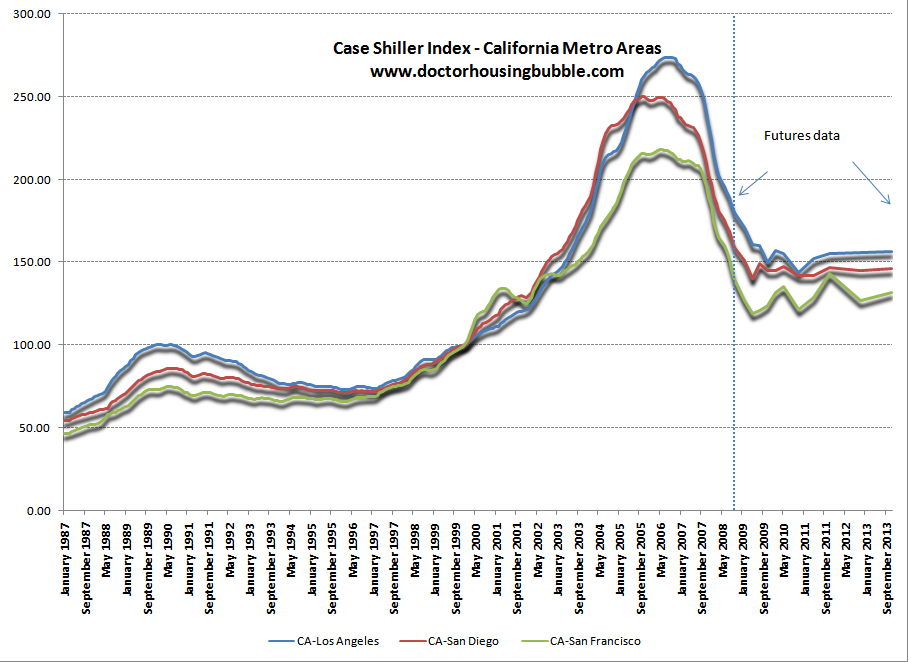

Reason #3— Case-Shiller Housing Prices

Click Here, or on the image, to see a larger, undistorted image.

I want to spend sometime on this chart. I have constructed the above chart using the Case Shiller Index data for 3 largely followed metro areas in California. The data up until October 2008 is from the actual data set. I’ve also included the 'futures' data which is traded on the CME.

When I tell you that California will not hit a housing bottom until 2011, I am not the only one who believes this. These contracts are backed by fairly sharp money people not accustomed to losing. If you believe otherwise, go ahead and bet against them with your own money. Let us see how many pundits put up some serious cash here to back up their rosy predictions.

The principal thing that should come to your attention is all 3 major areas have further to fall. Los Angeles and San Diego have the biggest drops ahead, according to the futures data. Yet what should jump out at you as well is how the market will essentially stagnate well into 2013. The contracts for 2012 and 2013 are little traded but you already have people betting for a stagnant market for another 4 years. I tend to agree with them.

There is very little evidence to show us that somehow prices will be rebounding anytime soon. Short of skyrocketing wages and solid employment, why are we to believe the market will do well in 2009?

Reason #4— California Budget

How can anyone listen to politicians tell us we are weeks away from a statewide bankruptcy and, then, in almost the same sentence, say things will be better in the state for 2009? Look at the chart on the left. I have used this chart numerous times because it highlights the magnitude of the problem.

The two largest sources of revenue for the state are personal income tax and sales tax. With unemployment rising (see above) and personal spending falling, that means less personal income tax and sales tax. With property prices tanking, this is another revenue source which will be shattered.

Also, California is home to many millionaires and billionaires, the most of any state in the country. Many of these people have money in the stock market. When they go to do their taxes, guess what is going to happen. We just had the worst stock market since the Great Depression. You can rest assured that many of these people are going to claim large losses, meaning they will pay substantially less in state income taxes than in 2008.

There is only two ways to fix this problem. Raise taxes or cut the state payrioll. Both are bad yet that is what is left. Cutting jobs only adds to the unemployment lines and raising taxes in a bad economy is a further drag on business. Our current group of politicians has no backbone. Do some of both and get on with it. Yet be a bit more strategic about it. Don’t be idiotic like our federal government that is bailing out crony capitalism and is throwing trillions of dollars into an abyss.

Unfortunately, we are broke both as a state and at a federal level. Where will the money come from? The California budget is well over $100 billion so this isn’t going to be solved by telling people to stop using staplers.

Reason #5— Pay Option Arms

The final nail in the coffin is the number of pay option ARMs that will reset in the state in 2009. These incredibly toxic loans are going to reset at the worst possible time. I’ve seen a few argue that lower rates will help yet this is another misconception: lower market rates will do nothing for the pay option ARMs of California. And for the purposes of pay option ARMs, over 50 percent of the nominal value of these mortgages outstanding rest here in California.

Why is this problematic? As we pointed out above, the median home price in California has fallen roughly 50 percent from its peak. Many of the option ARMs have little equity from home buyers. That is, little of the homeowner's 'skin' was put into the game. Now that prices have tanked, many borrowers are running the numbers and are gearing up for a 'moonwalk' away from their mortgage in 2009.

You can ignore the drop in foreclosures towards the end of the year. This was because of SB 1137 and the Fannie Mae and Freddie Mac moratorium. Guess what? Holidays are now over and now back to reality. These pathetic measures were the equivalent of an ostrich sticking its head into the sand.

In addition, you cannot refinance an underwater mortgage! And, the vast majority of these California loans are so underwater, they are swimming in Jacque Cousteau territory. These loans never served any purpose except to delude prospective homeowners and garner all of those lenders' middlemen outrageous fees. We can only hope that with new federal regulations, we will have an outright ban on them.

Those are 5 reasons why California will have a challenging 2009. There are many other reasons as well, but these should suffice for now, since the year is young. Buckle up because it is going to be bumpy ride folks.

M O R E. . .

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment