By The Mad Hedge Fund Trader | 1 September 2010

The Coming Takeover Wars

The spate of takeover bids we have witnessed in recent weeks, the BHP Billiton (BHP)-Potash (POT) deal, the Sanofi Aventis (SNY)-Genzyme (GENZ) deal, Intel's (INTC) acquisition of Infineon Technologies (IFX), and the ongoing bidding war by Hewlett Packard (HPQ) and Dell (DELL) to swallow 3Par (PAR), is telling the rest of us reams about the broader market.

Virtually all of the recent bids have been made for cash. That means that the acquiring companies believe that both their own and their target's share prices are historically cheap. That may be debatable, depending on whether you think the long term US GDP growth rate is 2%, or is going back to the torrid 3.9% we saw in the last decade.

The real education here is the outing of the industries that are attracting the premium bids. Those include agriculture, energy, commodities, biotechnology, and technology, especially in cloud computing and mobile applications. BP (BP), an oil major, is said to be attracting covetous eyes while its stock is in the basement. Also notice the foreign origins of many of the targets, which underlies my theme that 90% of global earnings for the next ten years are coming from outside the US.

Regular readers of this letter will recognize these industries as part of a handful of major growth leaders for the next decade. By watching the M & A action, you are letting the giants with deep pockets needed to fund massive research efforts do your sector selection for you. Direct investment always leads activity in listed share markets, often by years. Ride on their coat tails for free.

It all reminds me of the "Pacman" takeovers of the early eighties, when Boone Pickens said that it was cheaper to prospect on the floor of the New York Stock Exchange than in the oil patch. The 2010 iteration of that statement has to be that it is cheaper to hire people through takeovers than to hire them outright. The hard truth is the net effect of these mergers is almost always a reduction of the labor force. This is why the jobs picture has not, and will not improve. To boost your investment performance, keep close tabs on newly announced takeovers, or easier still, keep reading this letter.

The Great Bond Market Crash Of 2010

OK, maybe it hasn't really crashed yet. But the two day, 3½ point sell off in the futures for the 30 year Treasury bond (TBT), at the end of last week was the sharpest drop in 18 months. Winston Churchill's great 1942 quote, which marked the turning of the tide for Britain in WWII, comes to mind. "This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."

In my recent piece on the extreme overvaluation of government debt, I pointed out that the last time rates were this low, Treasury bonds brought in a miserly 1.9% yield for a decade (click here for the piece). Professor Jeremy Siegel at the Wharton School at the University of Pennsylvania has one upped me. After yields bottomed in 1956, bonds suffered negative returns for 30 years!

This should have occurred to me, as the first mortgage I took out on a Manhattan coop in 1982 carried an 18% interest rate. That was then Federal Reserve governor Paul Volker was waging a holy war on inflation and eventually won. I took out one of the first ever floating rate mortgages, and by the time I sold it three years later, the rate had melted down to only 11%. I tell this story to kids buying their first starter homes now and they look at me like I'm some kind of dinosaur.

I have always believed that markets will do whatever they have to do to screw the most people. A big part of the parabolic move in bond prices was caused by so many investors going into this the wrong way. Hedge funds were short Treasuries and long steepeners, while mutual and pension funds were underweight.

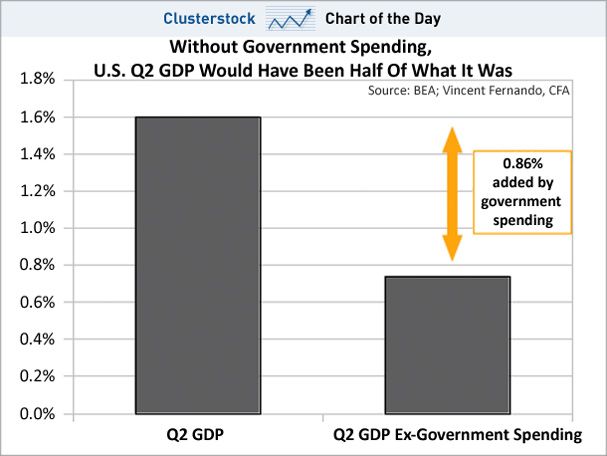

Remember, this was supposed to be the trade of the year? Of the decade? Only individuals and momentum players have been in there buying with both hands, not because they love low yielding bonds so much, but because they hate equities. All it took to set the cat among the pigeons was for Q2 GDP to come in at 1.6%, not as bad as expected, and for Ben Bernanke to remain silent about any plans to flood the markets with more liquidity.

This may not be the top in the bond market, but it is starting to resemble what tops look like. One more equity puke out in September could easily get us there.

Silver Is Hot, Hot, Hot

Those who followed my advice to watch silver should by now have the precious coins raining down upon them (click here for "Why the Really Big Play is in Silver" ).

Since then, the precious white metal has jumped 8% to $19.30, just pennies short of a multiyear high, compared to a more pedestrian 4% move by gold (GLD). It is thus fulfilling my prediction that it would outperform the barbaric relic by 2:1 on the upside.

The action has spilled over into the miners, with Coeur D Alene Mines (CDE) rocketing by 19% in two weeks, while Silver Wheaton (SLW) is up 14% and Hecla Mining (HL) has tacked on an impressive 16%.

Precious metals traders have been stumped by the move, expecting that industrial demand for silver would slump in the face of a double dip recession. What they aren't seeing is the surging monetary demand for silver, which continues to grow beyond all expectations. Not only do you see Americans and Europeans fleeing into silver, rather than lock themselves into 30 year returns in the Treasury bond market at 2.5%, the Chinese are leveraging up a rising standard of living into increased silver coin purchases.

Silver also has a much bigger catch up game to play. while gold is a mere 2% off its all time high, silver must appreciate by 153% to reach a new peak.

Your choices here are the silver ETF, the miners listed above, or futures contracts listed on Comex. You can also get physical by adding to your holdings of .999 fine silver buffalos at a small margin over spot by clicking here. If these guys sell out, shop around, because there are plenty of other merchants with competitive prices. You can always use them to bribe the border guards when you are fleeing the country.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment