Proshares Ultra Short Lehman 20+ Year Treasury ETF (TBT)

Direxion Daily 30 Year Treasury Bear 3X Shares ETF (TMV)

By John Thomas | 3 September 2010

Have Treasury Bonds Had It? You are probably tired of my yammering on about how close we are to a multigenerational peak in Treasury bond prices by now.

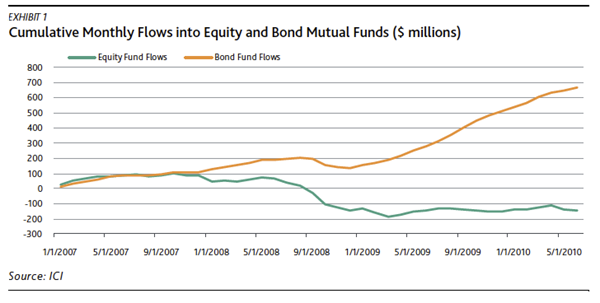

After yesterday's dramatic price action, which saw my preferred vehicle, the double leveraged (TBT) up 5% on the day, and the (TMV) tacking on a blistering 10%, you may be forgiven for thinking that the fat lady is getting ready to sing. Take a look at the chart below of the gargantuan cash flows into bonds, and you know that if this is not the top, it is not far off. Listening to the cheerleaders on CNBC applauding the pop in equities and the slide in bonds yesterday, you'd think it was a done deal.

|

.

The Great Bond Market Crash of 2010

By John Thomas | 30 August 2010

The Great Bond Market Crash of 2010. OK, maybe it hasn't really crashed yet. But the two day, 3½ point sell off in the futures for the 30 year Treasury bond, at the end of last week was the sharpest drop in 18 months. Winston Churchill's great 1942 quote, which marked the turning of the tide for Britain in WWII, comes to mind. "This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."

In my recent piece on the extreme overvaluation of government debt, I pointed out that the last time rates were this low, Treasury bonds brought in a miserly 1.9% yield for a decade. Professor Jeremy Siegel at the Wharton School at the University of Pennsylvania has one upped me. After yields bottomed in 1956, bonds suffered negative returns for 30 years!

This should have occurred to me, as the first mortgage I took out on a Manhattan coop in 1982 carried an 18% interest rate. That was then Federal Reserve governor Paul Volker was waging a holy war on inflation and eventually won. I took out one of the first ever floating rate mortgages, and by the time I sold it three years later, the rate had melted down to only 11%. I tell this story to kids buying their first starter homes now and they look at me like I'm some kind of dinosaur.

I have always believed that markets will do whatever they have to do to screw the most people. A big part of the parabolic move in bond prices was caused by so many investors going into this the wrong way. Hedge funds were short Treasuries and long steepeners, while mutual and pension funds were underweight.

Remember, this was supposed to be the trade of the year? Of the decade? Only individuals and momentum players have been in there buying with both hands, not because they love low yielding bonds so much, but because they hate equities. All it took to set the cat among the pigeons was for Q2 GDP to come in at 1.6%, not as bad as expected, and for Ben Bernanke to remain silent about any plans to flood the markets with more liquidity.

This may not be the top in the bond market, but it is starting to resemble what tops look like. One more equity puke out in September could easily get us there.

.

Don't Buy That Treasury Bond

By John Thomas | 26 August 2010

Don't Buy That Treasury Bond. Another week later, and Treasury bond prices have raced up to even dizzier heights, breaking more records for over valuation. According to the Investment Company Institute, outflows from equity mutual funds over the last two years totaled $232 billion, while inflows into bond funds soared to a staggering $559 billion.

Today, "bond funds" ranked with "Miss Universe" and "Lindsey Lohan" among Yahoo's top ten search terms. Companies, like FedEx, are looking to issue corporate bonds maturing in 100 years. No doubt the prospect of 80 million baby boomers bailing on equities so they can become coupon clippers for life is providing some extra juice for this market.

In a Wall Street Journal article last week, the Wharton School's Jeremy Siegel pointed out that ten year inflation protected securities (TIPS) with yields under 1% are selling at a PE multiple equivalent of 100 times, the same valuation that dotcom stocks saw a decade ago. Bonds with four year maturities have negative real yields.

The last time this happened, in 1955, ten year bonds brought in an annual return of only 1.9% for the following decade. The potential capital losses for these securities now loom large. In the meantime, the short Treasury ETF (TBT) trades at $30.60.

Let me run some numbers here. If the yield on the 30 year Treasury bond runs up to last year's low of 3%, the TBT will fall to a new all time low of $27. If I'm right, and we move back up to the 2010 high of 5.05%, the TBT pops back to $51.50. Running a downside risk of 11% to capture a potential gain of 68% sounds like a pretty good risk/reward ratio to me. But it might get better. Don't forget that my long term, multi year target for this ETF is $200.

If the futures players get this right, a move in the December long bond (ZBZ0) on the CBOT from today's high of 134.5 to this year's low of 111.50 multiplies your minimum margin requirement from $3,375 to $23,000, a 6.8 fold return.

But wait, there's more! If you don't feel like making big bets until you figure out what the new normal looks like, try a limited risk position through the TBT options. The March $30 strike calls are trading at $4. A run up by the ETF to this year's high puts these babies at $21 at expiration, a net profit of $17, a gain of 425%.

I'll tell you some key targets to watch for to determine the timing on this: when the yen approaches ¥80, the S&P 500 touches 950, the 30 year yield tickles 3%, and the ten year yield slams into 2%, it will all be over but the crying. I'm still keeping my powder dry for taking another shot at this trade, but my trigger finger is getting mighty itchy.

.

Get Ready for the Sack of Rome

By John Thomas | 6 August 2010

Get Ready for the Sack of Rome. I traded the great Japanese bull market during the eighties at Morgan Stanley, from the very bottom all the way up to the peak. The firm's fundamental analysts railed against the tide for years, claiming that stocks were liquidity driven, overvalued, and headed for a huge fall. Every time they made that call, their offices got moved ever closer to the elevator, and eventually, the men's bathroom. When the turn finally came, I had already taken off on an extended vacation, and the ignored analysts had moved on to hedge funds, where they proceeded to make vast fortunes.

When someone at last threw the switch on Japan, it got dark amazingly fast. Tokyo went out at an all time high of ¥39,000 on the last day of 1989, and then dropped a staggering 45% in January. Yesterday's close, 21 years later, was ¥9,489. These days, I feel like those Japanese analysts, except the market that is driving me nuts is the one for US Treasury bonds.

The more arguments I find that they should fall, the faster they go up. I probably would have fired myself by now, if I weren't my own boss (nepotism is always a powerful force). Now I hear that PIMCO's Mohamed El-Erian says that there is a 25% chance of real deflation hitting the US, after telling us it won't for so long. Again, this reminds me of Japan, where the higher it went, the more imaginative the explanations became as to why it should continue.

Ignore those 100 PE multiples, just focus on the damn Q-Ratios! I believe that we are witnessing the final blow off top in the great 30 bull market in bonds. A decade from now, it won't be stock investors complaining about a lost decade, but owners of bonds. Could it go on for another six months or a year? Sure. Like gold in 1979, technology stocks in 2000, the absolute tops of these parabolic moves are impossible to predict, both on a time and price basis. But when the turn comes, it will resemble the Sack of Rome.

No comments:

Post a Comment